This post is very important to me. As a single Mum with 4 little boys and VERY little money, Christmas was always a time when I was on my toes. I wanted it to be a magical morning, with Santa presents that brought joy and delight, because the window of time for that Santa magic is small and very precious. Just because I chose to leave my husband with $60 cash in my hand and 4 boys under 5 under my arm, why should that mean that the boys should miss out?

I’m sure I’m not the only one who has had this problem. Fortunately, there are ways around this to deliver a magical Santa reveal every single year without ruining the family finances every December. The huge advantage that Christmas has over other, more mundane ’emergencies’ is that it happens at the same time every year. Grab any calendar… there it is on December 25. So it can be organised and planned for.

I’m a teacher by trade. English and DRAMA. The Drama teacher hat always comes to the fore at Christmas. What’s one of the best moments whenever people go to the theatre? It’s that moment of anticipation when the house lights go down and the curtain is about to open. The audience’s attention is at its peak, waiting for the magic of being transported to another time and space.

Kids are like this on Christmas morning. Why do you think they wake at 5 AM and race breathlessly down to wherever Santa leaves his gifts at your place? Yes, some of it is pure greed, but most of it is because something crazily wonderful has happened overnight – something has been magically produced out of nothing.

That first moment when they see their pile of gifts – that’s what I call ‘the REVEAL.’ It’s all-important. It’s pure theatre. And I always wanted that first reaction to be “WOW.”

I love Christmas! Always have. To me, Christmas is a time for family and, back when the boys were small, a time to spoil the kids. I love it so much that part of the custody arrangements when my marriage broke up was that I would have the boys every Christmas Day, while my ex-husband would have them every Easter Sunday.

When my oldest was 5, I left the marriage and stayed at home with the boys until my youngest started school. This meant that money was tight during those years. Child support was often only $20/month and the boys and I were dependent on Centrelink payments of around $350/week. I had to pay the mortgage, food, bills and everything else out of this. Fortunately, I was brought up by frugal parents so I had lots of training! But it meant that things like Christmas had to be planned with military precision.

At my place, Santa would leave the presents for each kid in the lounge room, on chairs or on the floor. Each pile of gifts was covered by a blanket, with a label on each pile with a name. The routine was that the kids had to come and wake me up first, then we’d all go into the lounge room together and they’d stand by their particular blanket. Then, on a “ready, set go!”, they’d lift off the blanket and the REVEAL would happen. This routine was a deliberate decision on my part to build the anticipation further and have the energy of the room at fever-pitch. It was always exciting.

Afterwards, I’d have the boys stand together and call out loud, “Thank you, Father Christmas!” When, one by one, the boys started to know the truth, they’d look at me while calling out this – a private way they’d thank me while still keeping the magic going for the younger ones.

Anyway, I’ve set the scene for how the Santa REVEAL was done at my place. Here are the ways that I worked to make that particular December morning a hit for my boys on very little money.

Kids are visual creatures.

Little kids aren’t very bright. If they get a pile of gifts from Santa, they’re wildly excited. This doesn’t mean that every item has to be brand-new, designer and expensive. What you (as Santa’s helper) are aiming for is the thrill of the REVEAL – when the covering is lifted off their gifts and they see it all for the first time. This allows you, as the official shopper for Santa, to spend strategically.

What I aimed for, particularly when the kids were small and still believed, was to have a lot of colour and lots of items for their eyes to take in as the blanket came off. A central ‘show-stopper” item that the kid was really hoping to get, but surrounding it – lots of other, more minor things that look impressive in colour and number, but cost very little.

No more than 2 “Show stopper” presents per child. Usually, just one, or none if the child is very young. Spend your money in a way to get more bang for your buck.

Sure, I wanted Christmas to be impressive, but I wasn’t made of money! Plus, with 4 kids, that money had to stretch as far as possible. The boys didn’t need a roomful of expensive gifts from Santa – they’d be getting presents from my family, their father and their father’s family. The REVEAL from Santa is the most important, of course, but their entire Christmas experience didn’t hinge on just this.

So I’d listen. And I’d arrange to buy one or two brand-new things that the boys were desperate to own. When kids are young, you can buy these things at the July sales, because toys are toys. Kids are easy to plan for when they’re in pre-school to middle primary school. But later I learned to delay buying the “show-stopper” gifts until December. Teenagers are so unpredictable and there’s always a new game or album or something released just before Christmas that turns out suddenly to be the “must-have.”

When kids are very young, these “show stopper” gifts are most impressive when they’re physically large. A dolls house, a trike… things like that. Little kids equate size with value. Funnily enough, as the boys got older their “show stopper” presents started to shrink in size. A particularly coveted console game or CD/DVD used to be VERY successful at our place. Zelda and the Ocarina of Time for the N64, for example, was physically unimpressive but was greeted with hoots of joy.

And now I have that ocarina music in my head. The boys played that game for hundreds of hours. Safe to say that show-stopper gift was a success.

Shop around for “filler” gifts – the more of these, the better. Don’t pay retail prices for these if at all possible.

