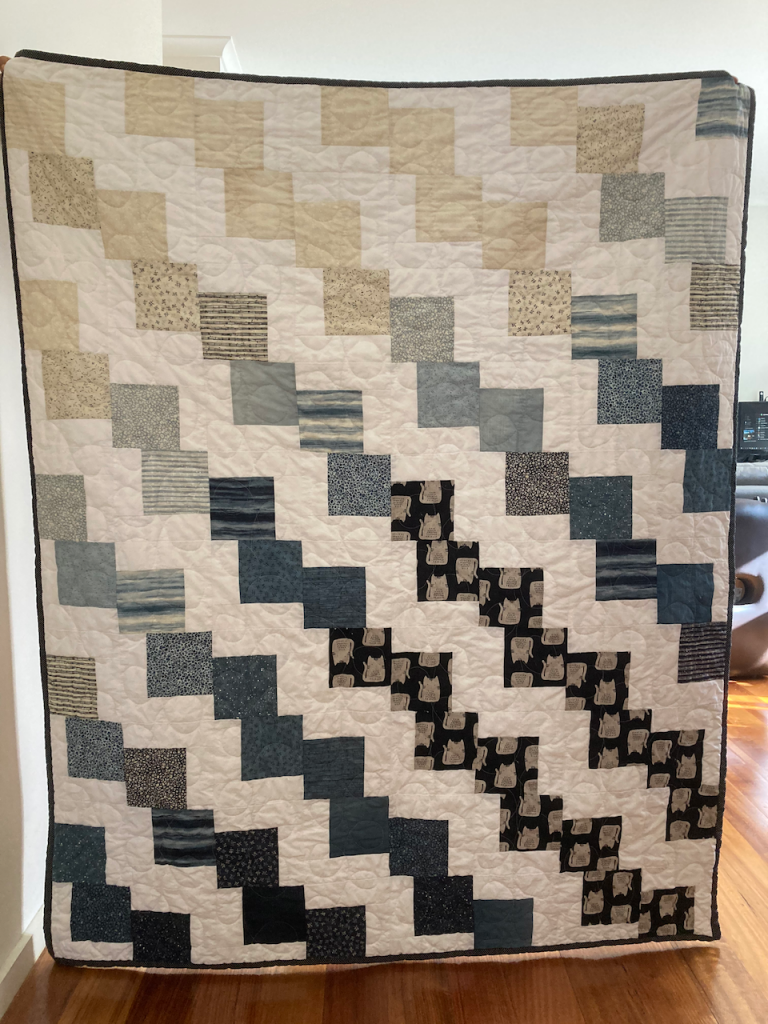

The quilt I made for my parents for Christmas is the perfect metaphor for the journey to financial independence. Quilting, like becoming financially free, has basic, simple steps but it certainly isn’t easy.

It’s not quick, either. But each seemingly insignificant decision that we make along the way contributes to the whole, beautiful product at the end.

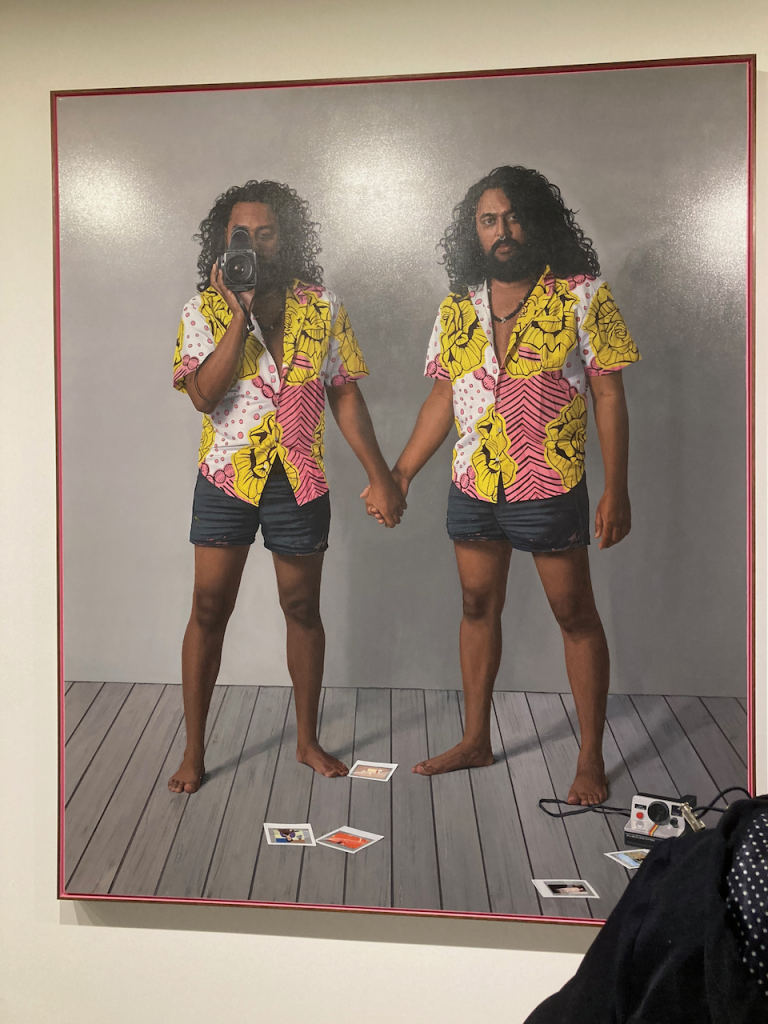

The broad brush strokes of this quilt are the same as every other quilt in the world – it has a top of smaller pieces of fabric sewed together; a middle piece of warm batting and a backing fabric, sewing through all 3 layers to hold it all together and with a binding fabric sewn around the edges to stop it from fraying and falling apart. All quilts are the same basic construction.

Financial Independence s the same. The basic construction is that a financially independent person has gathered together the resources, usually over a time-period of decades, to support themselves financially without having to turn up to a job or business for money. Every financially independent person falls into this broad brush stroke category.

But as with the quilt, once you zoom in, the details can vary tremendously.

Take another look at this quilt.

This is a quilt made from scraps. There is no other quilt the same as this in the whole world. When I decided to make it, the broad brush stroke decisions were already decided. I knew how this quilt would be put together. But then some further decisions had to be made.

- Each square would be made from scraps of one colour.

- I would not buy any more fabric – I would make this quilt from what I already had. (It was in the middle of lockdowns, after all!)

- Each square would measure 12.5″ square.

- Most squares would be rainbow hues, but a couple would be brown, black-and-white and pink, just to tone it down a bit.

- The quilt would be double-bed sized, as that’s the size bed my parents have.

Very similar to how we start along the path to financial independence. When I found out about FI/RE and decided to see if I could swing it, there were a few decisions to be made as to how I was going to go about it.

- I had already paid off my house, so I decided I’d concentrate on putting together a share portfolio. House prices, even back then, were prohibitive for a sole parent on one teaching wage. Buying rentals was out of the question.

- I decided to drop back a day a week at work and become a Thermomix Group Leader, running a team of consultants in my area. In other words, I chose to augment my wage by running a side hustle.

- I was still supporting my four teenage boys. Reducing my expenses by installing solar panels, creating a food forest with fruit trees, veggie gardens and chooks, and cooking from scratch would cost more in the short-term, but over the long haul would make my journey towards financial independence much easier.

So far so good. But just deciding these things will not produce either a finished quilt or a financially secure retirement. You have to go smaller. Which specific actions are you going to take to get these things done?

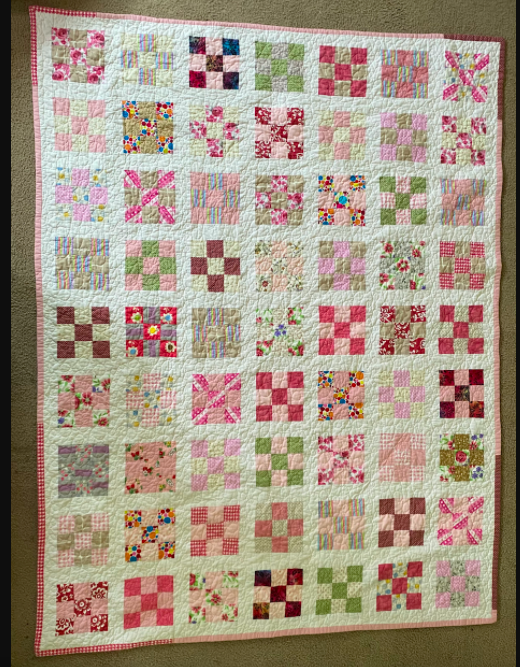

Zoom in on the quilt. Every single piece of fabric here is the result of a deliberate decision and a deliberate action. See the black and white square? If you zoom in on that, you’ll see pieces of fabric that are less than a quarter of an inch wide. (Yes, I’m crazy.)

Some of the pieces in these squares are much larger and therefore contribute more towards the overall finished quilt. But the quilt would not be finished without every single one of these pieces, no matter how small. Every single decision and action in putting these fabrics together has mattered.

You could make the argument that the smallest pieces of fabric in the quilt almost matter the most, as they show that the commitment was there to finish the overall quilt top, by using every single piece of fabric at my disposal – no matter how small. I knew that even though a 1/4″ stripe of colour wouldn’t contribute a huge amount; IT STILL HELPED. After all, all I needed was enough pieces of coloured fabric to cover the top of a double bed. Keep at it long enough, keep putting fabric pieces together no matter how small and I knew I’d eventually get there.

It’s the same with financial independence.

All you need to do is cover 25X your annual expenses and you’re golden. The broadest brush stroke of all, I know! But how we all choose to get there is incredibly varied. Each one of us has a FI/RE journey that is exactly like this quilt – – a one of a kind. I can’t speak for anyone else, but like the strips and squares of colour in the quilt top, here are some of the things I chose to do each day to push myself along the path to FI/RE:

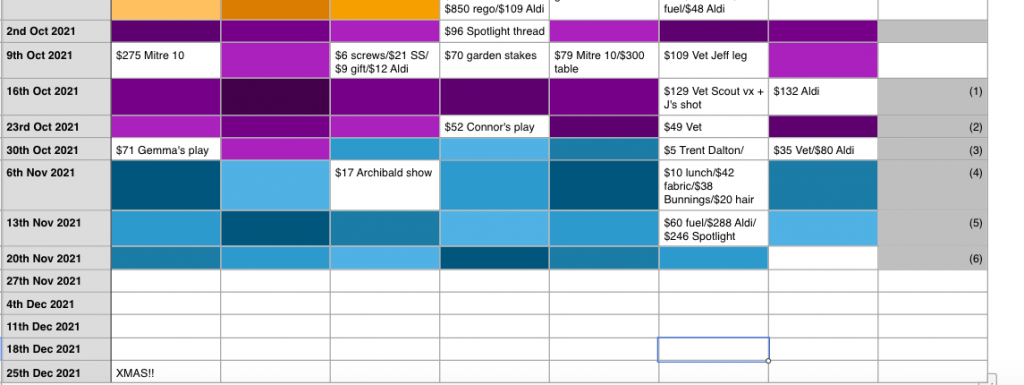

The most day-to-day decisions were all about frugality. I upped my income through the Thermomix side-hustle but I also deliberately chose to make the pool of money I had last a long time. I stretched my dollars any way I could. Some, like the quarter-inch strips, barely moved the needle. Others, like the big red and white polka-dot squares, covered much more ground. But they all contributed to the mindset of paying attention to the dollars:

- When Tom13 started secondary school, he had to choose between learning French and German. The other boys didn’t have a choice. They all used the same textbooks – each book was used four times. Bargain!

