Gardeners have a lot in common with investors. We both need to have a long-term view and the paths to success in each field are very similar.

Here’s where most people start off their financial lives: complete and utter devastation. They’re either starting from $0 if they’re lucky, or they’re in debt for credit cards, mortgages, student loan and cars. Some of us start the journey to FI early, but most of us start later in life.

This photo is an accurate representation of my financial life the day I left my husband. I had $60 cash, a 100K mortgage and 4 boys under 5. Like this snap of my backyard, it wasn’t a pretty picture.

These shots were taken after the first day the landscaper started. He dragged out the overgrown hedges and chopped down some trees. The white planter pot you can see in this picture had a lime verbena plant in it that I’d let die from neglect. I simply wasn’t paying attention. Basically, just as some people put their heads in the sand and try to ignore the devastation of their finances, I did the same with the yard. But once you face up to it, it’s time for a clear-out so that the work can commence.

Once your financial life is laid bare and there are no more surprises – (like that blue clamshell toddlers pool we found lurking behind the shed – who knew?!?) – it’s time to sniff out where you want to go from here. Poppy is demonstrating.

The new backyard is designed to give Old Lady Frogdancer as little upkeep as possible when she’s all old and rickety. Just like how I want her investment portfolio to be like. No one likes weeding, whether it be actual weeds or looking at bad investments.

The brick paving, all fully grouted in so that no weeds will sprout up, is the bedrock of the whole yard.

Education is the equivalent when we’re talking about our finances. When I was younger I had the whole ‘no debt’ thing down pat, but once I paid off the mortgage on the old house I was elated for about 3 weeks. Then I realised I knew next to nothing about retirement.

I discovered the Barefoot Investor and very shortly afterwards I stumbled onto the FIRE blogs. I read everything I could lay my hands on and learned about superannuation and investing.

On the upper level of the yard are 5 wicking beds. These are garden beds specifically designed to have a reservoir of water beneath the soil that the plants drink from. Excellent for drought protection… or, in financial terms – when the SHTF. You want to set things up so that your investments will enable you to sleep at night, even when times are tough.

This is where you start setting up some automated payments. You arrange to salary sacrifice. You open a brokerage account to start putting a share portfolio together. You might start researching where to buy a rental property. You keep reading and asking questions.

It’s all beginning to look fairly organised, isn’t it?

But it’s a bit bleak and stunted without any green stuff. This applies for both the gardening and investing metaphors.

Time to start planting!

And planting. And planting. In this case, columnar apple trees, with lavender to bring the bees.

With investing, you start buying shares or making regular payments into a managed fund. You might decide property’s your thing and so you start saving every payday for your first deposit.

The point is that you keep on planting and planting and planting. It becomes a habit.

Initially, you trim the budget to find some excess money. You’re able to plant more seedlings – and if you’re sensible, you make sure they’re heirloom plants so you plan to save the seeds and plant for free every year after this one.

This is a little like planning to re-investing dividends into buying more shares, rather than taking the money and running. Or planning to take rental income and use it to pay off the mortgage faster.

You hear about the damning effects of lattés and avocados on financial success, so you stop wasting little amounts of money and you add what you’ve saved to your accounts. Every little bit helps!

But a garden can’t grow without good soil. You start to look for ways to add to the health of your plants. Using the things you have available at home, you begin digging coffee grounds, tea leaves and eggshells into the soil and you begin composting.

But how can you keep adding more to your investments once you’ve trimmed the fat from your living expenses?

You look around at work and see that there’s a lot of compostable things that are being thrown away, so you arrange to bring them home. You value-add from your job, finding ways to accumulate more from your work to add to the things that you really value.

In a financial sense, if you have a job that allows paid overtime, you start picking it up. You go for a promotion. You make your job work harder for you and you pump what you make back into your investments.