Garage sales are your friends. Here in Australia, we’re so lucky we have Christmas in summer, because spring cleaning happens and people get rid of the toys their kids are sick of. These toys are PRIME filler material. Their kids may be sick of them but they’re brand-new entertainment for your kids.

Every fortnight, when A had the kids for his access weekend, I’d go and hit the garage sales in my neighbourhood to look for filler gifts for Christmas. I’d start as soon as Spring began because you never know what you’ll find. Fortunately, most toys for little kids are pretty generic – if you buy cars, dolls and lego, you’re good to go, so these things can be bought months in advance and you know they’ll be successful.

I have boys, so anything round and designed to be thrown or kicked was always a hit. Tennis balls, usually second hand, along with bats or cricket stumps, also found at garage sales and op shops. Aussie rules footballs, especially for Tom, were also a good filler item. Sheet music for David, guitar strings for Ryan and quirky fun things for Evan were all things I’d keep my eyes open for and snap up if I came across them at a good price. You know your children – cater to their interests.

I also used to use filler space to buy things for Christmas that I would have been buying anyway. I like the boys to look nice for Christmas Day with my family, so Santa would always bring new clothes for them to wear. Some years the clothes would be brand new, other times they were gently worn clothes that still looked new, depending on my finances. The boys didn’t care either way.

Bathers were another frequent filler, seeing as how Christmas is in summer, along with artsy things like textas and pencils that they’d need for school the next year. Clearly, these weren’t as exciting for the boys as the toys, but they bulked up the piles of presents every year and helped them to look more impressive. Remember, it’s all in the REVEAL.

Start some Christmas traditions that cost next to nothing.

You know those little bags of gold coins that appear at every supermarket and dollar store checkout in December? The chocolate inside is cheap, but kids love the glint of the gold and the feel of holding treasure. These bags only cost a dollar or two each. Every year they’d have a bag of coins in their pile of Santa gifts.

I’d buy a packet of those little Kellogs mini breakfast cereal packets and the kids would have a couple of mini cereals to have for breakfast on Christmas morning – along with the chocolate coins, of course. I never bought those mini cereals at any other time of the year – far too expensive – so the boys were convinced that this was a Santa thing and looked forward to seeing which breakfast they’d be getting this year.

When the kids grew older a tradition started where they’d be the ones to assemble the Christmas tree. We have a large fake one – being frugal I didn’t want the added expense of buying a real tree year after year – and the boys put it all together and place the decorations on it. Over time, the Christmas tree decorations become treasured memories for them. “Oh! Here’s the aeroplane! I like this one!” or “Has anyone seen the bird that sits on the top of the tree? I want to do it this year.”

One of the most enduring traditions – and by that I mean that we still do this – is something that I first bought as a filler present in poverty-stricken desperation. I bought some little jars of bubble mix as a bit of fun for them. That first Christmas, we went out into the backyard and started blowing bubbles. The dogs went nuts jumping and trying to catch them and we had so much fun. It was a much greater hit than I thought it would be, so the next year I tried it again. The dogs, and later, the cats would come out with us and they’d jump to try and catch the bubbles and we’d laugh and chill in the sun. The house next door to us was a rental and when there were kids living there, the boys would blow bubbles over the fence at them and the neighbour kids would race to pop them first.

Poppy, Jeff and Scout will be chasing bubbles for a while on Christmas morning – it’s fun and costs next to nothing. It’s a corny little throwback to when the kids were little and we enjoy it.

Finally, enlist the older kids into keeping the magic alive for the younger ones.

I had a pretty good run with Santa. Tom, my oldest, was 9 years old before he asked the question one day. Now, just between you and me, Tom9 was a blabbermouth, so I knew he’d be the weak link in the chain of silence, so I whisked him away down to the bottom of the garden under the old fig tree.

I said, “Do you really want to know?” He looked at me as if to say, ‘I’m not an idiot – just by saying that you’re confirming that Santa isn’t real.’

So I smiled and said, “Yes, you’re right. Father Christmas isn’t real.”

He nodded, then said, “So who does it?”

I looked him dead in the eye and said, “I do. Santa is me.”

His mouth dropped open. He looked stunned. He said, No WAY. You can’t afford it!!!”

I laughed and laughed. “Christmas is special. It’s magical. I make sure I can afford it.”

He gave me a huge hug, then looked stricken. “Oh no,” he said. “I’ve been telling the boys to ask Santa for all the expensive things they want, so you don’t have to buy them…”

OMG. How gorgeous is that?? What a beautiful little boy.

I thanked him for looking out for me like that, then we switched into the “you had many years of enjoying the magic, so now you join the grown-up world to preserve the magic for your brothers” talk. I was a bit nervous about it. Like I said, Tom9 was a bit of a blabbermouth, but he came through for the boys and Santa beautifully.

He loved the idea of being more grown-up than the others. He’d write Christmas lists with them and let me know what they were hankering for. he’d help hustle the kids off to bed on Christmas Eve so I’d have time to set up the presents. He’d stay up a little later than the others, so he’d get to bite the carrot we’d leave out for Rudolph and eat the snack for Santa, while I’d drink Santa’s glass of Shiraz.

