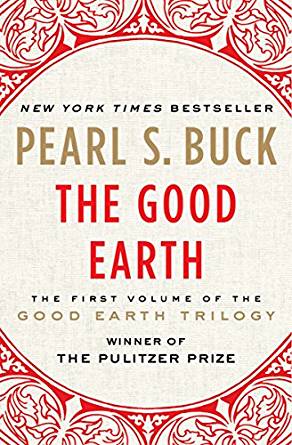

Many novels have basic money lessons woven through them, which is understandable really. After all, money is integral to the human condition, which is what literature is all about. Few novels, however, concern themselves with money lessons so much as Pearl S Buck’s ‘The Good Earth.’

For those who haven’t come across it, this is a cracking good read. It covers the story of Wang Lung, a poor Chinese peasant eking out a living on a farm in the days before Communist rule. Wang Lung is poor… dirt poor. But he has ambition and a fierce love of the land. This novel traces his life as he rises from poor peasant to rich landowner and what happens to his character and family along the way.

Wang Lung’s wife is chosen for him by his father. A practical man, his father chooses a slave girl from the rich and powerful House of Hwang in the village, a girl who can work hard on the farm as she doesn’t have bound feet, much to Wang Lung’s disappointment. O-Lan is not a beautiful girl, but she is devoted to the farm and to her new family and there is much more to her than meets the eye.

Of necessity, the family is frugal. I first read ‘The Good Earth’ when I was a teen and to this day, I still have to get every grain of rice out of the cooking dish, exactly as O-Lan did. I think of her every time.

They waste nothing. At first, it’s from mere survival instinct, but as time goes on and O-Lan’s skills bring more prosperity to the family, they begin to buy land. In their society, land was the only thing that could buy security and prosperity. This was especially important to them as their family started to grow.

O-Lan goes back to visit the House of Hwang with her first baby, dressed beautifully. The Hwang family clearly need to read ‘The Millionaire Next Door’. She says to Wang Lung:

- “I had but a moment for private talk with the cook under whom I worked before, but she said, ‘This house cannot stand forever with all the young lords, five of them, spending money like

waste water in foreign parts and sending home woman after woman as they weary of them, and the Old Lord living at home adding a concubine or two each year, and the Old Mistress eating enough opium every day to fill two shoes with gold.’ “

However, no bull run in the stock market lasts forever and it’s the same with life on the land. A few years later famine strikes. Despite having resources tucked away, hungry relatives descend upon them demanding to be fed and soon Wang Lung and O-Lan’s ’emergency fund’ of food and money is gone.

The neighbours didn’t know this and, fired up by Wang Lung’s evil uncle, they descend on the house and strip it bare, looking for food and other items of value to steal. There was nothing but a few handfuls of beans. After they leave, Wang Lung comforts himself with the thought that he’d put all of their spare money into investments, which in his case was land:

- “They cannot take the land from me. The labour of my body and the fruit of the fields I have put into that which cannot be taken away. If I had the silver, they would have taken it. If I had bought [food] with the silver to store it, they would have taken it all. I have the land still, and it is mine.”

The lesson here is clear. If you store your net worth in things that cannot be seen, you have a better chance of preserving them when things go wrong. Anyone can run away with a bag of diamonds or a shiny new car, but a share portfolio or a fat superannuation account is easy to hide.

Back then in pre-communist China, of course, there were no unemployment benefits. You either starved when the food ran out, or you found a way to make some money. Or you practise geoarbitrage and move to where things are better.

The family sell every stick of furniture in the house, except for their farm implements, and they set off to a big city 100 miles to the south, where the famine hasn’t reached. Geoarbitrage! Wang Lung picks up work pulling a rickshaw, while O-Lan and the children turn to begging. O-Lan utilised skills she picked up as a child to show the others how to make money as a beggar. One should never forget skills that one picks up along the way!

An easy way to make money was to sell a child to a rich family. O-Lan revealed that this was how she herself had become a slave. The couple had two sons and an infant daughter by this time. No way would they part with the sons, but the daughter? Wang Lung decides not to sell her, but it was a close thing.

Sometimes the road to financial independence relies on seeing an opportunity and taking action. While the family is stuck in the city, with no way to earn enough to get back home, there is some sort of revolution and the rich homes are looted. Wang Lung is borne along by the crowd and takes nothing, however O-Lan, who has lived in a Big House and knows what to look for, finds a cache of jewels.

The family is now set! They travel back home, with enough money to buy lots of land and set themselves up for life. O-Lan requests that she keep only 2 small pearls from the jewels.

- ‘If I could have two,’ she went on humbly, ‘only two small ones—two small white pearls even… ‘Pearls!’ he repeated, agape. ‘I would keep them—I would not wear them,’ she said, ‘only keep them.’

The rest they use to buy land from the House of Hwang where O-Lan once lived. That family has now fallen into decline, due to opium addiction and general financial recklessness.

There is now money enough to employ others to work on the land, money enough to take the sons from the fields and educate them and money enough to support some leisure activities. Wang Lung eventually buys the House of Hwang’s residence and moves his family in. To think! What was once the pinnacle of wealth and power to him, is now his.

However, lifestyle creep starts to cause problems.

O-Lan continues on as usual, but Wang Lung falls prey to peer group pressure from other rich men and starts going to gambling dens and ‘tea houses’. This is where he meets Lotus, a lady of the night. She looks like a kitten, with the smallest bound feet Wang Lung has ever seen.

She is incredibly beautiful, totally greedy and selfish and she bedazzles Wang Lung. He showers her with money and even asks O-Lan to give him the 2 pearls she had kept from the cache of

He builds her an inner court where she lives with her own household, so she and O-Lan don’t have to see each other. O-Lan is now totally disregarded by Wang Lung as she quietly goes about doing her regular work for the family until her death

As the family gets older, lifestyle creep continues to happen. But through it all, even as silver streams from their hands, Wang Lung will never sell any of the land he has accumulated. He knows that it’s the bedrock of their fortunes and everything else they’ve managed to build and to buy is based on that.

He’s the definition of first-generation FIRE. But unfortunately, he was so focused on his work, what the rich men of the town thought and on Lotus that he made a huge mistake. The next generation had been allowed to grow up without having much contact with the very thing that had given them their prosperity. They could remember nothing but ease and comfort.

At the end of his life, he is living back on the original farm with his daughter and a concubine. He overhears his two sons talking about how they will divide the estate once Wang Lung has died, which fields they will keep and which ones they will sell:

- But the old man heard only these words, “sell the land”, and he cried out and he could not keep his voice from breaking and trembling with his anger, “Now, evil, idle sons – sell the land!” He choked and would have fallen, and they caught him and held him up and he began to weep.

- Then they soothed him and they said, soothing him, ” No – no- we will never sell the land – “

- “It is the end of a family when – they begin to sell the land,” he said brokenly. “Out of the land we came and into it we must go – and if you can hold your land you can live – no one can rob you of land -“

- And the old man let his scanty tears dry upon his cheeks and they made salty stains there. And he stooped and took up a handful of the soil and he held it and he muttered, “If you sell the land, it is the end.”

- And his two sons held him, one on either side, each holding his arm, and he held tight in his hand the warm, loose earth. And they soothed him and they said over and over again, the elder son and the second son, “Rest assured, our father, rest assured. The land is not to be sold.”

- But over the old man’s

head they looked at each other and smiled.

There are a further 2 books in this series, but honestly, the final two aren’t a patch on The Good Earth.