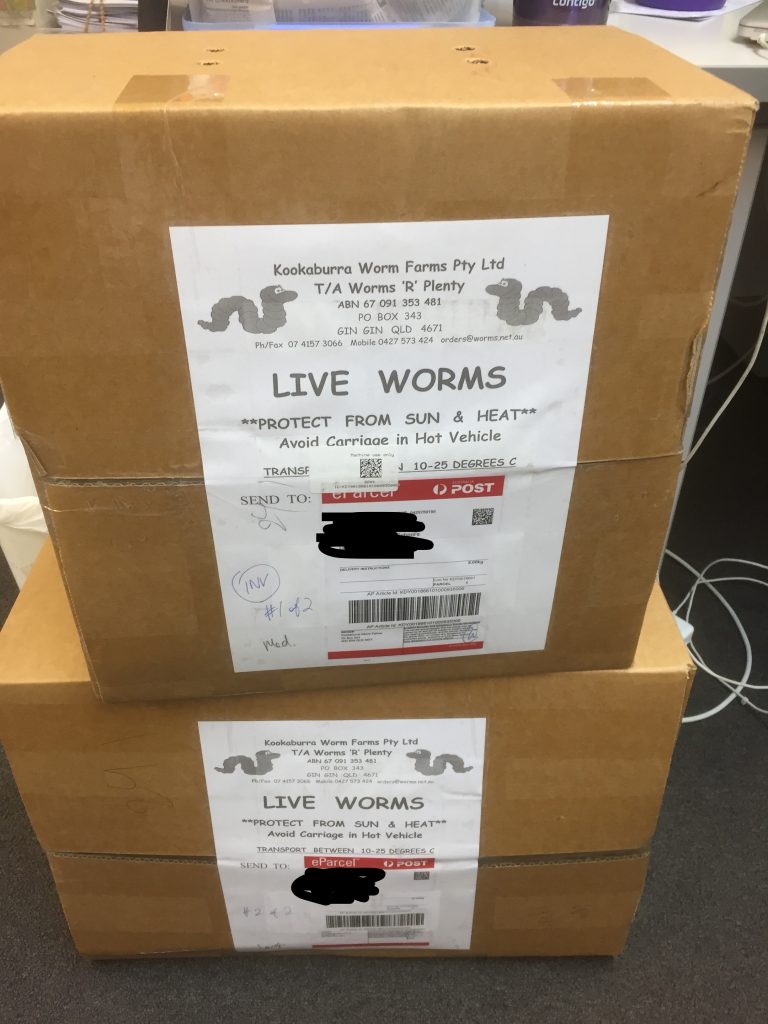

After a while, you look outside your property for things to help you grow your veggies faster. You buy some worm farms, (freaking people out at work when you have them delivered there), and put them on the garden beds. It won’t be a quick fix, like winning the lottery, but over time the worms will improve the soil.

Sounds a bit like a side-hustle, doesn’t it? Most side-hustles just bring in a few extra dollars, but everything helps. I tried a few different things, mainly on Etsy or tutoring, but it was my side-hustle as a thermomix consultant that seriously accelerated our path to financial freedom. I paid off my original house YEARS earlier, as well as paying for a decadent 9-week trip to Europe and the UK.

You still live your life. No one can stay in a garden or in front of a spreadsheet their whole lives unless they want to have a life not worth living.

Go to that beach with your family!

Chase that ball! Bark at those seagulls!

Enjoy the little things along the way.

Then, after what seems like a long while, you begin to see results! Apples!

The first income from your hard work begins to trickle in. Whether it be dividends or rental income or your superannuation account starting to climb, it doesn’t matter. Your heart sings.

You keep plugging away. As time goes on, your garden (and investments) become ever more fruitful.

Not everything will go your way. These celery plants were put in last September. They haven’t grown since and are turning yellow, and just towards the back of the wicking bed, you can see a dead snow pea plant. Also, see the spring onions? They should be ready to eat by now, but they are the size of toothpicks.

This can be disheartening. Some people start a garden, run into things like this and give up.

Obviously, there are times where the stock market loses value and your net worth goes down. The real estate market may soften, as it’s doing at the moment, or you may have damage from tenants. If investing was guaranteed to always make money hand over fist every year, then everyone would do it.

But investing is for people who are in it for the long haul.

Even in the lean years, there’s room for optimism for the future.

These potatoes weren’t visible above ground once the plant died off. But underneath the surface, they were still there, quietly growing.

The garden has surprises, just like the market. Sometimes you don’t get what you expect. See those purple beans? Pop them in boiling water, walk away and when you come back – they’ll be green.

Over time, as your knowledge about the ebbs and flows of the

And just like your investments, you can save the produce/profits for the future. These bags of zucchini are bound for the freezer! Future Frogancer will be enjoying the results of Present Frogdancer’s work.

With regard to your finances, if you keep treating your money like a garden, by the time you’re ready to retire you’ll be like these girls!

Wow! My husband and I have tried different versions of this over the years, but kind of failed…wah, wah. I will certainly reference this post when gathering the gusto to do it again. Well done!

Also, I’m here as a fellow bibliophile. I liked your post on A Purple Life’s interview so I thought I’d come check you out!

Haha! As a gardener, you can always look forward to ‘next year’ or ‘next season’.

Thanks for tracking me down. 🙂

I think when you find that 42 C temp days are the norm rather than the exception and all the sun’s heat is going to be absorbed and re-radiated by that brick paving, that you’re going to want some shade over those wicking beds and the rest of the garden, etc. If it was me (and I already know what 42 C can do to plants in full sun), I’d be thinking about putting a single shade tree in the centre of each wicking bed; naturally a deciduous fruit tree of some sort. You could just put up a trellis and shadecloth, but it wouldn’t provide extra food to eat. The tree would provide summer shade, help to cool the area and when it loses its leaves, allow the winter sun in. Just my thoughts.

At the old house I had a dwarf peach tree in one of the wicking beds. The peaches were HUGE!!