It’s funny how my perception of worthwhile purchases has changed since I reached financial independence, (FI). The latest thing I’ve bought – the pizza oven – is a perfect example of this.

I’ve always made pizzas for my family. Firstly, I married an Italian, so I learned to make pizza, pasta and lasagne very quickly after I moved in. I was brought up in a Skip family in the 60’s and 70’s, and Mum’s repertoire was pretty much meat and 3 veg with tinned fruit for dessert. The Italian cuisine was definitely a step up!

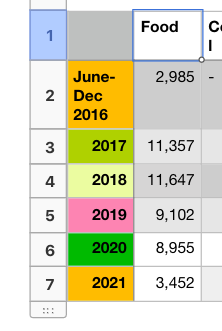

Then, after the divorce, when the boys and I were living off the Sole Parent’s pension of around 18K per year and, (for the first few years when I wasn’t teaching), $20/month child support, pizza, pasta, pancakes and mince were my best friends. You can feed an army with those items and, with 4 boys, I practically was.

Back then, the only pizza ovens that were around were in pizza shops. But if domestic pizza ovens were a thing in the 1990’s/2000’s, there would have been NO WAY I would’ve even considered buying one.

So what if the taste of pizza made in a proper pizza oven was superior? I was baking perfectly adequate pizzas in my regular oven, thank you very much.

So it only takes a minute to cook a pizza, as opposed to around 12 – 15 minutes in a regular oven? That sounds good, but really… it’s dinner time. We’re already in the kitchen where we need to be – a few minutes saved isn’t that big a deal.

And of course – the clincher:

They cost HOW MUCH??? Are you KIDDING me? Who in their right mind would pay hundreds of dollars to make a pizza taste better and save a few minutes? Not this little black duck! I have far better things to do with my money.

And Past Frogdancer would have been correct. She DID have better things to do with her money, such as pay off the house, send the boys through school, buy braces and glasses for whoever needed them etc etc. I called myself a ‘little black duck’ a few sentences back and that’s a pretty apt description for how life was back then. My little webbed feet were paddling furiously under the surface to make sure that the boys and I stayed afloat.

But now that I’ve reached FI?

It seems that the rules have changed a bit.

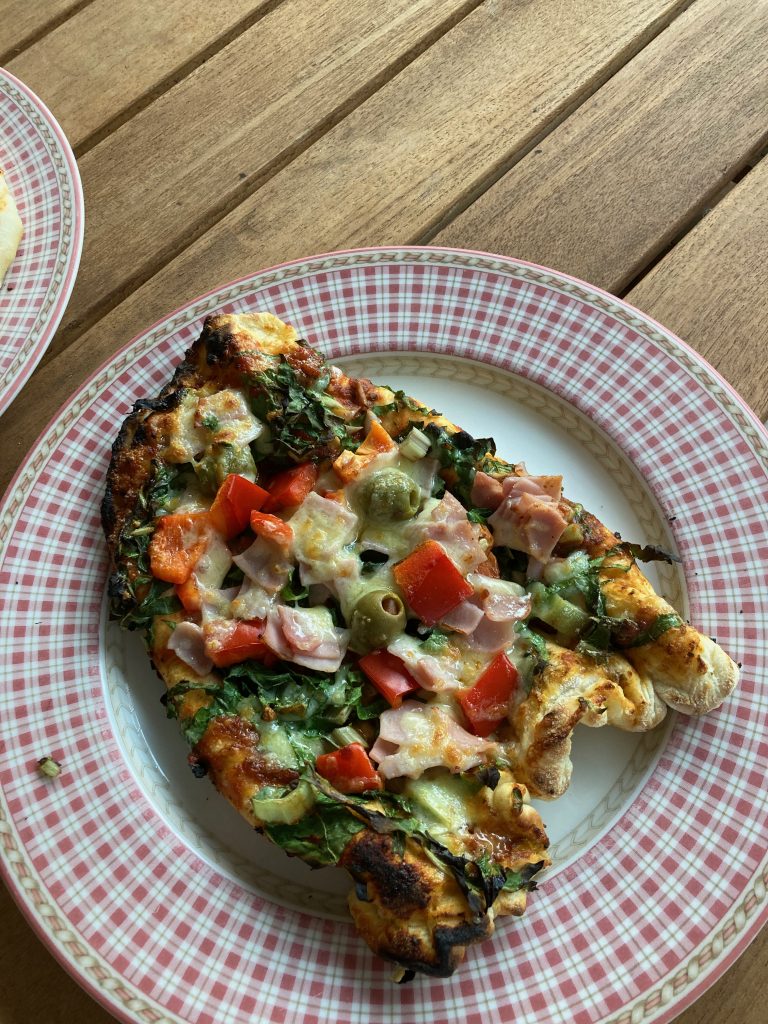

When I first saw that Thermomix was selling pizza ovens, the first thing I thought of was how fantastic entertaining would be with one of these working with me. I realised this was something that could definitely make a positive difference in my life. Safe to say, I was interested in finding out more.

