Frugal. Such a funny word. It seems to have a slightly different connotation to everyone. To me, it’s primarily a disinclination to waste things that I’ve put my hard-earned time, energy and money into. Frugality, to me, isn’t just a money thing. It’s also a refusal to squander my time and focus on things that won’t bring me pleasure and satisfaction.

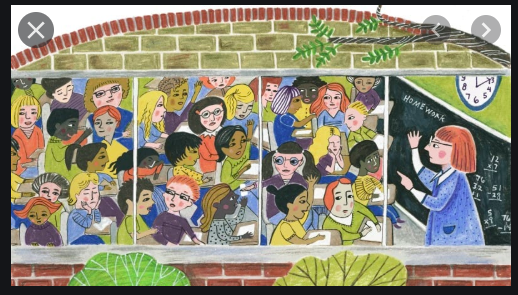

As I was taking this shot, it occurred to me that this photo is full of frugal elements.

First off: look at those plump Bellotti beans! Whoever grew and harvested them certainly knew what she was doing! But why grow them at all? I’ll go into that in a minute.

Then there’s the red bowl. I bought around six of them when the boys were small, from Ikea. I’ve lost a couple of them along the way, but the rest of them are still going strong. They’d be well over 20 years old by now. There are plenty of shiny new bowls in the world, both in Ikea and elsewhere, but why ditch them when they still do the job? Plus they’re a small part of the history of our family.

The library book. Yes, I’m still reading this novel, though I’ll finish it by the end of the day. When I heard that it was being released I was so excited and I could’ve easily just bought a copy and downloaded it to my iPad via the (free) Kindle app, but instead I waited in line for it from the library. Delayed gratification makes you stronger.

The table with the Queen Anne legs in the background used to belong to my dear friend Scott. When he and his partner moved to England over a decade ago, we took a few things off their hands for a bargain-basement price. (Thanks Scott and Mark!) I have absolutely no plans to upgrade – I love that table and so why would I get rid of it?

But getting back to the question of why I’d choose to devote time, energy and space in the garden to grow a few handfuls of dried beans…

See this garden? It has 5 wicking beds in it, metres upon metres of brick paving and a massive verandah roof on the lower half. If I grew veggies covering every square inch of this space from now until I was 87, I wouldn’t make back the money I’ve spent on this space.

Now this wasn’t a surprise. I knew that this would be the case going in. So why did I – the woman called a tightarse by her co-workers (and, to be fair, herself) – choose to do this?

Because to me, frugality isn’t simply being cheap and niggardly with money.

Frugality to me is a choice to recognise the fact that money is a finite resource; so it’s smart for us to utilise that resource in the most effective ways we can to enhance our lives.

With regard to the garden, this meant that I front-loaded the expenses so that for the next 30 years I can reap enjoyment and fulfilment from it. To my mind, that’s a helluva deal.

Because yes – I LOVE getting something for nothing. Those beans? They’re harvested from beans that I grew last year. Free food – my favourite flavour. I get a kick out of growing things from seed, then saving seeds or cuttings from next year’s crops. There’s a sense of continuity that I really enjoy.

Am I saving money by doing this? The short answer is yes, of course. But not very much. The next time you’re in the supermarket, have a look at what a pack of dried beans cost. Less than a dollar.

But there’s something so darned satisfying when you have a bowlful of beans that you’ve sowed, watered, let dry and then harvested. The sound they make as they fall back into the bowl and the feel of them as they run through your fingers. I have more of them still growing, but once they’re all dried I’ll probably cook them up in the slow cooker and freeze them into 250g lots. That’s how many cooked beans are actually in a 400g tin.

Every time I reach into the freezer to grab a bag of these babies, I’ll be smiling. It makes me happy to grow some of our food. It makes me happy not to have to race off to the supermarket if I need a tin of beans. It also makes me happy to utilise some of the land on my block for growing food.

Frugality is gaining joy from the tiniest things in life, such as a handful of beans. Or a pile of spuds.

This sinkful of spuds came from potatoes I planted over 3 or 4 years ago. Every year they keep producing food for us. I didn’t intend for this to happen – I just happened to be in Aldi, saw some seed potatoes and threw them at the bottom of one of the new wicking beds.

Yet here they are – the gift that keeps on giving. In the beginning, I visualised that we’d get a few meals’ worth of spuds from those seed potatoes, but there have been many more than that. Free food. Bargain. I can put the money that I would’ve used to buy a bag of potatoes towards something else.

