I had a couple of people ask me how I kept my food spending down so low, considering I’m a single mother feeding 4 humungous boys (all taller than me so I must be doing something right!), 2 dogs, 2 cats and 6 chooks while spending $130/week. This figure includes cleaning products; things like toilet paper/baking paper/alfoil etc; the evil takeaways; things like fertilisers or snail bait if I happen to pick them up at the supermarket… in fact anything bought at the supermarket and animal produce store is included on the spreadsheet. It’s easier that way.

The bottom line about all of this is that I scrimp and scrape on the things that aren’t that important to me, so that I can spend/invest the money in things that ARE important to me. An integral way of doing that is to keep the grocery spending as low as possible. This is the one area of the household spending where there is room to move because so much of it is down to choices. Any money that I don’t have to put towards going down our necks can be put towards getting us closer to our goals. I find that an exciting challenge.

I will disclose at the outset that we get free bread from a bread shop. We get whatever they haven’t sold on Tuesdays, so we turn up with 2 or 3 laundry baskets and collect the bread, buns and pies that were unsold and we share them with a couple of families in the area (and I take donuts to work for staffroom 1.) I sometimes get a box or two of fruit and veggies from my ex-husband’s fruit shop when the boys come back from a weekend at his place. (This varies wildly as to how useful it is, depending on who packs it. Tom19 brings back 3 watermelon (whole), 5 bags of carrots and a couple of cantaloupes. The ex-husband packs things that aren’t selling and these things tend to go off quite quickly, while Evan15 packs things we really need such as potatoes and pumpkin… plus baking ingredients for gingerbread. Last time he included 3 packets of vanilla sugar, because he saw it mentioned in a thermomix recipe.) Long-term readers may remember the drama we had a couple of years ago with child support issues. That angst has simmered down, but I make it a point of honour not to waste a single THING we get from his shop! If all else fails then the worms or chooks eat from it, but nothing gets thrown away.

With the bread and the fruit shop things, we save a fair bit right there. I maximise the savings by feeding the chickens from the bread shop buns and pies first thing every morning, so the edge is taken from their appetites by the time I put the feed pellets out for them before I go to work. On Saturdays, if there’s still a fair amount of stale bread and buns left, I give the chooks a “pellet-free” day, where they get fed exclusively from the bread shop leavings. I wouldn’t do this every day, because they need their nutrients, but I figure once a week is acceptable. After all, in the olden days chooks were fed on leftovers and whatever they could scrounge and they seemed to do ok. Tuesday night is “Pie Night”, where we take our pick from the pies, pasties and sausage rolls from the bread shop. It seemed silly to be bringing all this food home and not to use it for the humans as much as possible. (We’re getting a bit sick of pies, but we still make ourselves eat them!)

With regards to the rest of the shopping:

* I like to stay out of the supermarket as much as possible. I actually really like food shopping, but every time I pop into the supermarket for something I always end up buying more than I went in there for in the first place. So I learned that the more I stay out of the supermarket, the less money I spend overall.

So I tend to do a fortnightly – 3 weekly shop. This is pricey when it happens… I usually spend between $300 – $400 dollars at a time…. but it’s amazing how much I save by NOT buying all of those impulse buys.

* My first shop of choice is Aldi. I adore Aldi with a passion. SO much cheaper than the supermarkets, Aldi has been an absolute godsend to this family. They opened up near here just when the boys were hitting their teenage growth spurts, eating like horses and my grocery bills were soaring. Now I go to Aldi first, stock up with multiples of what we use and then I go to IGA or Coles to buy what Aldi doesn’t sell.

* I look at the supermarket brochures, particularly the “loss leader” specials on the front and back covers. If there’s a particularly good special on something we use, like coffee or peanut butter, for example, I’ll make a special trip to Coles or Safeway and stock up big. A year ago, Coles had a special on 500g tins of Nescafe for $10. I bought about 8 or 9 tins. I’m still working my way through them. Not a bad buy when the tins are usually $18 or so, which means that I’ve been drinking coffee at a rock-bottom price for the last year. I love going into the ‘rip off’ supermarkets with my junk mail brochure in hand, wheeling the trolley around the shop and then walking out with ONLY their specials. It makes me feel great that I’m minimising their profits.

