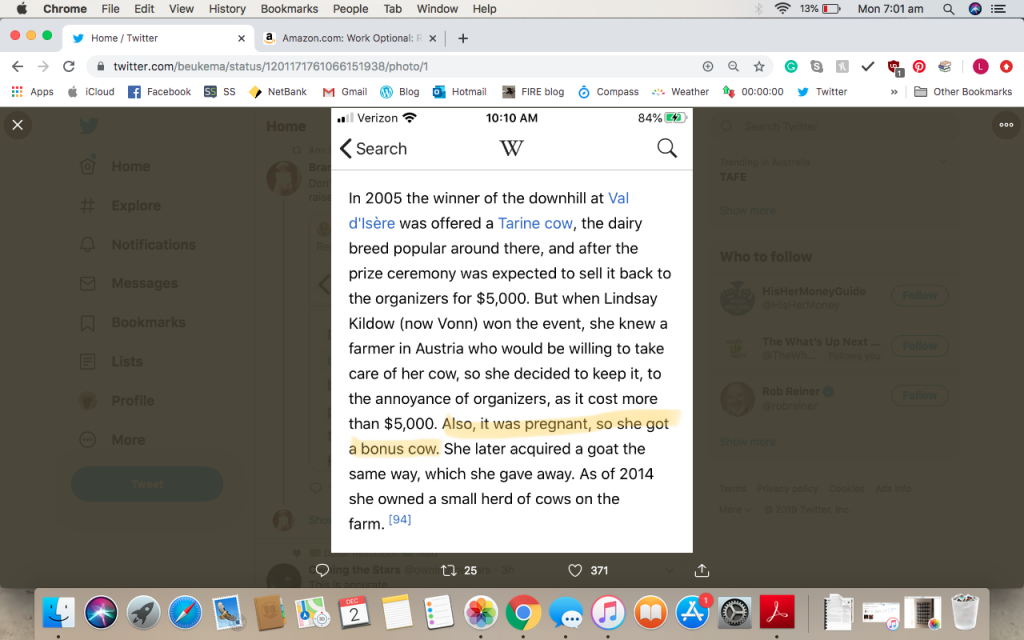

I saw this on Twitter a little while ago and it tickled my fancy. I loved how she took what the organisers of the skiing event obviously thought of as a novelty prize and used it as the basis of a thriving herd of cows today. Can you imagine the chagrin of the organisers as she blithely took them at their word and walked off with ‘their’ cow??

Obviously, one cow (even a pregnant cow) does not a herd make. But over time, it’s possible to build something from nothing if you keep quietly focussed and take strategic steps towards a goal, just putting one foot in front of the other.

There’s nothing stopping any of us from building our own equivalent of Ms Vonn’s herd of cattle. No matter who you are or where you’re starting from, there’s always room for a goal to be set and to be worked towards.

Picture me, back when I’d just left my husband. I had a starting position of $60 cash, with the added bonus of 4 boys under 5 to feed and water as well. I guess I started with my own little herd of humans! My overarching goal was always to keep a roof over those boys’ heads. But my first goal?

To scrape together 1K for what I called a “Buffer Zone” but which I now call an Emergency Fund. I wrote about how I learned very quickly that having cash between us and a hostile world was a very good thing, and when I was forced to cash it in, the first priority was to get it built back up again.

It’s easy to write about building up 1K in a cash stache nowadays, but back then it wasn’t easy to do. It took months of scrimping and scraping to get that 1K put away safely. It required many small decisions about what to buy and what not to buy; what had to be paid for now and what we could wait to get. It took me putting one foot in front of the other and slowly advancing towards that goal.

Even though this is a FIRE blog, I’d be stupid to suggest that every single goal worth aiming for has to be financial. We have to enjoy our lives along the path to being financially free, after all. Poppy is pictured above on my string quilt. This quilt is a totally unique creation that I initially started with the aim of using up tiny scraps of fabric instead of throwing them out. I wanted to turn them into something useable.

The concept itself was simple. I sewed strips of fabric together into 5″ square blocks. Some blocks have only 4 or 5 strips in them. Some have way more, which means that this was definitely not a quick job! The smallest strip is, I think, a quarter of an inch wide.

That quilt took me 9 months to complete. I put together square upon square upon square, sewing other quilts in the meantime and using scraps from those to keep putting this one together. It seemed as if it would never be finished, but finally, I got out a tape measure, worked out the dimensions of how big a Queen-sized quilt would be, then *shudder* did the Maths to see how many squares I’d need.

The answer was 396.

That quilt is on my bed to this day. It looks amazing and it’s hard to remember all of the many patient hours I spent at the sewing machine with tiny scraps of fabric, sewing together all of those 5″ squares. By themselves, each scrap of fabric is an inconsequential piece of nothing. But placed together, they represent a goal achieved.

On my way towards financial independence, I’ve set many goals and achieved them. Some were financial, though I’d argue that the underlying goal pushing me to achieve these ones was always a deep desire to provide security for my family. Others were more lifestyle goals, such as my Europe and North Korean trips.

For years, my Big Fat Hairy Audacious goal was to become mortgage-free. It took me 17 years, but I did it. But 17 years is a long time. Did I get bored and want to go nuts and spend my money on wine, men and song? You bet I sometimes did. But I kept making many small decisions about where I’d put my money. Every thousand that came off the mortgage made me smile, even though, especially in the early days, those days were very far apart.

But I kept putting one foot in front of the other and, seemingly overnight, that mortgage was gone and the boys and I had a secure base. After all, that 17 years would have passed whether or not I fulfilled that goal. May as well get things done while that time is passing, hey?

Today I’m focussing on getting The Best House in Melbourne ready for Future Frogdancer to live her best life in retirement. Instead of saving and investing money, as I did earlier on, I’m now looking deeply at what gives me the most pleasure and satisfaction in life, then I’m looking at spending my money in the ways that will continue to bring contentment and happiness to my life going forward.

I’m only buying things that have value to me. So upgrading my lovely little 2014 VW Golf is definitely off the table, while paying for self-watering veggie beds, a secure front fence to keep my dogs in and putting a huge verandah out the back to entertain my family on important birthdays and Christmases are things that are definitely happening.

Whether the goal has been a savings/investment goal such as reaching a specific number or getting an emergency fund topped up, or whether it’s a lifestyle goal such as the ones I’m organising right now, the way to reach those seemingly different goals has always been the same.

Figure out what you want.

Then find out how to get there. Break it down into smaller steps.

Then keep putting one foot in front of the other, step after step, until you reach it.

You can do this.

What a great post for this time of year. It’s the end of one decade and the beginning of a new one, so it’s the perfect time to set a BHAG (Big Hairy Audacious Goal) or two!

Now what do I want?

Now that’s the question.

🙂

What a fantastic post. Now to go and set some big goals and work out what I want lol.

Actually I want to travel but damn covid keeps ruining the plans. One day we will get to explore again!

Look on the bright side. Staying home in 2021, which is pretty much what I expect to be doing, just gives us more time to save for trips in the future!