But hey, let’s not get crazy here! The next thing I did was check out the price. I haven’t changed that much! There’s no point fantasising about owning something if it’s impossible to pay for.

Fortunately, the price was reasonable.

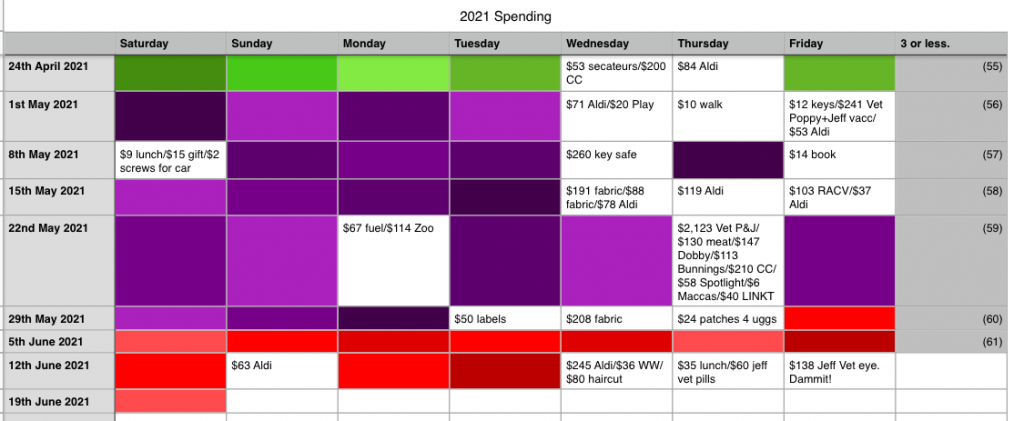

It’s interesting though. Unlike buying a thermomix, I won’t be using this pizza oven nearly as much. There’ll be weeks that go by when it won’t be touched. Granted, it’s not as pricey as a thermomix, but even so. The cost per use won’t be nearly as good.

But for the first time, that wasn’t the important part. The major tipping point for me was the thought of seeing my boys, my wider family and my friends gathering together and having fun, enjoying good food – because who doesn’t like pizza? – and it being something that everyone could look forward to doing.

In other words, the emotional draw of this product trumped (ugh – hate that word… I wonder why) the financial considerations.

This is the side of practising delayed gratification that we don’t often hear of. Everyone talks about front-loading the sacrifices to get to a point where you can loosen the reins and start indulging yourself. Not many people talk about what it’s like once they reach the point of being able to relax and reap the rewards earned by being disciplined with expenditure for so long.

Well, I’m at that point. I don’t want to run crazy, buying every shiny new bauble in sight, but it’s nice to have other things be the deciding consideration, rather than simply “How much does it cost?”

The decades of frugal living have left their mark, but in ways that I really like. I live a life filled with simple pleasures that don’t cost a lot, if anything. I love to go travelling – fingers crossed Antarctica can still go ahead this year – but I’m also extremely happy puddling around at home.

I spent years and years living on the knife’s edge of poverty when the boys were small, determined not to fall off. My theme song was Bon Jovi’s “We’re Halfway There”, except I changed the line to “It DOES make a difference if we make it or not.” I went without many things and made probably thousands of little sacrifices that, while I obviously noticed them at the time, have mostly faded into obscurity over the years.

All of those little daily frugal habits have brought me here. I hope that there’s someone reading this… maybe someone who feels like they’re stuck in the boring middle ground of FI when it seems like you’ve optimised every expense and now you’re just plodding through… someone who can catch a glimpse that it’ll all be worth it.

After all, the time will pass, regardless of whether you’re using the tool of delayed gratification or not. But it can make a huge difference as to where you’ll be when you’re older.

