Although the rest of the world is catching up, I think it goes without saying that there’s still a clear majority of Americans writing blogs and podcasts in the FI/RE world. Hence, there’s a lot of angst in a lot of posts about the ongoing costs of healthcare. The rest of us shrug, feel thankful we’re not in the US and scroll on past. However, I had an experience a few days ago which made me think about how my experience might have differed if I was in the US, which then led me to think about a couple of my sons’ experiences with the Australian health system when we were uninsured. Our wallets would have been hit by these things, in at least one case catastrophically, which led me to think… why not write about how people in most first-world countries deal with unexpected health issues? After all, we’re in the majority!

Here’s my first son’s experience. A couple of years ago when he was 23 he rang me at around 8 or 9 in the morning, saying that he was feeling really odd. His stomach was hurting, more on the right side than the left and he was feeling woozy and a bit “off”. While I was talking to him I googled his symptoms and we went through them. He had some of the symptoms of appendicitis, though not all of them.

I remembered a service called “Nurse Online” or something like that, where you ring a nurse and have a chat with them. I got Tom23 to give them a ring and then call me back. When he rang, he said that she’d suggested that we go to Emergency, as it sounded as if it could possibly be his appendix and they could check him out. So off we went to Monash hospital, just down the road.

When we got there it was relatively calm, with few people waiting. Being the mother of boys, I’d been there a few times before when they’d managed to hurt themselves after hours when our regular doctor wasn’t at work and it was always busy. It seems that early on a Sunday is a good time to go. Anyway, it wasn’t long before we were in front of a doctor. He poked and prodded Tom23, then said that it looked as if it was the early stages of appendicitis. He said we could go home and see if the symptoms quietened down, but personally, he recommended that Tom23 go straight in and have the operation that day.

One thing to know: we didn’t have Hospital Insurance. In Australia, you can elect to have Hospital and/or Extras insurance (or neither.) In my case as a single mother with 4 boys and usually pretty minimal child support, for years I’d gone for just the extras cover. I had 3 sets of braces and 2 sets of glasses to cover, as well as assorted chiro, physio and other bits and bobs that my ex-husband wouldn’t pay for, so I couldn’t afford to get extras cover AND hospital cover. It really wasn’t an issue, because I knew we’d all be ok. If anything awful happened to us health-wise, such as an accident or cancer, we’d be looked after in the public system. Anything else that was a chronic condition that we’d need to go on a waiting list for, we didn’t have. The odds were that we wouldn’t develop anything while we were all young. We’ve always been as healthy as horses, so the probabilities were that we’d never need it. So I put my dollars towards the extras that the boys needed. It just made sense. (Nowadays, with the boys as adults, I’ve flipped that, so if Old Lady Frogdancer develops a condition that needs to go on a waiting list for hospital treatment, she’ll bypass that and go on through.)

So Tom23 had no hospital insurance. He went in as a public patient and had the operation that same day. The picture at the top of this post is him pre-surgery. A day or two later he was home, with a bill for antibiotics and painkillers that totalled $60. That was all he had to pay. As a uni student with very little money available after paying for books and rent, this was a godsend. Now, fast forward two years later, he’s an accountant paying taxes. Some of those taxes are now contributing to other people’s health costs.

Now to my experience.

Last Tuesday I rolled over in my sleep at 4AM and felt a lump in my breast. Trust me, even if you’re dead asleep, that’ll catch your attention! Sleep was instantly gone and so Dr Google and I were getting to know some facts.

I booked a doctor’s appointment for late that day. My Doctor bulk-bills, so there’s no charge for an appointment. By the time I made it in to see him the lump was huge and there was a big red rash on the breast. It didn’t look to me like cancer, or to the doctor, but you can’t be too careful with lumps like this, so he loaded me up with a dynamite-strength course of antibiotics and a referral for mammograms and an ultrasound.

I rang around and booked an appointment for the following Tuesday, to give the antibiotics a chance to work. When Tuesday rolled around and I faced the receptionist, she asked if I was on a Government health-care card or on any sort of Government benefit. If I had been, the cost of the tests would have been free. However, my days of living on the sole-parents’ pension, (as it was called then) have been over for 16 happy years, so I had to pay the gap between what they charge and what Medicare provides. I gave her my Medicare card, she popped my number in and $160 was reimbursed back into my account.

I’m ok with paying $90 for 6 separate mammograms and a half hour ultrasound. If there was any bad news, I know that I’d be whisked into hospital straight away for free to have an operation. They tend to move quickly when cancer is involved. Thankfully, it appears that all is well.

One of my other sons suffered terribly from depression when he was in his teens. It went on for a few years and at his lowest point, he was hospitalised in a teenage psych ward for a total of 6 weeks. All up, I paid maybe a couple of hundred dollars for his medication. After that, he had psychiatric and psychological counselling for a further two years or so until he got a handle on it and learned to cope. After his first stint in the ward, I didn’t have to pay a penny for the counselling, just for his “happy pills”. I can’t tell you how thankful I was for our health-care system in Australia while this was going on. I was almost at the point of finally paying my house off… if I had to sell or borrow against the house to ensure that my child got the health-care he so desperately needed I would’ve done it… but I’m so grateful that I didn’t have to. That house was the bedrock of our physical and financial security. And what if I didn’t have any assets to sell? If he wasn’t given the care that he received, I’m very sure that he wouldn’t still be with us. He was pretty sick.

YEARS ago, back when most of the kids were still too young for school, they were playing a ‘running around the house’ game and a door was slammed onto David4’s hand. His thumb tip was squashed flat and sideways. He had microsurgery the next day (for free) and now, 20 years later, David24 is a pianist and is studying music at Uni.

**

I don’t know all the ins and outs of how our system works. There have been only 3 times where our family has had to use the system in the last few years and the boys’ health needs were far more dramatic than my own, so I haven’t needed to examine the system in all its glory. I know that our taxes are higher than in the US and I’m positive that this helps pay for Medicare. And you know? I’m totally ok with that.

Everyone gets sick. Everyone has health problems at some stage. Our healthcare system means that everyone puts in while they’re able, then they withdraw from it when they need to. Everyone who is able contributes, while those who are in need get looked after. It also means that when ill-health does strike, we don’t feel financial fear and delay getting treatment, hoping that it’ll go away. People may still put off going to the doctor, but it’s not from fear of bankruptcy!

It’s not a perfect system by any means. But it’s hard enough being sick – I mentioned bankruptcy in the last paragraph for good reason. This link to an article details the top 10 reasons people go bankrupt in the US – a whopping 62% of bankruptcies are because of medical expenses.

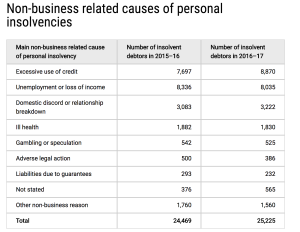

The following is a table taken from an Australian Government page about the causes of personal insolvency in Australia.

If I was your typical FI blogger, I’d be wading knee-deep into the numbers right now. I’d be throwing stats and percentages and drawing up my own google doc or excel spreadsheet to show you something-or-other. I’d be googling how much health insurance costs in the US as opposed to Australia and Europe. But I’m not going to, mainly because I’m petrified of numerals. Besides, if you’re curious I’m sure Google comes to your computer too. But you can see the difference between the two systems. My experience a few days ago simply made me reflect upon how different my finances would be if I’d been born into another first-world country that runs healthcare differently.

And I’m very grateful that I won the lottery of birth and was born here. 🙂

Thanks for sharing. Your experience is so different than what I’ve xperi3nced in the U.S.

I’m glad all went well with your mammogram. I’m also glad you didn’t dive deeply into the numbers —usually I have trouble following those posts and lose interest.

I’m glad I’m not the only one with lack of interest in the whole ‘numeral’ thing!

Such an amazing post and different things , otherwise always i seen posted about health insurance and these types of things . Thank you for sharing great post

This is exactly our take on health insurance too. I happily pay the levies and get the same level of care as private patients who are left poor by the gaps and the high cost of insurance. We too have had significant health situations and have experienced quality care through the public system