I’ve had an emergency fund for the last 2 decades. When I left my husband 22 years ago with $60 cash in my hand and with 4 boys under 5 to support, the first thing I set myself to achieving was building a $1,000 ‘buffer zone’ (as I called it then) to provide some security for the boys and me. I’ve written about how an emergency fund is a very good thing to have but is this still the case?

It’s been interesting to see how having that stash of cash has made life so much easier in this pandemic.

When, in December 2019 and January 2020, news started coming out from China, then Italy about this weirdo new virus, my spidey senses started tingling. I’m a bit of a germophobe at the best of times, so the thought of having to deal with a possible pandemic wasn’t a great feeling. Add to that my job as a teacher, being surrounded by germ-ridden teenagers all generously sharing their viruses with everyone around them – it meant that I was paying attention to what was going on.

Over January and February, I didn’t use my Emergency Fund at all. I quietly topped up on staples and non-perishables as part of my normal shops. By the beginning of March I was looking to be in good shape. I took a little holiday and enjoyed myself. Then, a week or so later was when the proverbial hit the fan. You remember – when people started panic buying toilet paper, flour and tissues.

The middle of March was the first time I deployed my Emergency Fund. The last time I tapped it was the beginning of 2019 when Tom28 needed a loan to repair his car. He paid it back within 2 months and then the emergency fund just sat there, biding its time.

Remember when I wrote about going to Costco the day after our state Premier announced a state of emergency? As David26 and I rounded the corner after parking our car and saw the 1,000+ people ahead of us in the queue, I decided that if we were going to brave this, we were going to make it worth while.

In the back of my head were all my fears about the ‘just in time’ policy that our supermarkets have. For years I’ve been telling the boys that you don’t want to be out panic-buying supplies when everyone else is fighting for them too. Far safer to be at home while everyone else is wild-eyed and desperate. That trip to Costco was illuminating. Turns out I was correct.

We were only there in the first place because David25 wanted to bring some supplies to his girlfriend’s family. Ok, fair enough, but I was damned if I was going to race around behind one of those huge Costco trolleys, dodging hundreds of last-minute panic buyers just to buy things for other people! If I was going to be doing this crazy thing, I was going to top up our own supplies as well.

So we bought bulk bags of plain flour, bulk dry pasta, another big bag of grain-free dog food, oil, eggs, coffee, cleaning supplies… between what we bought for Izzy’s family and ours we loaded up the trolley.

On the way home we passed Dan Murphy’s. Seeing as we were already stocking up and it was definitely a ‘Spend Day,’ (more on that later), we turned in. There were only about 6 other people in the whole place. We were definitely ahead of the trend in buying alcohol! We bought heaps of wine, ( I don’t want to do without my shiraz in the evenings!) and I shouted David26 and Ryan25 some vodka, beer and spiced rum.

Earlier that day, at 8AM, I’d been to Bunnings, buying fence paint and potting mix. I’d thought ahead and realised that I’d need to occupy myself in the lockdown I was sure was going to come.

All up on that day we spent around 2K.

That’s when I deployed the Emergency Fund. I pulled 2K out from it and put it straight onto my credit card. I didn’t have to go into debt to shore up our defences – we had the cash. After all, if a pandemic isn’t classed as an emergency, I don’t know what is!!!

But then came something else…

A week after we went into iso, my oven broke down. Great timing, hey? It had come with the house, was cheap and nasty and was always something that I was going to get replaced, but I wasn’t planning on doing it any time soon.

Now this WAS an emergency. I’d just begun a sourdough starter – I needed an oven to cook in!

This was where the Emergency Fund proved its worth yet again. If I had no money set aside and had to buy something on my credit card, I know full well I would have probably bought another cheap and nasty oven – anything to get food hot and ready for dinner. I’d want to limit what I put on the card, so it would have been the cheapest I could buy. This would mean that a couple of years down the track I’d be in the exact same position that I was now – hating the oven and wanting to buy a new one.

But now? I knew that I wanted a German-built self-cleaning oven. Something sturdy and of good quality that would last for years. These ovens don’t come cheap.

I’m of the mindset that I’d rather do something right and only have to do it once, rather than trying to cheaply do things and end up having the same problem over and over. The Emergency Fund meant that I had the money there to get the job done right – first time. Sure, I was a bit annoyed at having to spend the money right now – this was a job that I would have been happy to palm off to some future time – but having the Emergency Fund meant that I could take care of it properly.

(On an aside – you should have seen the guys who came to deliver and install it a week later. They were gloved and masked – it almost looked like they were going to rob the place!!)

So the oven, plus installation, cost nearly $1,800. That’s nearly 4K to come out of that account in a couple of weeks. So how does running the Emergency Fund look like after this?

Easy.

As soon as you tap the Emergency Fund, the iron-clad rule is that you devote the next however-many-pay-packets-long to building it up again. You want to get it back to its original level as soon as you can, ready for the next unexpected event.