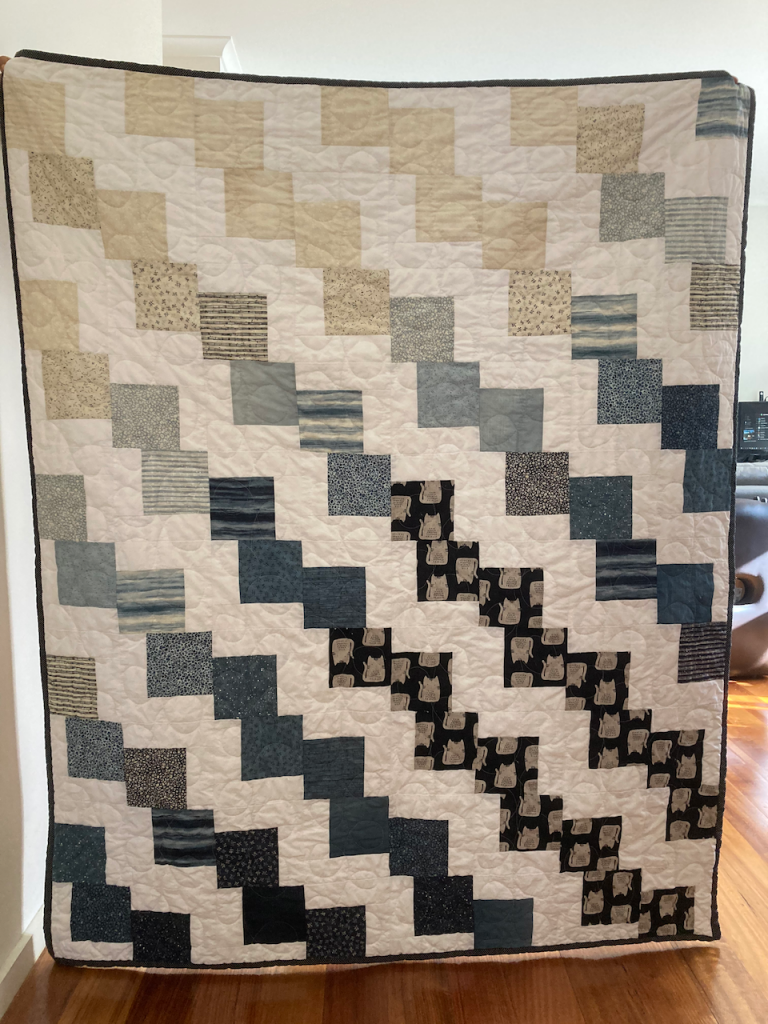

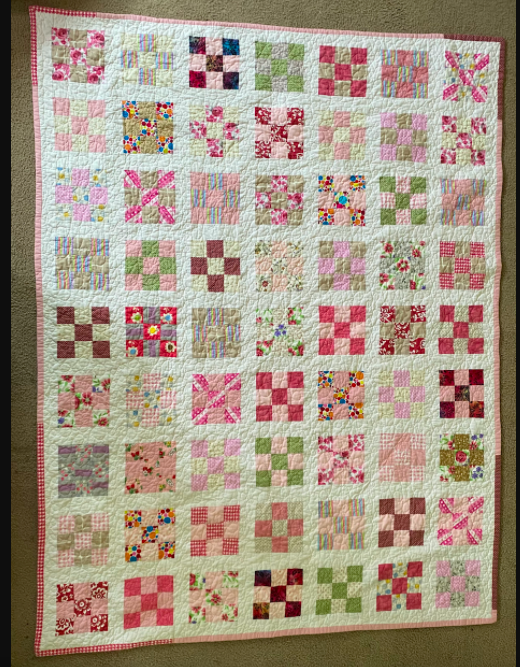

It’s 11:34 AM on a Tuesday. I’m about to get up and plant some new flowers into some hanging baskets, before making some bread rolls for lunches and then finishing off a quilt for my cousin. Tom30 is working from home and I can hear him singing in his room. Luckily, he has a beautiful voice! As I’m typing this I’m throwing a ball for Polly and Sout to chase, while Jeffrey is snoring beside me.

In an alternate universe, 11:34 AM on a weekday would mean that I’d be either in a classroom teaching 28 kids, or at my desk in the staffroom marking papers or preparing lessons. Not a bad life, granted, but I know which one I’m very happy to be living!

(In the comments last week, Maureen asked me for a review of the Ovana. Here’s the link, in case she missed it.)

Dad joke of the day: