This morning I got up when my alarm went off at 5:55 AM, let the dogs out and then fed them their breakfast. I fed Scout her chicken neck in the front yard and Poppy and Jeff in the back yard. This started from when Scout was a puppy and was so much smaller than the others and the routine has simply continued from there

When I let her in and she started trotting down the hallway to get to the doggie door to the backyard, she stopped and looked around at me, her eyebrows raised. She’s been doing this for the last week or so. When I said, “Outside!” she turned and raced up the hallway to the doggie door, tail wagging – the picture of joy.

‘Well, I guess this is a new part of the morning routine,’ I murmured as I went to put the kettle on for coffee.

This got me thinking about how much we humans rely on routines to set up habits – both good and bad – and to get us through the day.

Scout’s new ‘thing’ in the morning is harmless. For some reason unclear

The best, most productive routines are the ones that you’ve put in place for yourself, knowing that they’re most likely going to get you the results you want.

The routines that work best for me are things like:

- Taking the dogs for a walk as soon as I get home. If I sit down to check emails, it’s fatal. Once my backside hits the couch, I’m not going to go for a walk. So I try to grab the dog walking bag as soon as I walk in. As soon as they see me with that bag, I have to put the leads on them. Works like a charm!

- Making my lunch for the next day while dinner is being cooked. Then all I have to do the next morning is grab it as I head out the door. I didn’t do this last night – Ryan23 made pizzas for dinner and I forgot to get him to make me a salad while he was doing the pizza toppings. So today’s lunch is a microwave rice bowl from Aldi. Not nearly as nice as a fresh garden salad, but honestly, it serves me right!

- Before I go home for the evening, I look at the first 2 classes I’ve got and put whatever materials I may need, in a pile at the end of my desk. In case something happens and I’m running late, I don’t need to get my head around what I’m going to be doing – it’s already organised.

- As soon as I get paid each fortnight, the first thing I do when I log in is to transfer 1K across to my credit card. This ensures that there’ll be enough to keep running it as a debit card, but I still get points and the lights and water still stay on. Then I decide what to do with what’s left.

- A glass of wine at 5 o’clock (‘wine o’clock’) as a reward for making it to the end of another day. This may not be the most productive routine, but it’s one of my favourites!

Routines like this are great because they’re aligned with your personal values and there’s an intrinsic motivation to keep to them. I’d love to hear in the comments about any routines that you’ve made yourself stick to.

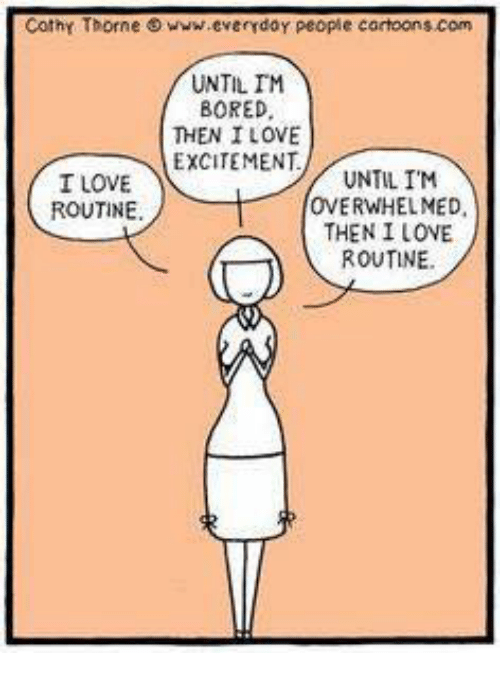

It’s not quite the same when a routine is imposed upon you.

Work routines are like this. Being a teacher, my work days are defined by bells. Classes start at set times and finish the same way. I know that Mondays and Tuesdays will always begin with my year 7 classes, while the last 2 periods of the week will always be with my year 12 Theatre Studies kids. Unless there’s a fire drill, there’s usually no surprises.

Lunch is at the same time each day, as is recess, whether you’re hungry or not.

It takes a month or so before I know which classes I have on which days and which rooms they’re in. The working week takes on a familiar ebb and flow for all of us. But these routines are dictated to me by the timetabler. She has decided that Wednesday and Thursday are my frantic days, while Monday and Friday are cruisier. Personally, I prefer to start off the week busy busy busy and then ease off as the week goes along. But I have no choice in the matter.

To mix things up a bit, because I’m a wild and crazy rebel, I drove a different way to work this morning. It took 5 minutes longer but I got to nod hello to ‘Maisie’, a beautiful little tree on a nature strip on a busy road that I used to see every morning until I found a more optimised route to school. Tomorrow? Odds are I’ll be back to the usual routine. It’s quicker.

There’s nothing so wonderful as when a bolt of inspiration hits, or you get into the flow of doing an activity and time seems to vanish. Moments like this are golden. But, as William Golding, (above), said; it’s a matter of getting into the habit of hammering out the material. Every day, making sure that you’re doing something to advance you along the way to where you want to be. Stephen King, the novelist, writes about this in his fabulous book On Writing. He writes 2,000 words every day, without fail. He won’t switch off his computer until those words are done… and coincidentally, he’s completed over 65 books.

Remember my chart of productive habits that I started at the beginning of the year? It’s now March and it’s working like a charm. It’s become a habit to mentally tick off the categories as I do them. For example, in today’s first lesson, I used the 10 minutes silent reading/writing to read from an actual book. *details at the end of the post. I can now tick off the ‘write every day’ box. I wiped over the bathroom before I left home this morning, so the cleaning one’s been done too.

It’s now become part of the dogs’ routine to expect a walk when I come home from work. Their delighted expectation makes this one easy to tick off.

The chart is a simple way to make sure that the habits I want to instil in myself are going to be formed.

We all have routines that are placed upon us. But if we have the self-discipline to impose routines that are meaningful and relevant upon ourselves, we’ve immediately optimised our chances of success

*The book I was reading is called ‘The Gay Galliard’ by Margaret Irwin. It’s about the relationship between Lord Bothwell and Mary Queen of Scots.

Yes, I know that the title hasn’t passed the test of time well, (it was written in 1944), and it’s very long-winded, but I’ve wanted to read it since I was young.

It’s a shame that Ms Irwin has the unfortunate gift of turning the Interesting into the Dull-as-Ditchwater…

However, once Poppy and Jeff have some counselling and get their goals back into realignment, we all set off together.

However, once Poppy and Jeff have some counselling and get their goals back into realignment, we all set off together.