Look at this bunch of rainbow chard. Whoever grew these babies knew what she was doing!

We have a saying in this house: If we grows it, we eats it.

The only exception to that rule is kale. Ugh. I grew it one year and it was so horrible I let the cabbage moths swarm all over it. It was a fitting way for it to go. It also meant that it wasn’t wasted. It was a decoy for the moths so that other, more delicious veggies, could grow.

Now that I only have one other person living here, meals tend to go a lot further. Last night we had bolognese with sweet potato gnocchi. I’ve blogged before about the one tomato plant I had that decided it wasn’t going to go down to winter and death without a fight. It kept producing tomatoes until a month ago, when it dropped some seeds and turned up its toes.

I wasn’t going to let those tomatoes go to waste. I threw them into the freezer. There were 200g worth – not enough for a can’s worth but still useable. Last night I grabbed them and threw them into the sauce. I wasn’t going to let that plant’s heroic efforts go to waste!

The extra dollop of tomatoes made the sauce extra large and so there was enough left to make a lasagne for us tonight. My rule is that if we have greens in the garden, a lasagne must have layers of leaves and our pizzas must have lots of greens on them.

I picked enough rainbow chard to make a lasagne and a couple of pizzas for tomorrow night.

This is layered by tomato, pasta, tomato, leaves… then it’ll continue until I run out of sauce. Then I’ll top it with a cheesy bechamel sauce and into the oven it’ll go. I love getting extra greens into my kids. Even when they’re taller than me.

But I don’t like using the stalks in this dish. So what do I do with them?

Sometimes their fate is to end up in the compost tin where, over time, their elements will make more plants in the garden, but not today. I make my own stock pastes. It was the item that pushed me over the edge to buy a thermomix when I went to my first demo. I don’t stick to the exact veggies in the recipe, but use whatever comes to hand. I simply cut these stalks up and popped them in the freezer for when I make my next batch.

It won’t matter if they go a bit freezer-burny. They’re going to be chopped into a mush and cooked when I drag them out, so it’s all good. Just because they’re stalks doesn’t mean that it’s ok to throw them away. They still have fibre and nutrients, whether I use them for humans’ benefits or for the next generation of plants in the garden.

The soap recipe I usually use has 500g of copha in it. For some reason, I had 125g of it sitting in my fridge. I decided that rather than throw it out, I’d force myself to do some maths (sigh) and make a 1/4 batch.

When making proper soap, you have to stay strictly to the recipe, otherwise it won’t work. For prettiness, I threw some dried calendula and cornflower petals on top. I bought these a while ago and they’ll last me for YEARS. They don’t lose colour when the soap is curing and they add a touch of fanciness. They weren’t exactly cheap, but that doesn’t matter if I actually use them.

Only 6 bars of soap, but they’ll be ready to use when I finish using up my motel soaps. They’ll tide us over until I can get to Coles and buy some more copha.

And I got to use up the little block. No waste!

They’ll be sitting in the laundry for at least 6 weeks, curing until they’ll be ready to use.

My washcloths are finished. I sent one to a teacher friend who I know likes them, but I haven’t heard back from her so I hope I have her address right. Or maybe she just didn’t like this one…

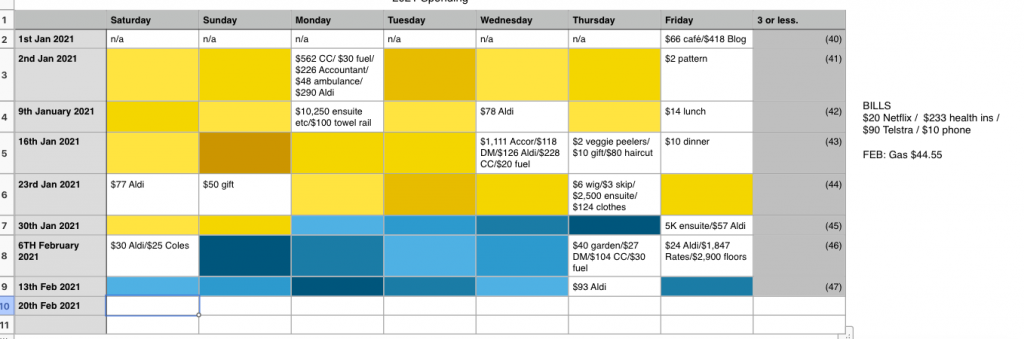

I know there’ll probably be some people who’ll think that doing things like this and being conscious of not wasting things that I make and grow is an ironic waste of my time. I’ve retired early(ish), so why am I mucking around with things like this? For many years when the boys were kids, I HAD to do things like this to make our dollars stretch as far as they possibly could just to survive. But those days are over. So why bother to do them now?

A part of it is looking after the Earth and sustainability – though probably not as big a part as it should be, if I’m honest.

Mostly it’s to do with respecting the time and money I’ve put into things. I feel that buying something isn’t a waste of money if you use it. So that’s why I unpicked the bamboo top and reknitted it into washcloths. There was a lot of money tied up in an item of clothing that was never going to be used. This way – I get to make gifts and people will use them. The money spent on that beautiful bamboo tape won’t be wasted. Plus it kept me entertained for nearly a week as I knitted and listened to audiobooks.

We make sure we use as much as possible of the food that I grow. I’ll never recoup the money that I poured into setting up the food garden in the first place. But growing some of our food was never an economic decision.

The garden offers so many things to my retired life. Obviously, it gives us the freshest organic food that it’s possible to eat. But it also offers the chance to run experiments, to problem solve and to get outside and quietly while away the hours being productive. Poppy loves to steal beans from the vine. As I chop and drop, I kick the ball for Scout and Poppy to chase while Jeffrey snoozes on the couch on the verandah. Sometimes I listen to podcasts or audiobooks as I work, while other times I let the birds and the wind do their thing.

(Incidentally, I’d like to thank Nic for posting a comment this afternoon on my previous post. They mentioned planting potatoes and that reminded me that I had some seed potatoes and some grow bags that were still sitting in the laundry. They’d been there for more weeks than I’d care to own up to. Within 10 minutes the potatoes were planted and I’d used the potatoes and seed bags that I’d spent good money for. Plus I felt good that I’d ticked another job from my list.)

When I was working I used to look at the price of things I wanted to buy and work out how many hours of my life I’d put into teaching to get that much money. It was roughly $50/period. Then I’d think of my absolute worst class. Was this pair of shoes equal to putting up with 8K for 3 periods????

Sometimes it was; sometimes it wasn’t. But it would NEVER be worth it if I bought the shoes and then never wore them. What a waste of my mental anguish putting up with that group of kids for all of those periods!

This is why I try not to waste anything. Time, money and hours of my life have gone into the things I have around me. I respect Past Frogdancer and so I don’t want to ignore what she did to get to where we are.

Does that make sense?

Dad joke of the day:

After I posted a couple of days ago, I realised that I forgot to include a Dad joke. Sincere apologies to anyone who felt let down by such unprofessional Personal Finance blogging behaviour.

So here’s an extra one to make up for it:

I saw a magician yesterday that turned audience members into wind turbines.

I immediately became a big fan.