Late last year I wrote a post on how I sold my house, with fully-approved plans to build 2 massive townhouses on it, to a developer. I was going to do the build myself, but when I was offered a crazy sum of money to sell the house ‘as is’, I decided that a bird in the hand was worth two in the bush, so I sold it.

Last November it was passed in at auction. In the time between me selling and them building, the wildly expensive property market in Melbourne had begun to soften. They had a reserve of 1.6M for the right-hand townhouse, but at the

Since then they’ve reduced the price twice and last Saturday it went up for auction again. I was planning to drive down to see it, hoping that this time the developers would get lucky. It’s all too easy to put myself in the situation and imagine how I’d be feeling.

I was paying bridging finance for The Best House in Melbourne at 72% of my take-home pay for 8 months, then when I dropped my gig as a thermomix consultant and went back to full-time teaching it was “only” 55% for a further 8 months or so. Imagine if I was still paying that today? I would be beside myself with worry if it didn’t sell.

The reserve price at the last auction was 1.6M. On the actual ‘For Sale’ on the website, it now suggests a range of between 1.4M – 1.480M. I was interested to see where the sellers’ heads were really at. The lowest suggested price on a real estate board is rarely what the sellers will accept!

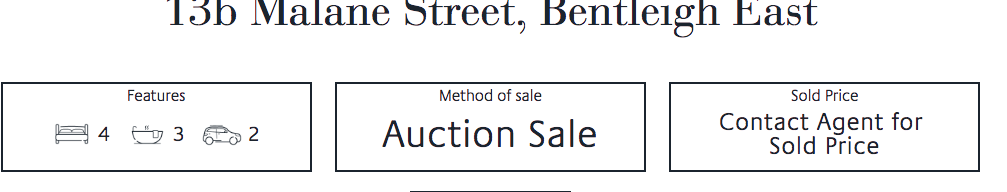

But, just as I was planning to get ready to leave, I thought I’d check the website to make sure I had the auction time correct. This is what I saw:

There was no sticker on the board at the front of the property yesterday morning, but when I rang Tom27 he said that he drove past in the late afternoon and saw them putting the ‘Sold’ sticker on it then. You’d think he’d tell his mother straight away, but I guess not…

I sent a text to the real estate agent, asking what they got for it…

… then I waited. Saturdays are a busy time for real estate agents.

The suspense was killing me…

… and then he rang.

The townhouse went for 1.45Million, with the buyer paying an extra 47K for modifications to be done to the house by the builder. Imagine having the money to pay an EXTRA 47K to pay for ‘improvements’ after you just spent just under one and a half million dollars…?

I’m so glad for the builder that he finally managed to sell this property, but the scary thing is that he had a reserve amount of 1.6M back in November and had to drop 155K off his projected profit to be free of it. That’s a substantial amount of money.

Still, no doubt he still made a profit. I’m also VERY glad I took the money and ran when I did. Part of financial success is hard work, attention to detail, making a plan and sticking to it for a long time. And part of it is timing.

Clearly, I’ve benefitted from both. May we all be as fortunate!

i agree about timing. mrs. me bought our house in a beaten down american city for 98k around year 2000. it’s a massive stone house built around 1860 with real wood and premium materials. fast forward almost 20 years and the city had a lucky resurgence and i’ll bet we could get 400-500k if we sold this year. it was all pure luck. if we had to buy it for that price we just wouldn’t do it. she wasn’t speculating on the uptick but did it the right way in just purchasing a place to live.

Your place sounds gorgeous!

I love your last sentence – that’s why I bought the original house – a place to live in the school zone that I wanted.

The property bubble was luck.

What good fortune indeed, I’m glad for you that you made the call at that time.

We bought somewhere in what I would consider a bubble but the SF area is so weird that it’s honestly hard to know where we are in any given bubble. We purchased as little house as we could find for our needs and the price was still outrageous. But we needed a place to live and smaller or equivalent places were renting for just as much, so we scraped together the cash and made big inroads into the mortgage. I expect that we’ll see the market drop at least a little in the coming years, hopefully enough so more MC people can afford to live here!, and it’ll probably go back up. But my financial plans are predicated on the assumption that we won’t make money off this home, so we don’t foolishly count on the market moving the right way at the right time for our security. My hope is to make the real estate portion of our portfolio almost irrelevant in our plans for retirement outside of having a secure place to live.

I could hardly do otherwise when we live in a part of the country where an earthquake could wipe us all out!

Yes, that whole earthquake thing is a bit financially scary.

I don’t include the value of my home in my net worth – I figure that I have to live somewhere so that portion of my financial life will always be covering my housing.

Wow 1.45 million for a townhouse! Sounds expensive- similar to Vancouver prices.

Good job on profiting on the market!

I have relatives that live in Melbourne, it’s nice!

We are in the middle of building a house right now and I just got my first grey hair at age 35. It’s stressful. Either that or my toddler is stressful haha. Or maybe both combined.

Building AND a toddler??

You like to live dangerously!