So at any time, our pantry could have 10 jars of peanut butter, 20 tins of tomatoes, 15 tins of marked-down beans as well as all of the other things that are in there. It doesn’t matter, because they’re not going to go off and we work our way through them, bit by bit. When an item is a good price, I buy lots of it, usually in multiples of 10. My supermarket trolley looks very different from most other people’s, but it means that we’re eating a lot of our food at discounted prices. Over time, it all adds up.

* Look at the unit prices on EVERYTHING. I was rapt when they changed the law and had to provide the unit price on everything on the supermarket shelves. It saves so much money, especially when I assume that the larger size is cheaper, but it actually turns out otherwise. For those of us who are mathematically challenged, this has made life so much easier. I also look at the top and bottom shelves of supermarket shelves, because they quite often put the cheaper products away from eye-level. This puts the sport into supermarket shopping and makes it fun when I bag a bargain.

* You need to know your prices! There’s no point buying something on special at Coles if it’s cheaper at Aldi. I sometimes put together a price book, with the unit price of our staples written down, but in the last part of every year, I let this slide. It’s one of my holiday jobs to get this started again because it’s a very useful tool. I just have a small notebook that lives in my bag, and when I do a large shop I sit down after I’ve put everything away and take the prices from the docket and put them in the book. It’s handy to have this record because sometimes you’ll be out and about and see a special on something. Instead of just grabbing armfuls of it and racing to the checkout, it’s good to know whether it’s REALLY a special or not. The warm glow you get when you stop yourself from being inadvertently ripped off (or when you realise that it’s a rip-snorter of a bargain) makes it worth all the nit-pickiness of starting the book in the first place. I want to go with my friend Liz to Costco to see what it’s like. Having a price book will DEFINITELY stop me being carried away and spending up big on things that I think are good value. I need to be sure they are.

* Brand loyalty is stupid. The bottom line is by far more important. Having said that though; I will NOT buy any brand other than Vegemite. Don’t mess with my breakfast! I only buy Nescafe instant coffee and Aldi powdered milk. Their powdered milk is the only brand we like the taste of. Oh! And Masterfoods Devilled Ham spread for a treat. (My grandfather used to use this all the time, so I buy it for my boys. Call me a sentimental fool…) Apart from those things, nothing else we buy is brand related.

My rule is to buy the generic/Aldi brand product first. If we don’t like it, then we try other, more expensive brands. For example, the kids declared that they didn’t like the Aldi peanut butter. Personally, I couldn’t tell the difference, but it’s the boys who eat the most peanut butter, so I complied. We buy the Black and Gold brand from IGA because it’s the next-cheapest and the boys like the taste of it. Recently Coles had a special on Kraft peanut butter (om nom nom… the taste of my childhood…) that made it cheaper than the IGA one, so I bought 20 jars. The kids LOVE it, but when the jars run out we’ll go back to the IGA version, at least until Coles runs the fabulous Kraft Peanut Butter Special again. Though on second thoughts, now I’ve bought the thermomix I can grind down peanuts to make our own peanut butter, so that might be one item that stays off the shopping list. Things change…

* Think ahead. Last December I read a comment on the Simple Savings forum where a woman called Joan said that every January she goes on a marked own ham hunt, where she freezes the portioned-up ham and uses it throughout the year. What a bloody brilliant idea! Me being me, I got a bit carried away and bought 3 hams. I chopped them up into pizza/macaroni and cheese-sized pieces and froze them in little meal-sized bags. Those bags of ham lasted us till the middle of September. I can’t tell you how fantastic it was to be able to reach into the freezer and pull out a bag of good quality ham pieces to chuck into a dish when I was cooking in a hurry. I was quite upset when we used the last one. So a couple of days ago I bought 4 hams. Cost me around $150 up front, along with the 4 hours solid I stood at the kitchen bench slicing and dicing away. TEDIOUS. I’m guessing that a lot of people wouldn’t want to put the time in.

But I now have 54 meals’ worth of ham (including the 4 ham bones for pea and ham soups throughout the year) in the freezer. That works out to $2.77 a meal, or 0.55c per person for each meal, (assuming the boys and I are all eating each meal together). Now that’s what I call affordable meat, and makes the job of cutting it up so worthwhile.