One by one, the boys found out the truth, but never from their older brothers. Evan was the last one. From memory, he was Evan7 or Evan8 when a nasty little kid told him Santa wasn’t real on Christmas Eve!!!!! I was furious when he asked me about it as I was putting him to bed that night. What a time for him to have doubt put into his mind!

What was I to do? He had been all geared up for a visit from Santa and was so excited. I looked at his little eyes and saw hope there – hope that the kid had lied to him. He was so little… but my parenting style has always been that if a kid is old enough to ask a question, then they’re old enough for the answer.

I made a split decision and broke my rule, opening my eyes wide and saying, “Of course he’s real. How else could all of those presents get there?” He smiled, relieved, and snuggled down to sleep and I tip-toed away, feeling like a heel but wanting him to have just one more Christmas morning of magic.

Just after Easter he asked me again. This time I came clean and when he asked why I’d lied to him before, I told him why, saying that I wanted him to have one last magical Christmas. He thought about it for a second, then nodded and simply said, “Thanks.”

Then he looked up at me and said, “Don’t tell me the Easter Bunny isn’t real either?!?” And like that the magic was gone.

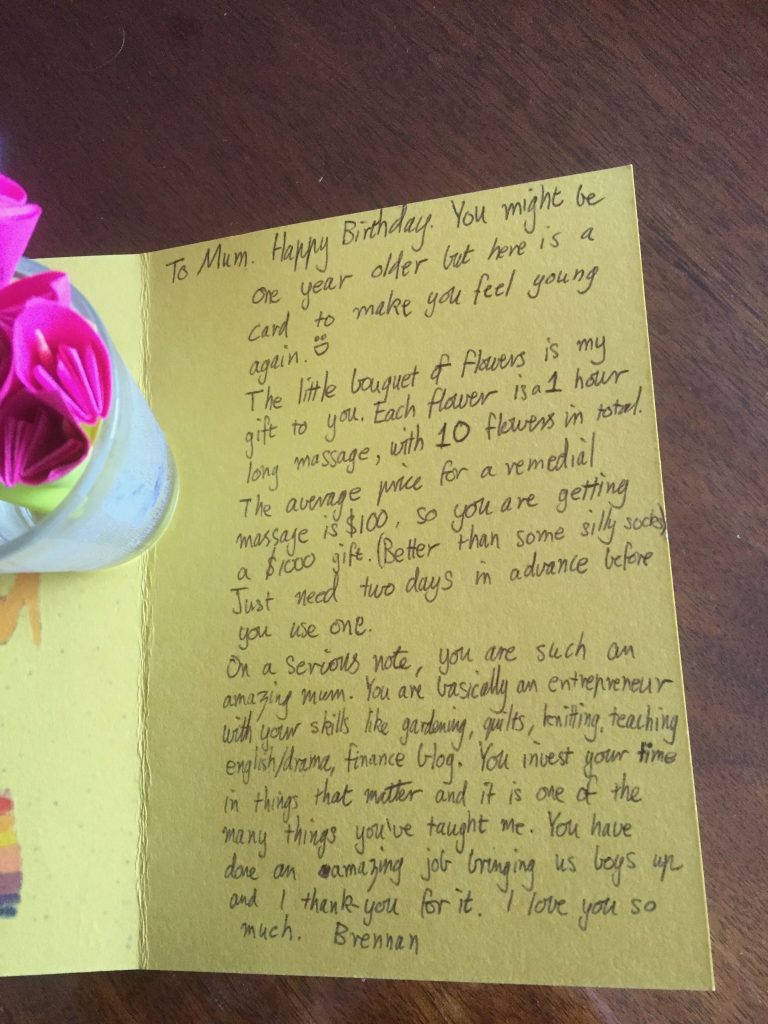

Christmas now has a different kind of magic for our family. The traditions and routines have evolved now that we are a family of adults. Christmas is still hugely important but now we all buy gifts for each other. My extended family has a Kris Kringle where we buy for only one person (price limit of $50) and the boys have the same price limit for each of our nuclear family. Three of them are still students so this is a big expense for them of $250 – 3 brothers, 1 mother and 1 Kris Kringle… but like I did back in the day, they save up for it throughout the year and enjoy the plotting and planning to get gifts that suit the recipients down to the ground.

Christmas is as important to them as it is for me and we put a lot of effort into the presents we organise. We look forward to getting together with Mum and Dad, my sister Kate and her family and of course, each other. The boys still come over every year to assemble my Christmas tree – now with added decorations from my travels in Europe, China and North Korea – and those still at home will blow some bubbles for the pets on Christmas morning.

For those going through a financially challenged Christmas, I hope that I’ve helped with some strategies. The funny thing is – some of the things that I introduced to make Christmas affordable are the very things that are now cherished family traditions! It’s very possible to have a wonderful Christmas with your kids on limited funds. It’s all about a little bit of forward thinking and – of course – the REVEAL!