At the moment I’m pointing the car towards home and I’m in Naracoorte, but this morning I woke to rain hammering down outside. A perfect morning to do a little ‘catching up’ with you all.

I still have some shots to show you of the first day, when I was in Port Campbell looking at the sights on the coast. When I put up this photo, I wondered if I could find a youtube thingy to show you how London Bridge used to look when it was attached to the mainland. I hit the jackpot.

Imagine being the tourists stuck on the wrong end of London Bridge! I’ll bet they were glad they weren’t walking across 5 minutes later…

It would’ve been a very scary dive down to the sea.

The Arch is much smaller.

As I said in the post before this one, the tourist board here has made these spectacular features very accessible to view. I was on the boardwalk looking down at The Arch on my way down to the viewing platform to see it properly. As I leaned over the edge, the wind blew up from this little bowl of seawater and the smell…!

It was beautiful. So salty and fresh. I walked down behind a family with 3 little girls all chattering away to see this:

You can see the bowl of seawater below it. I’ll never forget the fresh, salty tang of that lungful of air.

Even though it was school holidays, there weren’t that many people there. When I was doing my research the day before, lots of articles and posts were warning people to get to the 12 Apostles etc at sunrise or sunset, when all of the big tourist buses weren’t there. But here was I, in the middle of the afternoon, wandering around without too many other people around. I was never alone – which for a single woman travelling alone would have probably creeped me out anyway! – but there was plenty of space for everyone.

It couldn’t have been just the weather – covid is still definitely having an effect.

As I was walking back to the car park, I tried taking a shot of the waves below, hoping I’d get an accurate picture of the colours. I’m just using my iPhone.

Isn’t it lovely?

And now we come to a place I’d never heard of before I came here – but I LOVED it.

It was a fair walk from the car park but it was all pretty level until the steps descending steeply to the actual grotto. The chatty family with the 3 little grls was with me again and I overtook them on the path as we walked to the top viewing platform.

Then I went down the steps to The Grotto.

The chatty family and I shared this space for about 10 minutes – 10 LONG minutes. I just wanted them to take their pictures and go away, because I knew that this space would be so serene and peaceful if I could stand there in silence. Eventually the family left and I could let it all soak in.

It’s incredibly beautiful. The rocks lined up at the bottom of the photo are at the top of the fence which protects the pool from yahoos who want to wade in it.

To the left is a little cave, but to the right is the arch looking out towards the horizon. It was quiet, with only the sound of the waves washing in and the cry of an occasional seagull. The tide was coming in.

Even on such a dull day, the light was constantly changing.

I stayed there for quite a while, then it started raining, so I decided that I’d seen enough.

There were another 2 sights to see, but I decided to leave them for the way home. I’m planning to drive along the Great Ocean Road all the way to the ferry at Queenscliff.

I hadn’t bothered to have lunch so I was starving. I was parked outside the pizza shop in Port Cambell, waiting for it to open when my phone rang with an unfamiliar number.

**** Here’s the story that I was never going to tell anyone, but it’s too funny not to.

Yesterday, when I was researching the trip, a blog had mentioned a particular motel in Port Campbell as being quite good. I pulled up one of those booking sites, booked a night’s stay in Port Campbell, but when I drove down and went to check in at the good motel, there was no one at Reception and no key had been left for me.

A little miffed , I rang the phone number on the door and the woman who answered told me to take room 7 and to flick my booking confirmation across to her when I had a chance.

I dumped my bags in the room, emailed her and then took off.

The phone call was from her. “Frogdancer, I’ve looked at your booking and you’re actually meant to be staying at a different motel.”

I felt like such an idiot. Thank God I hadn’t used anything in the room. So I left the pizza place, grabbed all my bags and loaded up the car again and drove to the other place. I told the girl in Reception about it and we had a good laugh at my expense.

WHAT a fool.

I went back to the pizza place and bought what might be possibly the worst and most expensive pizza I’ve ever eaten.

Served me right.

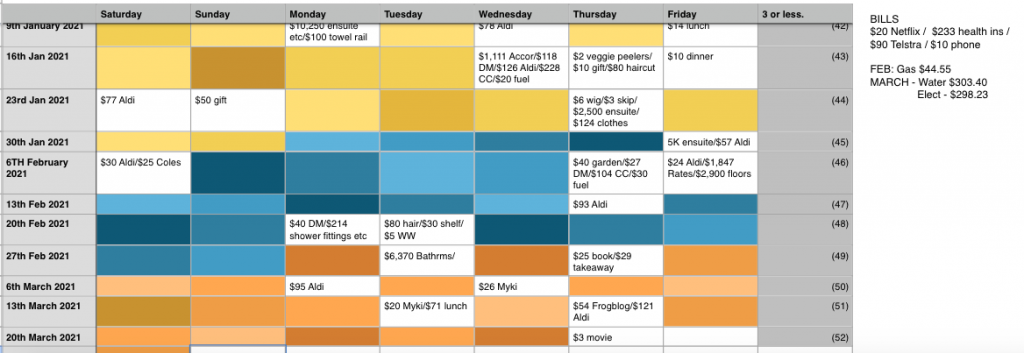

Day 1 cost of the trip:

*Food I bought from Aldi for meals and snacks: $60

*Fuel $55

*Accomodation at the second motel: $138

*Unenjoyable pizza – $20

Running total: $273

Can you believe that I saw all of these amazing things for NOTHING? I really want to keep the costs down on this trip – I have Antarctica to pay for, after all.

EXTRA THING – Remember when I wrote an imaginary Money magazine article a little while ago? The Joyful Frugalista sent it to the actual magazine and they published ‘How I retired early as a single mother with four kids‘ a couple of days ago.