Another way I thought ahead was when I was renovating the kitchen. I allowed enough space to buy a full-sized fridge and FREEZER to stand side by side. I have enough freezer space to be able to take advantage of bargains when I come across them (such as the Christmas hams, for example.) I can freeze our excess produce that I grow in summer and use them in winter casseroles and spaghetti sauces. I love my huge freezer. This item is an integral tool in the next point which is:

* Waste not, want not. I know it’s a cliche, but it’s really very true. Anything you spend money on, you should use… otherwise, it’s a waste of money. With food, “waste not, want not” is truly a motto to live by. We all have to fill our stomachs at regular intervals. If you have teenage boys, they are adamant that they need to fill themselves up every 15 minutes or so. If you manage to fill the stomachs with food you’ve already bought/been given/grown yourself, rather than going out and buying some more, then you’re ahead of the game.

When I was a SAHM over a decade ago when the boys were running around being toddlers, I remember seeing an Oprah show where they were clearing out someone’s messy house and they were throwing rotten food out of the fridge. The organisation guru who was doing the cleaning totted up the prices of the food that he was throwing away and declared the total. It was around $200 or so. He then said, “This is exactly the same as taking four $50 bills and putting them straight into the trash. In fact, it’d be easier and quicker just to do that, rather than go to the trouble of going to the store, buying the food, carting it home and then throwing it in the trash a few weeks later.” That hit me right between the eyes and I’ve been mindful of waste food ever since.

Nowadays we have a food chain going on here which guarantees no wastage. Humans first, then dogs.

If the dogs don’t want it (or they’re getting too fat) it goes to the chickens. Added bonus… eggs for us and manure for the garden.

If the chickens won’t eat it then it goes to the worms. Added bonus, castings and worm wee for the garden.

Anything unsuitable for the worms goes into the compost. This, of course, gets put onto the veggie garden to produce more food for us.

* We grow food. There’s no denying that I’ve put in a lot of money up-front to establish things like the water tank and the raised wicking beds, along with fences for the chicken run and veggie gardens. Ryan17 looked at me recently, raised an eyebrow and asked if this whole veggie growing thing was cost-effective. I said that now that we have the groundwork done, then yes, every year it’ll get more and more economically worthwhile.

Saving and swapping our seed; using home-made fertiliser such as weed tea, worm wee tea and castings; composting all of our waste scraps and chook bedding to use on the gardens; freezing and making jams etc from the things we grow; substituting ingredients to use the things we grow rather than buy the “correct” ingredient from the supermarket; all these things add up to big savings. The main way it saves money for us is that if I’ve gone to all the trouble of growing it, then I’m by far more likely to respect the time from my life that I devoted to it and so actually USE it to cook with, rather than go and buy more food. Again, keeping out of the supermarket is helpful in keeping the grocery bill down.

Without a doubt, the main reason I grow our food isn’t for the dollar savings. I got fired up about growing food when my son’s battle with debilitating depression surfaced. I decided to cut out as many chemicals and preservatives as possible from the food we eat so that I could help him to get well. My philosophy was, “it can’t hurt and it might help” and anything I could do to help him – I was going to do. However, the dollar savings aren’t to be sneezed at either.

*Powdered Milk. Substituting this one product has saved me hundreds of dollars over the last 3 or 4 years. I don’t drink milk (ugh!) but two of my kids drink it like there’s no tomorrow. The up-front saving is, of course, that litre for litre, the cost is less by using powdered milk. The savings with this alone are worth it. But the other saving is that if you keep a few bags of powdered milk in the pantry…. YOU NEVER RUN OUT OF MILK.

This means that I don’t have to drop into the supermarket on the way home. This means I don’t spend money on impulse buys when I’m in there looking for milk. Obviously, there’s no way of calculating the savings I’ve made by not going through those supermarket doors, but I have a shrewd idea that the amount would be substantial.

* Put shampoo and conditioner in pump packs. This makes shampoo and conditioner last SO much longer. Instead of the kids picking up the bottles and squeezing a huge dollop of shampoo in their hands, the pump-top containers dole out a measured amount. The kids have to work to get a comparable amount in their hands, which takes too long. They’ve adjusted to using a smaller amount, which of course mean I don’t have to buy shampoo as often. It all helps and if I can get savings by doing something so simple, I’m going to do it!

* Making things from scratch is usually far cheaper than buying ready-made things. I work full-time and I definitely class myself as ‘time poor”, particularly during term times. Sometimes I don’t get around to making biscuits or cakes for the kids’ recess snacks, or I’m racing around on the weekends doing gardening work or housework and so the kids rustle up their own snacks. I’ve noticed that particularly in the last parts of the school terms, I buy shop-bought biscuits/cookies and convenience foods to save myself the effort of baking. Seems cheap enough… a couple of dollars for a pack of bikkies/cookies, right? But the biscuits I make myself are cheaper, have far more filling ingredients and have no nasty chemicals in them. Buying “cheap” packets of bikkies adds up to $10 a week, which over time adds up to a huge amount. All this for a snack that doesn’t even fill my boys up, so they’re peckish heading into period 3 and by lunchtime they’re ravenous. How can they concentrate on their work?

Doing my own baking saves us heaps every year. Adding some bags of flour, extra milk, cocoa and sugar, along with some fun things like chocolate bits or hundreds and thousands to the shopping list may seem like I’m adding extra items to the shopping trolley, but in reality the raw ingredients end up so much more cost effective than the ready-made items, because (for example) I can make 5 day’s worth of biscuits from a bag of flour costing far less than $2. The same is true for the other ingredients. Over time, it makes a huge difference. One of my holiday jobs, before I go back to work in February, is to have a few logs of biscuit/cookie dough in the freezer for those mornings when I can’t find the time to make a cookie dough from scratch, but I CAN switch the oven on and slice up a log of cookie dough while I go out and water the veggie garden, and have the cookies cooked and cooled, ready for the boys to grab on the way out the door to eat for recess. It’s an investment in their health and wellbeing, plus a money-saving thing as well. It just takes some thinking ahead and some organisation.

I also make our own soap. This doesn’t save us money because I used to buy the cheapest soap on the shelves. What it DOES do is give us the purest, best quality soap in the world for a very reasonable price. The pay-off with our healthier skin is absolutely worth the extra money I spend on the ingredients.

* Watch the attitude. I look on this as a challenge. I love finding a bargain and shaving yet another thing off the shopping list (Why do you think I’m so excited about the thermomix? I can make SO many more things for us with ingredients made from scratch, which means I my shopping list and shopping bill will keep going down!) If things become a chore, I know I won’t do them. I choose to look on the cost-cutting as a fun thing, rather than a burden.

* Get priorities right. I don’t “do” coffee in cafes. My sister and some of my work colleagues can’t understand that, because much of their social lives revolve around meeting friends for coffee and cake. I look at that and think that if you did this every weekday, at a conservative estimate of $6 for a coffee and something to nibble on, that’s $30 a week, or $1,560 a year. Even allowing for a couple of weeks off here and there for holidays, etc, that’s still a huge pile of money for coffee beans and water. You may be able to shrug your shoulders and say that’s ok, but for me… that’s a sh**load of money that I could use for far more useful things, like braces for Evan15, braces for David18 *sigh* or a water tank. Or school books… 2 days ago I just spent over 1K on textbooks and stationery for the 3 high school students. Gotta love it. Thank goodness Tom19 pays for his Uni textbooks himself!

My priorities will be different from yours. My main financial priority is to be totally and utterly debt free, which means that I want to pay my mortgage off. I bought my ex-husband out 14 years ago and I still owe money on this place. I hate that, so I’m throwing money at it. However, I could have paid it off by now, but I have other priorities as well.

Overseas travel for the boys, so they can see how other people live and how good we have it here. I don’t want them to grow up to be ignorant bogans. So I took all the boys to Bali in 2006, then we went to Phuket in 2007. (Shouldn’t waste all those empty pages in the passports! Waste not, want not…!) The first Christmas (2009) that David18 chose not to spend with his father, I took him to Singapore to get him out of the empty house and away where he’d be distracted by all the bright, shiny Singapore things. Then, of course, we had the school’s Stage Band tour in Los Angeles, where David18 and Ryan 17 went for 2 weeks. There’s also expensive school camps, but they get to see places like Central Australia and Tasmania that otherwise they’d never see. So I don’t begrudge spending money on travel. It broadens the mind, so they say.

When I started full-time work, I decided to renovate my 1950 weatherboard house to put a decent kitchen and bathroom in it, as well as a ducted heating and cooling system in. I was going to pay off the house first and then do it, but then I thought about how silly it would be to be getting all of these things done to make the house more liveable… just when the boys were moving out. So I decided to get the work done while we were all still living here and able to enjoy it all. So I doubled my 100K mortgage, got the work done and now I’m almost back to where I started, mortgage-wise.

This past year I bought a lot of Project Things, such as a water tank, solar panels, the thermomix, solar oven and such like. They’re one-off purchases to minimise our bills in the future and/or make like easier. Now I have them, the job is done and I don’t have to buy them again, barring unforeseen accidents, of course. Now that I have these things in place, I can turn my attention back to the main priority, which is the mortgage.

I have also spent a lot of money on music lessons, over the years. Again, I don’t begrudge this, as playing music and singing well is a skill. Investing in developing skills is money well spent.

As I said in the beginning, I’m very conscious that I’m a single wage earner who is supporting a lot of people. I don’t want to end up eating tinned cat food in an indigent old age, so I’m paying down debt and stewarding my money in the most prudent, mindful ways possible. Cutting down on our food bill while still providing my family with the best food I can is probably the most important way I save money to safeguard our financial future.

Plus, I like the challenge!

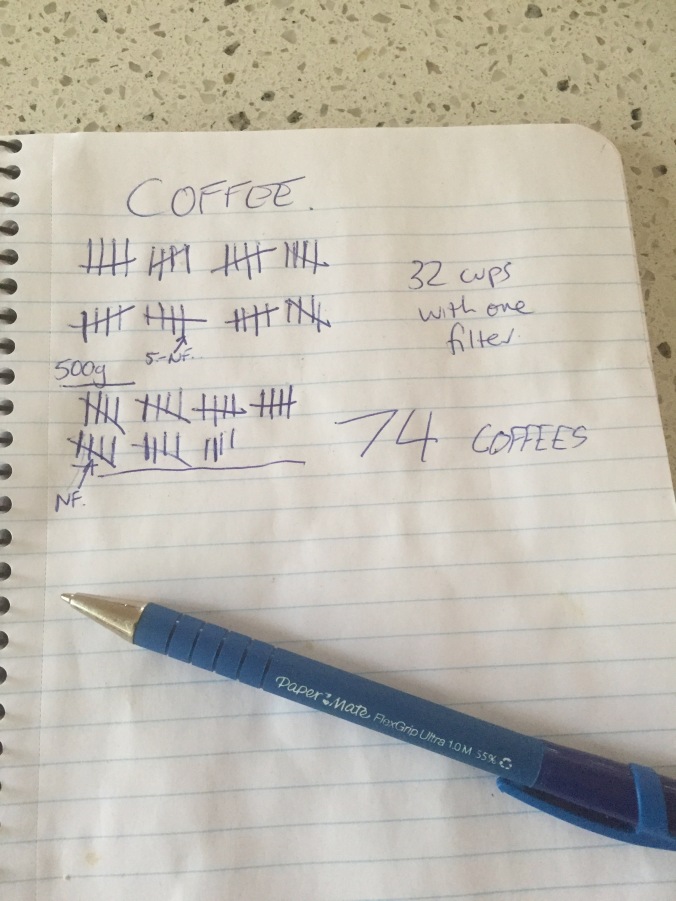

As you can see, out tracking of how many cups per kilo that we got was done with primitive, yet effective technology. A pen and paper beside the Aeropress and kettle did the trick.

As you can see, out tracking of how many cups per kilo that we got was done with primitive, yet effective technology. A pen and paper beside the Aeropress and kettle did the trick.

The woman who runs the canteen is Just Like Me. She’s making a food forest at her house, she has bees, she even has a few horses who live out in the country somewhere. She was rapt at the thought of turning the food scraps into Something Useful. We bonded over talk of harvests, home-made honey, horse poo and the like. I now have a 20-litre bin in the canteen kitchen and I take the contents home twice a week.

The woman who runs the canteen is Just Like Me. She’s making a food forest at her house, she has bees, she even has a few horses who live out in the country somewhere. She was rapt at the thought of turning the food scraps into Something Useful. We bonded over talk of harvests, home-made honey, horse poo and the like. I now have a 20-litre bin in the canteen kitchen and I take the contents home twice a week.

The photo above was taken when the NGV art staff let me into the Van Gogh exhibition in the back door not once, but twice, when I was taking kids to the Art Gallery on 2 separate days. How amazing was that? I queued for an hour to get into the Van Gogh museum in Amsterdam and I loved it, but somehow these snatched viewings were sweeter. Love a freebie!

The photo above was taken when the NGV art staff let me into the Van Gogh exhibition in the back door not once, but twice, when I was taking kids to the Art Gallery on 2 separate days. How amazing was that? I queued for an hour to get into the Van Gogh museum in Amsterdam and I loved it, but somehow these snatched viewings were sweeter. Love a freebie!