When people whine and say that “kids should be taught personal finance in schools!!! Wahhh wahhh!” you can tell them to pull their heads in.

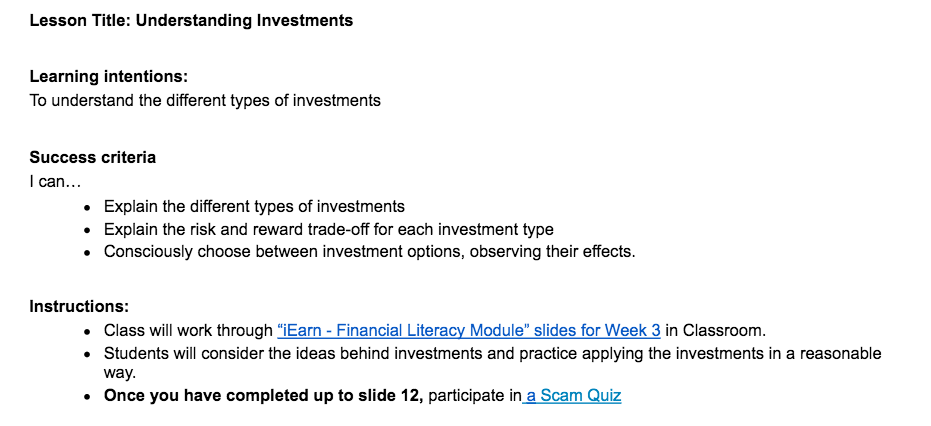

This was the lesson plan of the first class I taught today. It’s a year 9 class that every kid takes, where they learn about our political system, how to manage money and invest, careers advice, the media and lots of other things.

As you can see by the lesson plan, kids ARE being taught real-life lessons about money and how to handle it.

The hook for the lesson was a 3 minutes news report that I played on the interactive whiteboard. It was about Afterpay and similar companies, and how people are running amock with it in the short-term and then living to regret it in the long term, as the levels of debt they rack up make it impossible to get mortgage loans from banks.

Then they went on to what the lesson plan outlined. Learning about different investments and going on to “Consider the ideas behind investments and practice applying the investments in a reasonable way.“

This is all real-life stuff. About money and how to evaluate the best way/s to use it.

Kids ARE being taught about finances. They always were.

The only reason people think that they weren’t taught how to manage money in school is because they weren’t interested in the subject when they were teenagers and so they didn’t retain the knowledge. (A bit like me and mathematics.)

We’re preparing the kids for the future! Anytime someone tries to whip up anger against teachers/schools for not doing this, they’re talking through their… um… hat.

Dad joke of the day:

What do you call a wolf who has everything all figured out?

Aware wolf.

As much as I think it would be useful for kids to get more education on financial literacy in schools, my understanding is that the best time to teach this is actually just before people start having to use various products etc. So learning about credit cards just before you use them, mortgages, investments etc. The problem is that they’re mostly out of the formal education system at that stage, and who is going to sign up for a short course on mortgages or investing in their spare time?

Separate to this is that I think a lot of teachers don’t exactly have a great handle on personal finances themselves (some of your stories have reinforced this belief!) and it can be hard to teach something you don’t understand yourself.

Last but not least, the hard part about personal finance isn’t the math (although you can argue the point here!) but the behaviour, in particular delaying gratification. And I’m not sure that schools are great at teaching this, or that it should be up to them to do so.

Who’d be a teacher? We’re damned if we do and damned if we don’t!

I believe that the parents are the best teachers. If you can get parents to learn about saving and investing etc, then our kids will be better off. All of my three kids have learnt more about looking after their future from me than they have from any of the school programs. I have given my kids the tools to use and taught them to share what they have learnt and not be jealous of one another doing well. My Eldest (20) has been in his home now for 2 years, drives a $30,000 car he paid cash for, My 17 year old (middle child) now has a deposit saved up for her house when she turns 18. She owns her $10,000 car outright. I lent her $4,000 towards the car because it was a good deal and she has paid it all back to me as of last week. My 14 year old has about $6,000 in the bank and she has only been working for 5 months. Education begins at home.

Your kids are doing brilliantly!

I love that after pay was a topic of discussion because I believe “kids/teenagers/young adults” understand this. Ask them what a lay-by is and they probably haven’t got a clue. With a layby you still had to work to pay it off before gratification of collecting the item. The afterpay is get it now and worry about paying it back later. You then have to work to get the money to pay back something you already have. I know 100 years ago [well not that many but a lot] I needed to buy a new fridge and washing machine and did not have $2,000 so back in the day “GE Finance was the 12 months interest free finance at Harvey Norman and the like”. The minimum payment was I think $40 a month for the year and then of course after 12 months it probably jumped to 28% or something crazy. I divided the $2,000 / 12 and paid $167 a month for 12 months interest free. So I got my whitegoods and paid them off in 12 months with no interest. It does help that I worked in admin for an accounting firm for 12 years and learnt so much about negative gearing, capital gains tax, tax in general and I love numbers and spreadsheets. A lot of people who need to get $2,000 credit to get whitegoods may only think of the first 12 months being interest free but I’m a wake up to all of that. I used it to my advantage. I have taught my kids from a young age about money, credit cards, savings and spending and they have hosted a dinner party for 7 people with $50 for a 3 course meal [one of the activities in the Barefoot Investor Family book. It was about 4 years ago and they were 14 and 12 and LOVED it, they each had to work out the menu, go on line and work out items they needed to buy and then go through the supermarket and buy the goods…actually that was funny because they left the bags in the car [which I knew] but we got inside the shop then they had to go back to the car. Also I walked behind them in the shop and they had to find everything [included where would sesame oil be]. Usually when we were in the supermarket they would be behind me because I know where everything is. They came home, prepped chicken marinade, chopped veggies, my daughter made ice cream in the Thermomix and sticky date pudding. They also had to work out if they could do a cheese platter. They spent about $49.50. They put together a playlist, served us drinks and we set the table with the good china and white table cloth which my daughter ironed. It was a great night and they loved it. Also I said we don’t spend $50 on every meal because that would be $350 a week however for a 3 course dinner party for 7 people that was amazing. They used pantry staples but I was impressed as their mother and they felt so great and loved every minute of it. Both of them have had part time jobs and save really well and go op shopping. I love teaching them about money at home however that’s because I totally understand it.

This is such a great comment!

That dinner party is definitely something that’ll live in their memories forever.

I’m very glad the subject matter includes finance topics and in a practical way. Our states are different and my son is now 28 but I don’t remember anything like this being taught through his high school years. He did have a week at the end of year 12 where they had some ‘life’ classes but he has either read or taken in what’s happening here at home. He is now taking on his first home loan and has an almost 2 year old with additional needs from type 1 diabetes. He often rings or messages Mum to work through a budget or just talk interest rates etc.

My son with the new mortgage also does this. It’s so special.

In New Jersey (US) the kids have to take a full semester on personal finance. Besides learning about the stock market, investing some “money” and watching what happened over the semester, they also had to research starting salaries in areas they were interested in for college. The day they learned the difference between gross pay and net made for a hilarious dinner conversation! Then lastly, researching apartment costs, utilities etc to build a full expense budget and compare to their net salary. BIG wake up call for a lot of kids.

That’s brilliant. Yes, when they find out about tax, they’re always gobsmacked!