Like Antarctica. Fingers crossed, I’ll be going in December. Definitely not a frugal destination… but wow. Icebergs. Penguins. That’s definitely adding value to my life!

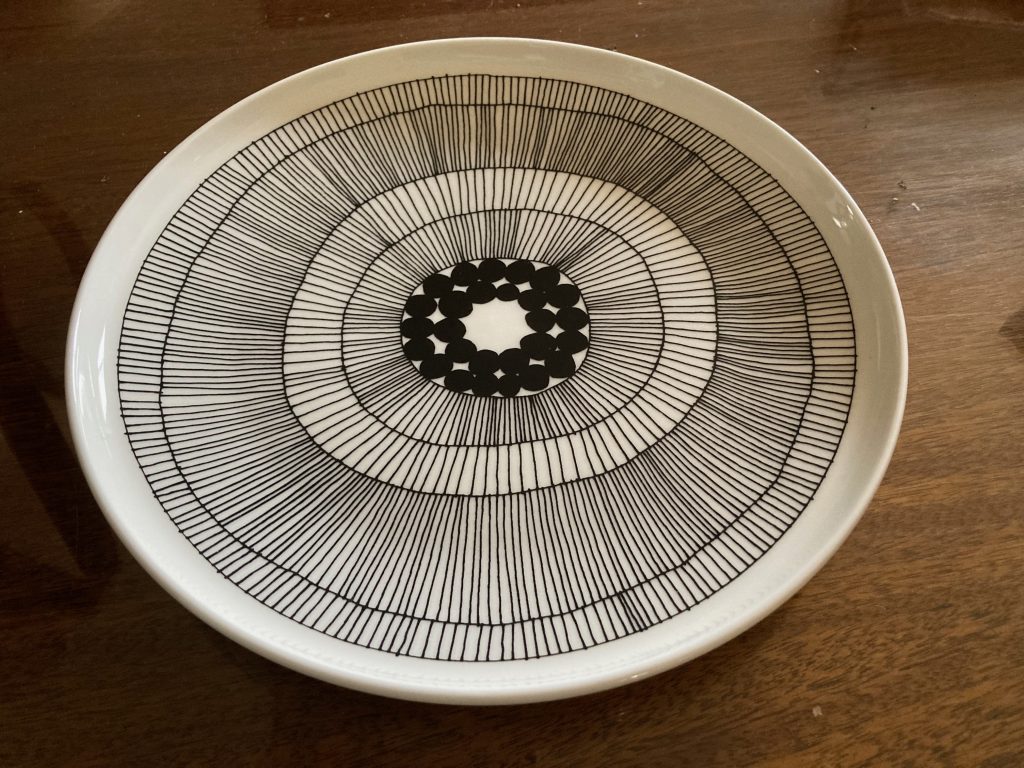

Frugality is also probably why I like quilting.

Quilting can be a frugal(ish) way to pass the time, or it can be hellishly expensive. When you shop for fabric at a ‘proper’ quilting shop, the prices START at $20+ a metre for cotton. Batting (the warm stuff in the middle) isn’t exactly cheap either. If a quilter chooses to buy new fabric for every quilt they make, the costs mount up considerably.

I know – one of the last quilts I finished was made from designer fabrics. It was queen-sized and it was just a tad exxy. But aside from the fact that my son Ryan27 designed it and then I made it – HUGE satisfaction, creativity and engagement right there! – I have lots of green, yellow and mustard scraps that I’ll be using in quilts for years to come.

How do I know this? Because at heart, I’m a scrap quilter. No hardly any scrap is too small for me to throw away.

I’m currently working on a quilt for a friend of mine who recently lost her Mum. Now, this quilt is the ultimate in frugality! It’s a ‘quilt as you go’, which means that instead of using a huge piece of batting, I’m using remnants left over from previous quilts. You sew directly onto the remnants, then join them all together to make the quilt. Zero waste. This makes me happy. Some of the batting I’m using is from quilts I made over a decade ago.

The money that Past Frogdancer spent is not being wasted. That’s important to me. For many years, Past Frogdancer had very little money to throw around. To be able to respect that and to use what she bought is pleasing to me.

And look at the fabric that will be in the centre of each square. It’s golfball fabric that I bought nearly 15 years ago to make Tom30’s first quilt. I also included it in the quilt I made for Mum and Dad this year – another scrappy quilt. Fabric doesn’t go off if it sits there for a while. The trick is to remember to keep using the material I’ve got, instead of buying All The Colours whenever I go shopping.

It’s funny, but when I’ve been using fabric for a long time, I get a kick out of using it again. I remember the quilt/s I’ve used it in before and it’s like seeing an old friend. It takes many, many hours to make a quilt. When I make a quilt from scraps, I’m getting extremely low-cost entertainment, while extending my creativity and productivity as well. This makes the frugal part of my brain almost purr with satisfaction.

With quilting, like the back garden, I front-loaded the costs and now, at my leisure, I can kick back and savour the things I’ve put in place.

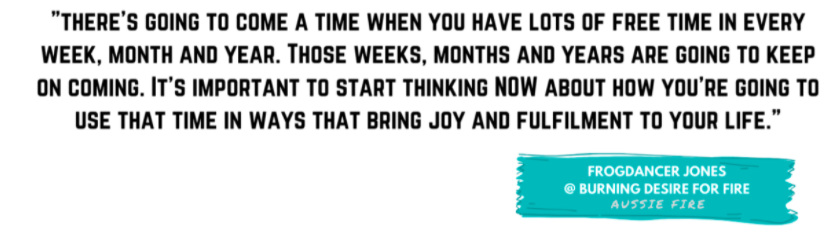

Sounds a bit like someone working towards FI/RE, doesn’t it? Frugality and FI/RE have a lot in common, which is why so many naturally frugal people seem to quickly see the possibilities of the FI/RE concept.

Working steadily with an over-arching goal in mind, such as the goal of financial freedom, requires frugality with both money and focus, as well as a big dollop of delayed gratification.

Frugality is a keen weapon when used intelligently. When we bring it together with other tactics such as harnessing the power of compounding; making the most from our jobs; maybe working a part-time job on the side; educating ourselves about finances and things like geoarbitrage… then we are unstoppable.

Use frugality as a lens through which to view your choices. Pour yourself into the things that will propel you further and add value and joy to your life. After all, we only have so much time, energy and money to give.

Save the bulk of your resources for the good stuff!

Dad joke of the day:

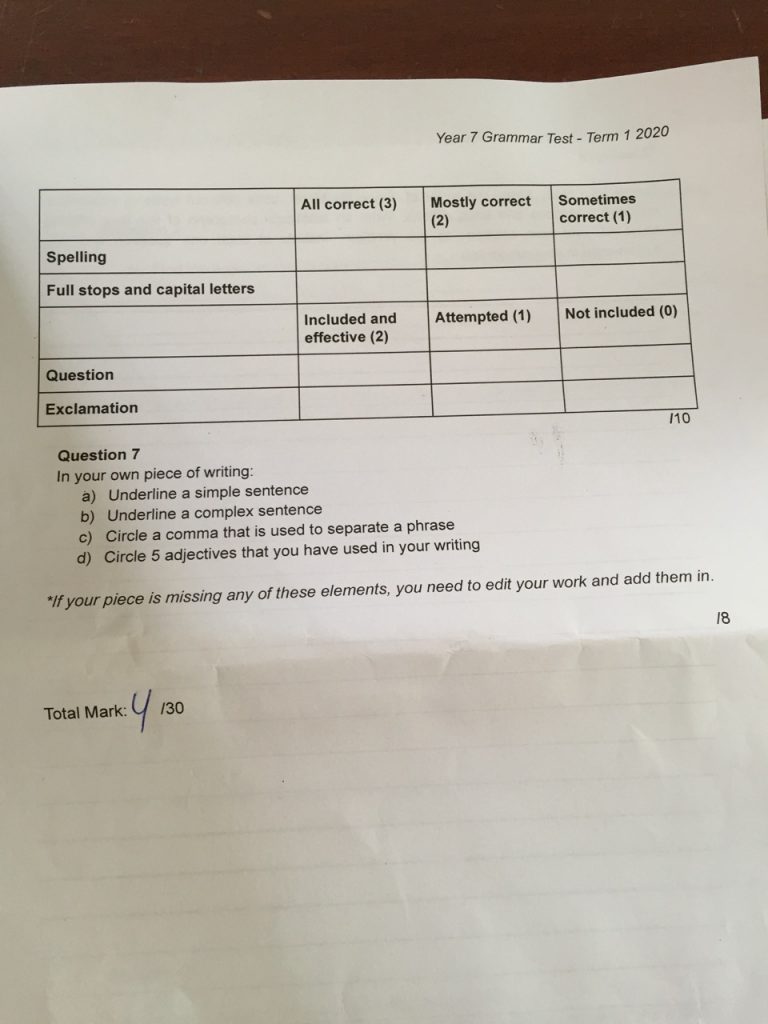

1S2A3F4E5T6Y7

Safety in numbers.