Sure, the timing’s been a little annoying. With that dip in the share market, I would have loved to be buying cheapish shares with my surplus money like a lot of FI/RE people have been saying that they’ve been doing, but in the Jones household financial security comes first. This means that a strong Emergency Fund is the top priority.

My next pay is on Wednesday. I have $500 to go to get my Emergency Fund back to its pre Covid-19 level. How have I done it so quickly?

Haha! My secret weapon – my ‘No Spend Days’ chart. It’s all about turning buying things and spending money from a mindless activity to an INTENTIONAL one.

I posted about how it works HERE. It’s worth reading if you think that this might be something that will help you have fun tracking your spending. It really works for me.

Basically, every day that I don’t spend anything, I get to colour in a square. if I have 3 or less days a week where I’ve spent money, I get to colour in a silver square at the end of the week.

The idea isn’t that I never spend any money at all – that’s obviously unsustainable. But what it does is to force me to consciously consider WHEN and WHAT I spend my money on. It turns spending from a constant dribble out of my wallet to a truly deliberate decision.

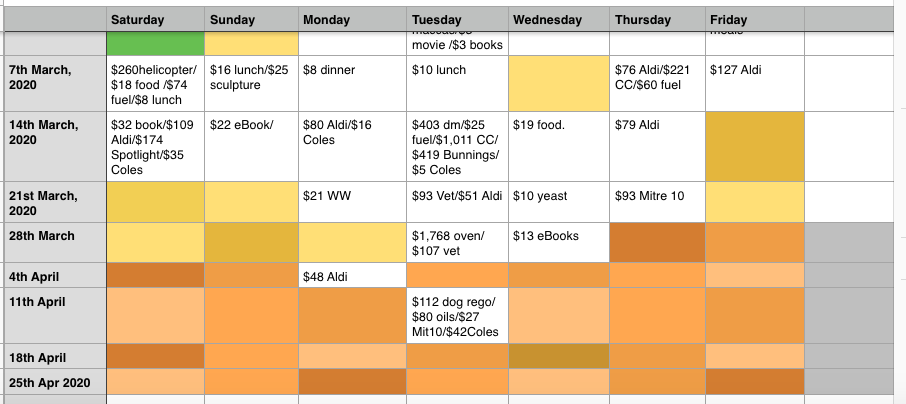

Now have a look at the screenshot I took from my chart. It’s showing March and April. April is orange – March is yellow.

From the 7th of March, I was away on my little holiday at Bowral. You can see there’s a spend of $260 on a helicopter ride – that’s not a usual item in my budget! I arrived home the following Tuesday, had a ‘no spend’ day after that where I just chilled at home… but then I swung into gear mopping up the last of the Covid-19 lockdown preparations.

On the 14th March you can see my ‘panic-buy’ at Spotlight, where I bought $174 worth of quilting supplies. A few days after that, on March 17, was the hideous Costco shop, along with the Bunnings and Dan Murphy buys. I deliberately grouped them all together, knowing that they’d be substantial. Geographically, they were close together too – saving on petrol. Why not? 🙂

The rest of March, the shopping was just for little incidentals to pick up tiny things I may have missed. An example is the $10 yeast on the 25th March.

But look at what happens once April starts:

Well ok, buying the oven on the first day of the month was annoying, as well as having to take a sick dog to the vet. But after that, the spending has plummeted. Why do I need to spend money once everything I need has been taken care of?

Some people I see on Twitter and Facebook are preening themselves on their cleverness in using online shopping to buy food and anything else they want, saying that they’re taking themselves out of the line of infection. But that doesn’t sit right with me – I think that by doing that, you’re putting other people INTO the line of infection by having to get your order to you. I know people need the work, but for me? I’d rather know that I’ve looked after ourselves and we’re not asking other people to risk their health just so we can bunker down and feel safe.

I’m lucky in that I still have a wage coming in. Most of that wage has so far been replenishing the Emergency Fund. But this is something that anyone can do whether they have a job or not – I know because I did it myself when I was absolutely broke and living on the Sole Parents Pension.

It doesn’t matter if you can afford to tip a thousand, a hundred or ten dollars a pay into building your emergency Fund back up – IF YOU KEEP ON DOING IT EVERY PAY, IT WILL GET THERE EVENTUALLY. You just have to keep the long view in mind and know that it will happen and you’ll be all the more secure for it.

As for our long streak of not spending any money, this will end tomorrow. With all of the delicious sourdough I’ve been making – (RECIPE HERE, thanks to latestarterfire’s recommendation), we’re down to our last stick of butter.

I’ll be whisking myself off to Aldi to buy butter, top up our fresh produce (though the garden has been a godsend in keeping us away from the shops – (another security measure I should maybe write about??) and to buy some chicken chips. I still have some chocolate, but nothing beats the salty crunch of potato chips/crisps when I’m watching ‘Survivor’.

In a few days my Emergency fund will be back to normal and I can relax, knowing that when – not if – the next unexpected thing hits us, the one thing we won’t have to worry about is money.

And that’s a precious thing.