- Same with school uniforms. Everything was handed down from boy to boy and, wherever possible, bought at the school’s second-hand uniform shop. Boys are tough on their clothes, so why pay full price?

- I bought grocery specials in bulk. If we ate it and it was on special, I bought up big. The aim was to eat as much as we could at half-price. Over time, that makes a difference.

- If a cut of meat cost over $10/KG, I didn’t buy it. Even now, with only 2 of us in the house, I still look at the unit cost of everything.

- The boys were all given swimming lessons. That’s a non-negotiable for Australian kids. But after that, each boy was only allowed to take ONE extra-curricular activity at a time. None of this running each kid around to forty-seven different gym classes, dance classes and sport clinics every week! At first they tried sport, but then over time, they all gravitated to music lessons. Instead of being ‘Jacks of all trades, masters of none’, they’re all very proficient in their instruments of choice. David27 has made a career out of it!

- Once I found out about FI/RE, I read everything I could lay my hands on about investing. The share market was a big mystery to me and, being deathly afraid of numerals and maths, I had a lot of mental blocks to slowly overcome. It was hard, I won’t lie, but I knew that if I kept at it, blog post by blog post, book by book, things would slowly become clearer.

- I kept food costs low by growing as much of our food as we could. I kept chooks, not just for the eggs but also for the free fertiliser they provided. If I grew it – we ate it.

- I also grew the food that I needed to take to Thermomix demos as much as possible. After all, I was there to MAKE money; not spend it! My customers all had the herb and garlic dip instead of the hommus, (I grew the garlic, parsley and spring onions) , and they always had the rissotto (I grew the spinach.)

- We were given free bread from a bakery every Tuesday night. We picked up everything they hadn’t sold that day for YEARS – all of their breads, pies, cakes and doughnuts. I stuffed my boys full of that free food – and I gave it away to friends and took the excess cakes and pastries into work every Wednesday. the chooks would also have a day of leftover bakery food each week. I made that free food COUNT!

- I prioritised my goals. My first, most immediate goal was security for myself and the boys. Leaving a marriage with only $60 cash and 4 boys under 5 will do that to you! My over-arching goal was financial freedom, but I also had a life-long dream of going to England and Europe. In the end, I slotted that trip in between paying off the house and retirement. It cost around 30K and I thought it’d significantly delay my retirement… but I have never regretted going on that trip. It was truly a dream come true. And I never dropped my gaze from the FI/RE goal.

- I took advantage when opportunity knocked. Obvously, making the decision to geoarbitrage and sell my original house was a HUGE clincher for my early(ish) retirement, but I also did smaller things, such as forming a close friendship with the Cavalier King Charles Spaniel breeder who bred my first bitch. For two decades, we had dogs from her kennels living with us. They were either older dogs who were past their breeding and showing days, or they were bitches I got for free on breeding terms. Poppy is the last of the line for this- I got her for free on condition Jenny could breed from her. (She ended up having only one litter. ) It was a bit of a shock to the system to have to pay for Scout!!

Every day there were tiny little decisions that on the face of it meant absolutely nothing and were noticed by no-one but me, yet collectively those tiny decisions swept me along the path to being financially free.

Many of you are in the boring middle part of the FI/RE journey. You’ve made all of the big and middle-tier decisions and put them into gear. It’s easy to lose heart and think that it’s all just too slow. But remember, just like piecing together a quilt, all of the little decisions and actions continuously help move the needle – and I’m here to say that a life without having to turn up to a job every weekday is a mighty fine life indeed.

Keep your eyes on what YOUR finished product will look like! Decide what YOUR little decisions and actions will be and then keep on doing them. Future You will thank you.

Dad joke of the day: