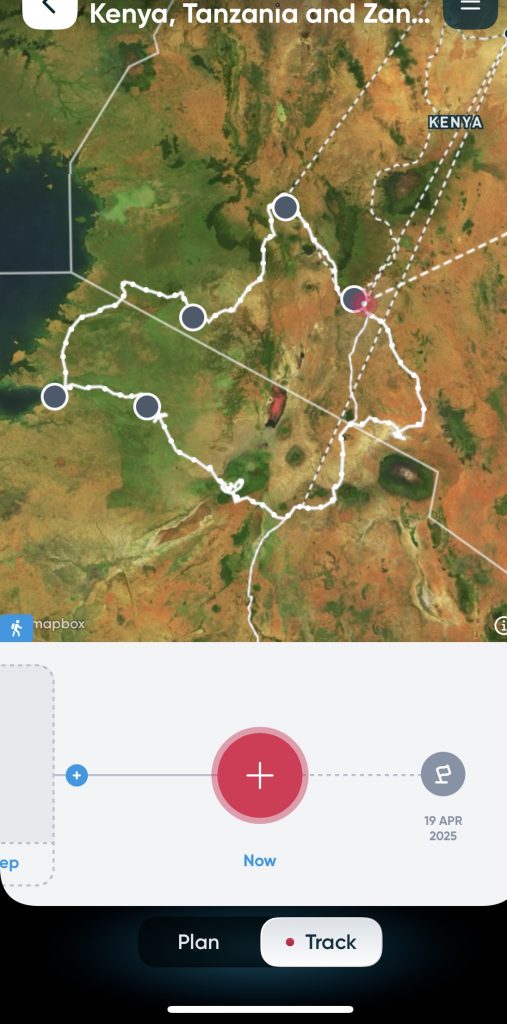

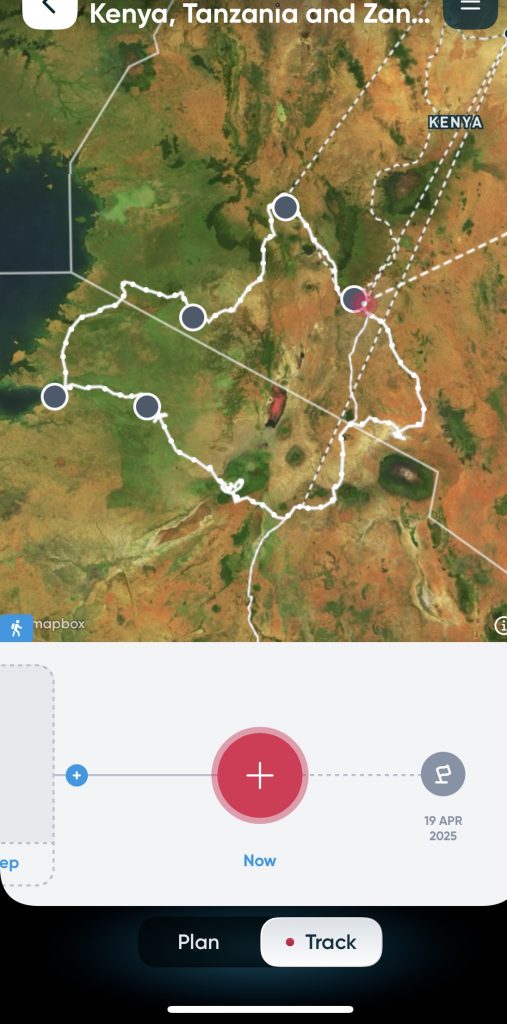

I wasn’t going to post anything today, because it’s a travel day to Nairobi airport to Zanzibar, but some photos just beg to be taken.

Here’s where we’ve been so far.

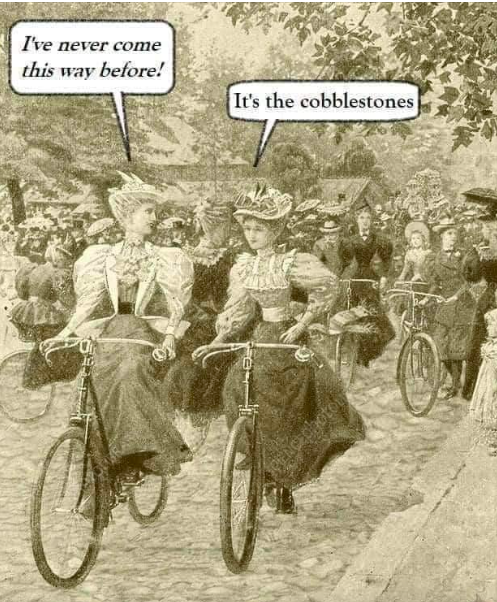

Dad Joke of the Day:

Financially Independent, Retired Early(ish) at 57.

I wasn’t going to post anything today, because it’s a travel day to Nairobi airport to Zanzibar, but some photos just beg to be taken.

Dad Joke of the Day:

We left the lodge at 6:15 this morning for a game drive. I was only hoping for a nice sunrise and a good view of Mt Kilimanjaro, and I got both.

Hippo. He’s out later than usual because the sky is cloudy and it’s good for their delicate skins. When they’re grazing – and the eat 35 kgs a day – they go singly.

In the water, they gather together in a dominant male and their harem.

They tend to kill people because they regard them as predators. Villagers in the area are at risk every time they go to get water.

Blacksmith bird. He was going crook at us. They are ground nesting birds.

Hyena. They tend to live around 12 years of age in the wild.

Young are born fully developed. Gestation period is 3 months.They are matriarchal, like elephants.

This one is a nursing female, who is headed back to the tree line to feed her cubs.

She has something that looks like a penis but is in fact her clitoris. Lucky girl! That’s a clitoris anyone could find!

When hyenas greet each other, they lick each other’s genitals.

The collective noun for hyenas is a cackle.

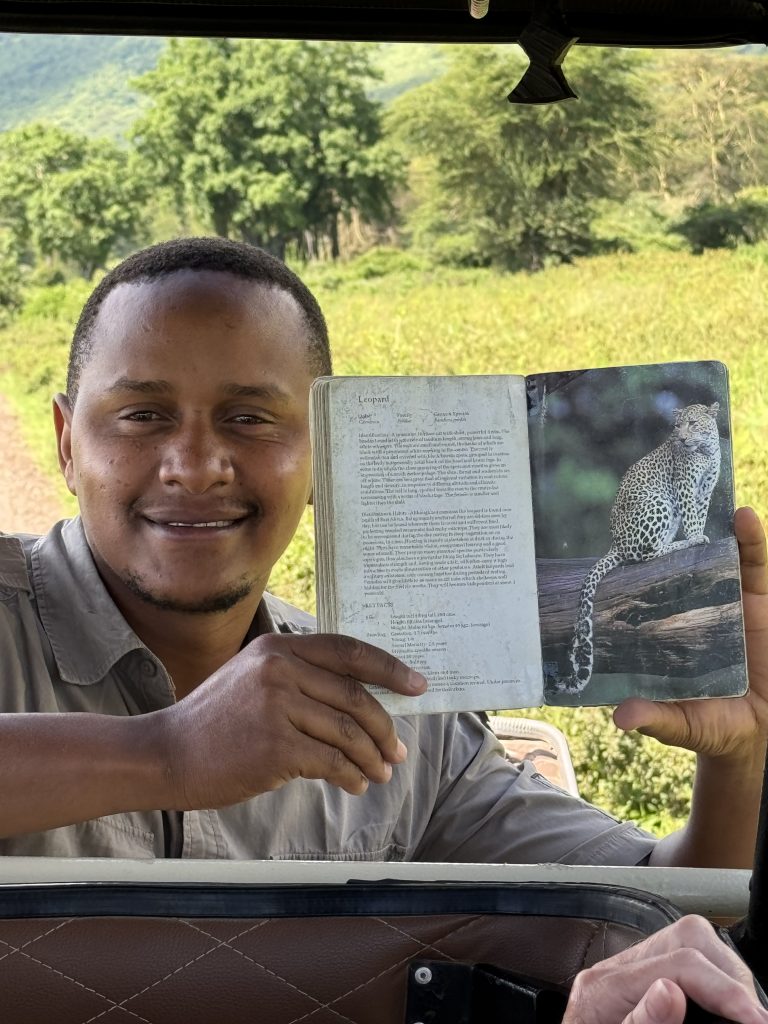

I’m with Martin, my favourite guide, this morning. He has lots of good fun facts.

Mt Kilimanjaro is the tallest free standing mountain in the world.

Look at how clear she is! I’m a very lucky woman.

Martin said that we were lucky to see both peaks. People come here for 2 nights like we have and she’s usually wreathed in clouds.

Common Kestral. This is a small bird of prey. This is one for all of you twitchers out there.

It was still very boggy. Martin had to drive carefully every now and then to avoid getting bogged.

The people who stayed behind to sleep in have missed out. It’s going to be a cloudy day and Kilimanjaro will be hidden.

Grants gazelle. We were all set to take photos when a jeep drove past and set them off. Julie shared this shot with me. Sometimes you’re in the right place at the right time!

A rumble of jeeps.

I just made that up.

Then OMG.

Elephants. Many, many elephants. This is what this place is famous for.

Martin saw which way the herd was going, so he drove to where they’d cross the road. We parked where we’d be able to get a good view. As we watched, the first thing we noticed were the babies.

Then more and more elephants joined the group. For a couple of minutes they stopped, while the smallest baby had a quick snack, then on they came.

As you can see, the herd split and they were crossing at both ends of the jeep. You can see the baby cross in the middle of this clip.

It was like a silent grey stream. It was magical.

I’m sorry, but elephant babies are irresistible.

This one must’ve had an argument with the missus, because it headed on up the road by itself.

A massive bull elephant was the last to cross.

And off they went, while we headed back for a late breakfast. We go out again at 4…

If I was a twitcher, I would’ve loved this last drive.

Sadly, though I like birds as much as the next person, I like mammals more. Still, it was interesting. I’ll only show some of the birds we saw.

White faced whistling ducks, Greater egret and Goliath Heron. The Goliath heron on the left is 1.5 metres tall.

10 years ago all of this was flat bear land. The difference is possibly caused by tectonic plates shifting. Rain and water from Kilimanjaro top it up.

White-faced Whistling Ducks.

Greater Painted Snipe.

Very rare bird. It’s only the second time Martin has seen it. He was excited! You know it’s a special occasion when the guide takes out his camera.

Flamingos. A flamboyance of flamingos. These seem pinker than the ones we saw in the crater.

I don’t know how they can contort themselves like this, but they seem comfortable.

Water thick-knee bird with chicks.

I’m only including this one because of the silly name it has.

We were driving around looking at birds, and to be honest, I was getting a bit bored. I let my eyes drift over the water and then I saw something. A hippo! Now we’re talking!

They were too far away to photograph well, as you can see, but we could hear the sounds they made as they were breathing and snorting to each other.

The Blacksmith bird with eggs. She was right beside the jeep and she wasn’t happy we were there.

Hippo, baby and Egyptian Geese. I know that it could be almost anything, but trust me— it’s a hippo.

Female impala with a small bird on her back, getting rid of fleas and ticks.

We drove around for a while as the sun began to set.

But Kenya gave us one last gift…

As we arrived back at the lodge, Mt Kilimanjaro showed her face one last time, as if to say goodbye.

Tomorrow is a travel day back to Nairobi, where half the group fly home to Australia and the rest of us fly to ZANZIBAR.

Dad Joke of the Day:

So I may have bought this on the way out of Tanzania. The artist has glued a piece of fabric on the canvas where the lion is and has crinkled it up, so it’s a little bit 3D.

It’s HUGE. I’m not sure how I’m going to get it back to Australia…

The place we’re staying at is very luxurious, but they have monkeys and baboons on the grounds. We were warned not to leave our doors open. I sat outside to blog, leaving the front door open behind me. This little guy was about to walk straight past me and into the room, as brazen as you like!

I think we’ve been spoiled so far on this trip. We drove back to Kenya today, and we’re staying in a luxurious lodge right in the centre of a game park renowned for its large herds of elephants and gazelles.

Unfortunately, it’s been raining for the past few days, so the animals have all moved higher up the slopes of Mt Kilimanjaro.

We drove slowly around for a couple of hours with pretty slim pickings.

Hyena walking after some cranes.

Jackals appeared out of nowhere, right behind the hyena.

Another hyena was nonchalantly walking, even crossing the road close to the jeep.

The cars didn’t seem to bother him at all.

As we were during, we saw two elephants walking across the immense plain. As they got closer, we noticed something.

The back bull elephant had only one tusk.

“They lose them sometimes when fighting,” said Nickolas, our driver. “Once they lose them, they never grow back.”

As we drove, there was a gap in the clouds and we could see snow on the mountain. We stopped to take pictures. This might be the best view we have of Kilimanjaro, who knows?

Then as we watched, the clouds began to move.

Can you believe that in the space of 3 weeks, I’ve seen both Mt Fuji and Mt Kilimanjaro-and they’ve both been clear?

And to think I thought this drive would be a fizzer!

Then, as the moon looked gorgeous…

…a hippo appeared. They come out of the water at night to graze.

An owl was sitting in the grass. I took this…

… but look what you can see once I zoomed in. I’m so glad I bought this phone!

Later, when we were all in the bar having pre-dinner drinks, a monkey suddenly jumped on the table and started stuffing his face full of peanuts. He was going for his life, because he knew he’d be chased away. He was salty about it, standing up on the roof behind us to intimidate us.

Tomorrow we have to leave at 6:15 for an early morning game drive.

Dad Joke of the Day:

At 8 am we were driving towards the famous Ngorongoro Crater. We were up so high we’ were driving through clouds. The crater was filled with mist.

The whole crater is a protected place for the animals.

2.5 million years ago there was an eruption

Largest unbroken crater. No girafffes or impala have..

220 square kilometres and 20 kilometres in diameter.

The first things we saw, on the very steep road down, were zebras and warthogs.

We saw a buzzard in a tree.

Bustard. Most of the time they don’t fly.

We were down by the lake, looking at some flamingos, when all of a sudden Houth said, “Get down!” and the jeep started reversing. One of the other drivers had see a Servil Cat’s head poke up out of the grass.

We sat there for what seemed like ages…

… and there it was.

A little while later, it gave up trying to hide and it strolled out.

Here are a couple of Grey crowned cranes doing a courtship dance. They look like synchronised swimmers here, don’t they?

Just down the road, we saw these lions basking in the morning sun. Then, while we were admiring the lions, Houth put his binoculars down and said, “Rhino! Get down! Hurry!”

omg. We saw rhinos from a LONG way away on our first game drive, but I wasn’t expecting another sighting. They’re notoriously difficult to spot.

Black Rhino. This is the most rare, and is very endangered. While we were there, the rangers showed up. The rangers keep an eye on the rhinos, making sure no one is harassing them. Every rhino is tagged, meaning the rangers can keep a constant eye on them.

We stayed watching him for ages. He lay down under a tree forever, then just as I was wondering why we were still there, he got up, started walking in a clearing and I got this shot.

My sister and Mum were visiting Dad in the hospital while I was watching the rhino, so I sent her this shot.

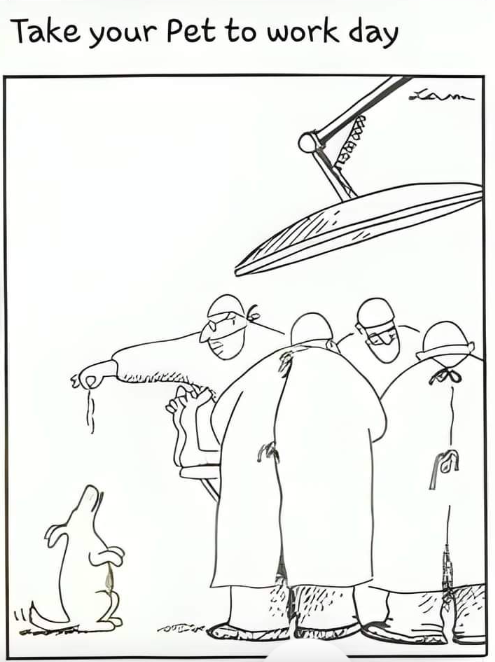

We kept telling Houth that we wanted to see a leopard. I don’t think this cuts the mustard, though!

Elephants. There were heaps of them, right beside the road.

We could hear them breaking branches and eating. Also making low noises to each other. There were a couple of babies and their mothers were keeping them between them, away from us.

As time went on, more joined them.

This one puffed out her ears at exactly the right time.

Newborn gazelle, only minutes old. Houth says that the mother will hide the baby in the tall grasses nearby, then leave for a while to draw the hyenas away. The baby won’t move until she returns.

They prefer to give birth around midday, because the liquid from the afterbirth will dry quickly. Eagles are also a worry.

We can hear the sound of the baby chirping to her.

Zebras looking for predators. Together, they have a 3360 degree view.

When an elephant reaches its last set of molars, he or she will isolate themselves and stay near food to preserve their teeth. This elephant is old, maybe 60 years old. He will be here until he dies.

Elephant graveyard myth came about because the old elephants die near water, then floods come and wash all the bones downstream to one spot. People assumed the elephants walked here to die.

Mother and baby hipppo.

We ended up seeing 9 Black Rhinos! Houth says we’re very lucky. These ones were a lot further away.

Flamingos.

Just all having a natter and walking along. I love them.

They’re so beautiful, with their backwards knees.

Elan. The largest antelope. They’re very delicious, apparently.

We were looking to take pictures of something else, but this guy was standing, definitely keeping an eye on us. He didn’t move a muscle until we left.

At lunch time, we passed by these two. It looked like they were having a day at the beach.

If you zoom in, you can see how close the lions and the wildebeest are to each other.

“The wildebeest definitely know that the lions are there,” said Houth.

Isn’t this just like a painting? We were heading off to a picnic place at a lake full of hippos when we saw jeeps clustered together. Always a dead giveaway that there’s something to see.

These two lions were the last animals we saw in the crater. How funny are they?

On our way back, we stopped to have an hour’s long walk along the rim, accompanied by two rangers toting stun guns. This came as a rude shock to me, as to me, walk are only fun if there’s a dog with you. However, the others all assured me that it was on the itinerary right from the start. (I really should start reading that thing.)

I have to admit, it was worth it for the view down into the crater. If you ever get the chance to come here, grab it with both hands!

Just to prove that it’s really me here.

WHAT a trip I’m having!

Dad Joke of the Day:

We had a long drive this morning to get to our lodge for lunch. It’s near the crater. Tomorrow will be a fantastic day!

We were driving like the fast and the furious along the rough roads.

The car bumped as I took this, but I love it!

You’ll have to zoom in to see the wildebeest on the horizon. There were thousands of them from one side of the horizon to the other.

And all of them, including lots of zebras, seemed to be intent on crossing the road in front of us. There a few near misses… zebras are reckless and wildebeest have a devil may care streak.

The roads were dry here. The people on the right side of the jeep had to roll their windows up because the dust was blowing in.

I was on the front left side, so I was golden.

After a while we left the Serengeti National Park and went into a conservation area. The Masai people who were kicked off their ancestral lands when the National Park was established are able to live and farm here.

It was strange to see human silhouettes where we’d been seeing only animals.

We were headed for the crater inside an extinct volcano.

There it was.

When we turned up to the gate, there were some Masai men loading goats onto a truck. The bleating of the goats was pitiful.

But first, we had a visit here. Everyone who has ever paid attention at school would know about Louis Leakey and his wife Mary – the palaeontologists who discovered “Lucy” – the skull that proved that Homo Sapiens had ancestors that we evolved from.

We were here, where it all happened.

I was very excited about this. I remember reading about it as a child.

We were taken to a place that overlooks where all of the digging took place.

I wish that photos did views justice. This view was spectacular.

A guy gave us a talk about how/when and where evolution of humans took place and also how scientists gathered all the data. It was very interesting. I took heaps of notes, but the internet is very slow here, so I’ll just give a few points.

(These are the first footsteps of bipedal humans.)

German colony in 1911. A German doctor was here, looking for things to do with sleeping sickness. He collected a few fossils.

Dr Louis Leakey saw the bones collected by the Germans in 1930, so he came here.

1935 he married, then had 28 years of finding nothing. Then in 1959 Mary Leakey discovered a skull that was 1.75 million years old. She was sick with malaria and was just poking around by herself. Her husband was off looking in the completely wrong spot.

Before then, Asia was thought to be the oldest. This changed everything.

Then they discovered Lucy- who was names after Lucy in the Sky with Diamonds. It was the 70’s…

And here she is.

4 million years old…. Lucy’s skeleton. Humans walking by two feet. 1metre tall.

Apologies for the awful photo, but it was impossible to take a picture without reflections. This is the oldest rhino known. She was 57 years old when she died of natural causes in the park. Most rhinos die at least 15 years earlier.

The guide said that she lived so long because she didn’t have babies. “She had no worries!”

I bought a beaded star for my epic Christmas tree from the gift shop. There’s always a gift shop.

We passed by many goat herds with their attendant herders, and many women selling Serengeti honey by the side of the road.

The rain clouds were rolling in.

More honey sellers.

For a while there, it was a wild and woolly ride as the rain poured down. The jeep slipped and slid, while visibility was low. It was exciting…

But soon, we arrived at our lodge, where we had a free afternoon. It’s strange, but sitting in a jolting car all day tends to tire you out. We were all glad of a little downtime.

Though having said that… I’m REALLY looking forward to the crater tomorrow.

Dad Joke of the Day:

Impala with lambs, considerately positioned right beside the road.

Today some of the women in our group went on a balloon ride, so we got to sleep in and have a lateish breakfast before going to collect them.

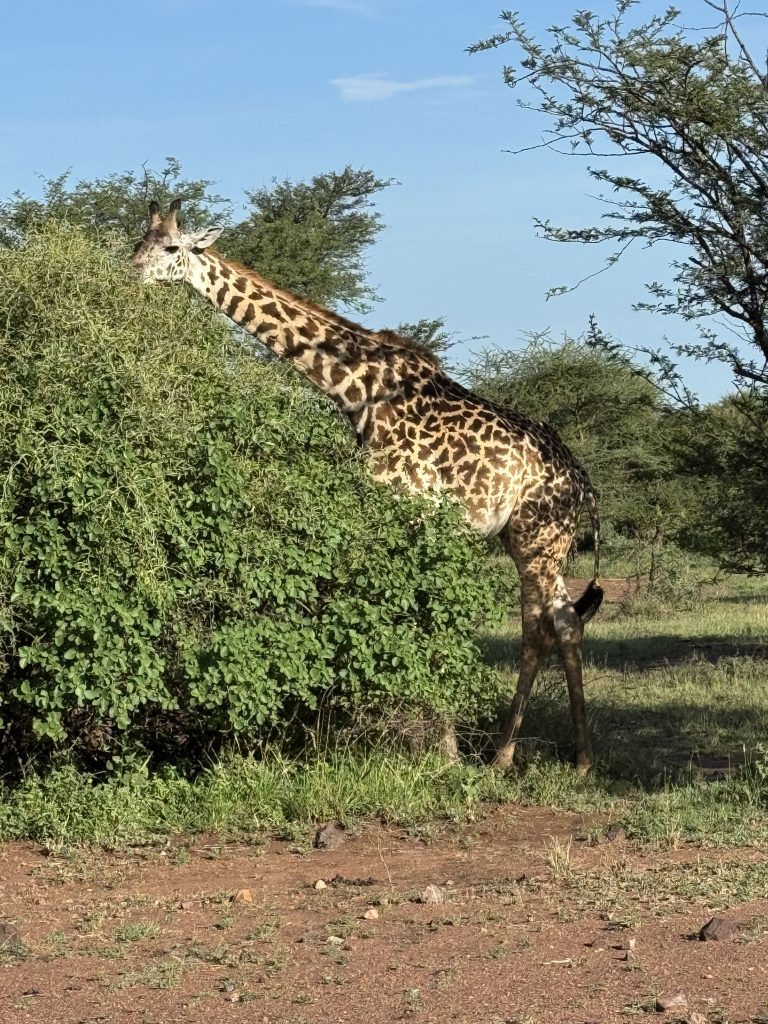

“Giraffes! someone yelled. I was so busy focusing on this one that I completely missed the huge one right outside my window.

Typical.

I was in Houth’s jeep today. He said that these two look very similar in age. It must be nice to have a half brother or sister to hang around with.

Dik dik. Always in pairs. They find an area, drop a poo and wait. If a partner comes along and poos in the same spot, the proposed is accepted and they pair up.

Old Cape Buffalo bull.

This is one of the most dangerous animals in the bush. He’s isolated himself from the herd because he can’t breed anymore. His days are numbered, as lions will target him.

“ I’ve seen many things here,” said Houth. “ But I’ve never seen a buffalo smile.”

It didn’t take long for a tse fly to find me. I’ve read about them, and yes. Their bite hurts!

Elephant. Chased the car in front of us away, but then settled down a bit.

Breeding season. Testosterone is high, which is why he was aggressive.

Just when we came around a corner there was a group of wildebeest by the side of the road. I really love the way the light catches their coats.

This isn’t a good place for them to be. This part of the park hasn’t had rain for a few days, so the grass is dry and the lions can blend in.

“Sometimes, you can be sitting watching them, and all of a sudden a lion will appear.”

Black faced vervet monkey. No blue balls on display.

This is what the underside of the flat.topped African acacia trees looks like.

No leopards lurking here.

Impala. Houth said that the male has a very short life expectancy. He’s keeping his eye on the bachelor males and on mating with the females. He’ll soon be picked off by a predator and some other male will get to have the harem.

After we picked up the balloonists, we were driving around looking for a leopard that was rumoured to be in the vicinity. Spoiler alert: we didn’t find it.

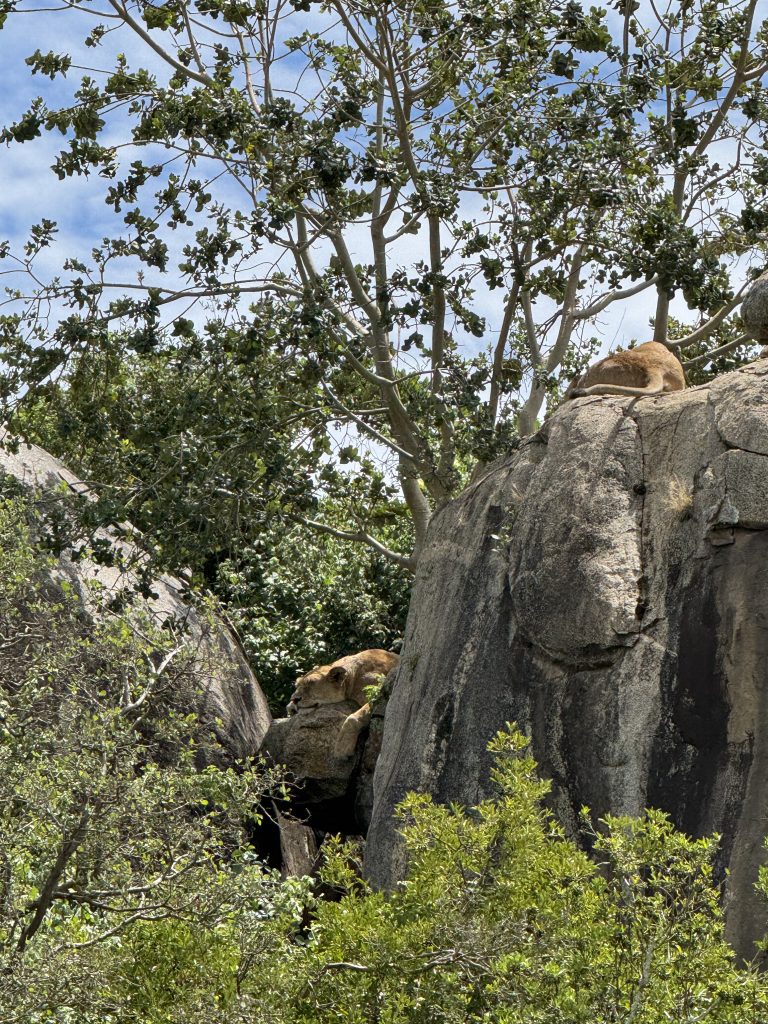

After a while, our jeeps headed for a pile of rocks sticking up from the ground. The cats sometimes go there after a night of rain to get warm.

The lioness on top of the rock was keeping an eye on us. .They climb up there in the mornings to get the sun, especially after it’s been raining. Then we moved for a bit and there’s another one up there as well right beside her.

They call rocks like this “The landscape of fear.” There are always cats around, even if you think there’s nothing here. “Not a good place to eat our lunch.”

Bee-eaters. They swoop down, grab a bee and then they’re back to the same branch. They’re beautiful little birds.

As we drove slowly around the pile of rocks, more and more lazing lionesses appeared.

“She looks like she’s sleeping, but if I got out of the car, they’d all be up and after me,” said Houth. He opened his car door and her ears flicked forward.

All up, we saw 11 lionesses. The males stay at the edge of the territory, only coming back to mate, or to get fed when the girls hunt. “ They call it protection money.”

“Do you see how dangerous it would be to stop and have lunch on the road?”

Related females tend to stay together for life, unless the pride gets too big. Then they’ll split up so they don’t run out of food. If food gets more abundant, they might rejoin.

No territorial problems between different predators, but they worry about competition from their own kind, so they’ll kill another lion, for example.

A funny thing is when you need to go to the toilet in the bush.

For males? Checking the tyres.

For females? Picking the flowers. Some of us, my roommate included, can’t seem to hold on for very long. Fortunately, my bladder is made of sterner stuff.

Male elephant standing right beside the road. I stood up on my seat and we were almost eyeballing each other.

Soon, we saw more. I didn’t realise at first that they were sheltering a baby.

A hippo pool. Houth was amazed at how many there were.

We drove past them the next day and they looked like they hadn’t moved.

Two lions in a tree. On first glance, you might not see them. One is higher up on the left.

Look at how relaxed she is! It was starting to get hot, but I think she was catching a nice breeze up there.

2 lions under a tree. It was getting towards the middle of the day and they were HOT. There was no way they were moving, even when the jeeps drove right up to them.

We had the rest of the afternoon off. Annette was on the balcony, talking to her husband when I heard her say there was a dik dik outside.

Later, after dinner, there was a Cape Buffalo near the pool. There was a ranger nearby, with a gun, just in case he turned nasty.

No wonder they insist on guests getting an escort to and from their rooms after dark.

” What happens if a lion comes?” I asked.

”You scare them off with torchlight,” he said. “ If a buffalo or hippo comes, we all run upstairs!”

Dad Joke of the Day:

I spent the morning catching up on blog posts, looking out over Lake Victoria. Anyone who has travelled with me knows that if I start to fall behind on my blogging, I get a bit antsy.

Some of us went across to a fishing village and school. I stayed behind and caught up on the last two days.

Now I feel so much better!

After lunch we jumped in the jeeps to see the Serengeti and go to our new place, where we’re staying for the next two nights. The trip was supposed to take around 3 hours, but due to animal sightings and the torrential downpour we had last night, it took 6 hours. None of us were complaining.

(Well, some were, but they seem to whinge at the drop of a hat.)

Here is our afternoon…

Serengeti means “ Endless Plains” in the Masai language.

Here are the rains down in Africa… (thank you Toto!)

Serengeti chicken , otherwise known as the Guinea fowl.

Impala bachelors.

We saw a zebra wallowing in the dust to get rid of external parasites. We also saw lots of resident wildebeests who don’t migrate because they know where to find food and water.

Flying egrets.

Flying storks.

Hamercop bird. It’s a huge nest that both partners build together. The nests have 2 rooms and can weigh up to 50 lbs. mud and sticks. They always go near water because they eat frogs and fish. Once they raise their chicks and leave, other birds like eagles take over the nest.

If you look down at the bottom left of the tree, you’ll see the bird. It seems like an an awfully big nest for such a small bird.

Here’s what they look like close up.

Blue balls monkey, otherwise known as the Black Faced Vervet.

In case you were wondering, their balls are indeed an incredibly bright shade of blue.

This was really sad. This elephant is around 18 years old and has broken his left leg. He can still feed himself, but he can’t walk. This won’t end well for him…

A herd of giraffes took our minds off the poor, doomed elephant.

There was a range of all sizes.

This guy was huge.

You’ll have to excuse me for not being overwhelmed by the African crocodiles on show, after the hundreds I saw in the Northern Territory last September.

We saw a baboon troupe on the road in front of us.

We’ve already reached the stage of “Seen one baboon, seen ‘em all!”, but this baby was cute.

Wildebeest were everywhere. The Great Migration isn’t due to start yet, but there are thousands of resident wildebeests who stay put in this part of the Serengeti.

These ones were impossible to resist filming.

This photo has a lion in it.

See?

To e fair, it took me ages to spot the lion. I’m pretty unobservent at the best of times, so I was looking at anything other than “the rock.”

Elephant dung is used to start fire, as we saw in theMasai village , and also as a mosquito repellent if you burn it in the house. Ifyou inhale the smoke if you’ve got a headache it’ll relieve your sinus passages too.

Never say that I don’t give handy hints.

Two lionesses. Easy food for them with all of the wildebeest and zebras around.

A journey of giraffes. They’re way off in the distance, but I love the shape of them.

Baboons. They were putting themselves to bed up in a tree to be safer from predators.

A baby hyena wanting to be fed, and asking Mum. After I finished filming, she gave up, lay down and let him suckle. I just love the noises he’s making!

More of the wildebeest migration. We could hear them, and Awade said that it’s mainly the little ones looking for their mothers. As we drove the herd just kept on going and going and going. There were thousands of them. It was absolutely incredible.

The Great Migration must surely be a sight to see:

Just arround the corner we came upon a massive herd of Topi. Awade was blown away by how many there were. The rain might make the roads slippery and boggy, but it’s certainly helping the grazing animals.

Town eagle.

Awade asked for my phone because I was on the wrong side of the jeep, so he took this shot.

We took a lot longer to get to the lodge than we anticipated, because the rain made some of the roads boggy and exciting. It wasn’t bad though. We saw some beautiful African skies.

Pink rain on the Serengeti. Have you ever seen anything more beautiful?

Dad Joke of the Day:

Crowned Crane, which is the national bird of Uganda. Just a bit of trivia for you.

Today was certainly a day that if we were ever going to get IDO syndrome, it would be today.

IDO stands for “Internally Displaced Organs Syndrome”, otherwise known as getting a Kenyan massage. Seriously, the roads in Kenya are really bad.

Though bits and pieces remind me of Australia. Remember the hills that ring Alice Springs? This reminded me of them, though they’ve had more rain.

The rest of the photos on this post are taken from the jeep’s window. We were driving like the fast and the furious today. We had a lot of k’s between us and our accommodation in Tanzania.

Everywhere we went, there were small boys looking after livestock by the side of the road. One photo I missed was a boy with his herd, looking at his phone.

This is my last Kenyan photo. Our jeep paused to turn into the border crossing and these boys waved.

Tanzania now.

I love this one.

Women getting firewood. Our driver said that they can walk as much as 10 miles a day to find enough.

This is one of my favourites for the day.

Kids everywhere call out and wave as the jeeps go by. Usually, I’m too busy waving back to snap a photo, but I got this little guy.

I don’t think he’s wearing a seatbelt.

We kept seeing these houses with really steep roofs. Our driver explained that they’d seen movies from colder climates where the houses had these roofs because of snow etc, and they’ve now become a status symbol.

We passed by one place with an impossibly steep roof.

“Look at that,” he chuckled. “ He could have built another house instead of that roof!”

There are so many 3 wheeled cars in Tanzania. These guys were kind enough to pose for me.

This looks like hard work.

Kids playing with tyres, just like in “To Kill a Mockingbird.”

And finally, if you zoom in on the ends of the branches, you’ll see Weaver bird nests. The males build the ests. If a male doesn’t do a good enough job, a female will destroy it. and make him do it again. Once she’s happy with the nest then she’ll breed with him.

Fair enough, too. 😀

Dad Joke of the Day:

I was going to have a balloon ride over the South African countryside when my sister Kate and I were there 11 years ago. Unfortunately, the weather stopped it happening. We were disappointed, but today was the day I’d get that job done.

My first hot air balloon ride and it just happens to be over the Masai Mara.

Here are the lions we saw yesterday. Most of the pride had moved off, as there were buffaloes and warthogs nearby, but a couple of lionesses and some cubs were still there. Zero in and you can see them.

I’ve never been able to drive binoculars very successfully, so this is the view of the elephant herd I saw. Zoom. In, and you’ll be able to see them. They have babies…

Here’s a wonderful silhouette. The balloon pilot was trying to go left, but the wind was pushing us to the right.

”You don’t take up ballooning if you need to be in control of everything,” he said. “You can control the actual balloon, but with everything else you have to be adaptable.”

It was nice up there. You could see for miles, of course, and the sky was changing colours every second.

The wind blew us over the river.

“The guys have to find a way to cross to pick us up,” he said. “ It’s almost at the hour now, but we can’t fly for a bit longer.”

We had no problem with that.

We were heading straight for a tree with a vulture perched on it.

”I’ll fly over this,”he said, giving the balloon a bit of a kick of flame. “It’s a waste of energy for him to fly if there’s no need.”

After an al fresco champagne breakfast – don’t mind if I do – we headed back out for a game drive.

Almost immediately we were face to face with three of these.

We were so close, we could hear him chewing.

After a while, we left them to it and drove off to see what else was out there.

We couldn’t believe how close this hyena was to the road. He wasn’t moving for anyone!

Can you BELIEVE this?

A pride of lions with a fresh kill. When we were up in the balloon we saw some lions chasing a warthog. The balloonist said they were just mucking around, but maybe things turned serious.

Do you notice how the boys are eating first. The girls do the hunting, but the boys eat their fill first.

This was sad. The baby Cape Buffalo still has the umbilical cord. We all assumed it was with its mother, but then Martin said, “ These are male buffalo. They’re trying to make the baby go away.”

One of the two very stupid women we have on the tour said, “Oh, surely they’ll take it to a mummy who’s lost her baby.”

”No, no,” said Martin. “They don’t adopt other babies. This one will almost certainly die.”

Hooley Dooley, it was a good day for lions!

Look at her swinging that snack around!

After a little while, they walked off through all the parked jeeps to find some shade from the afternoon sun.

I have heaps of photos of this guy, but I couldn’t resist showing you the video. I always try to be in front of, and at this moment I was very glad I was.

Another jackal. I think they’re beautiful.

See?

Then we found another courting couple. Look away now if you don’t want to see the full extent of a lion’s bonk.

All 12 seconds of it.

A giraffe hung around for a while.

Then guess what? We drove up to a river bank and we were allowed to get out of the jeeps.

Hippos!

We could hear them grunting and bellowing as we stood on the bank. We stayed for quite a while, watching them disappear and reappear from the water.

This day was EPIC.

Then after lunch, we had a couple of hours to chill – and when I said a few swear words about the non-existent wifi – then we were off to a Masai village.

Here’s the famous jumping dance.

We were given a fire-making demonstration. I tell you what – these guys should go on Survivor. A handful of elephant dung, a knife and it was away, even on a windy day.

We were given a tour of the village. The guy who took our group was telling us how the women make the houses, bring up the kids, do the cooking and make crafts to sell, while the men protect the village and look after the livestock.

Janet, a woman on the tour who is distinguishing herself by her lack of filter, said to him, “That’d be right. The women do all the work while the men just laze around.”

omg.

Sylvana, the team leader, and I looked at each other, appalled. The man impassively looked at Janet for a couple of seconds, then invited us into the house. I saw Sylvana tap Janet on the shoulder and whisper something to her. Janet was well-behaved for the rest of the day.

The village was surrounded by a thick fence of thorn bushes to keep the animals out. It’s crazy… people are scared of Australia’s wildlife, but we don’t have things like lions and hippos that can rip you limb from limb.

Inside the fence, the village is built in a circle. The “village green”, if you will, is where they bring their cows and goats in at night for protection.

There are 350 people living here, which means that these huts must be packed. Polygamy is allowed here. The houses have a tiny window, presumably for safety if an animal does break in, so it was almost pitch black inside. I don’t know how the women are able to do their cooking.

These kids were mucking around with me, so I took their photo for them.

His kids.

After this, it was back to the game park for another drive. We only saw one main animal, apart from the usual zebras, gazelles and such.

But WHAT an animal.

A cheetah.

There was a documentary film crew following a cheetah around, and the other drivers had to hang back until they got their footage. Our driver was looking, looking, then he suddenly floored it when he heard something over the radio.

For ages, no one could see where he was, until Liz, who has eagle eyes, spotted him hiding behind a bush.

Rangers were there, and they allowed us to leave the road and slowly drive close to him.

Just stunning.

The Masai Mara park certainly delivered today! Tomorrow, we’re off to Tanzania.

Dad Joke of the Day:

Today was a long driving day, but with the promise of another Game drive in the Masai Mara game park.

In the morning, all I did was take photos of the people I saw along the way.

These little boys were outside the place we stopped for a morning coffee. I bought a painting of some Masai warriors here. We’re seeing a Masai village tomorrow, so they say.

So many donkeys! I love how donkeys look.

We eventually arrived, after jolting along the worst roads I’ve ever experienced. Our drivers have all said that Landcruisers are unbreakable, and they’d have to be.

We drove in and the magic began to happen.

So many zebras. Look at how brown this baby is.

A hyena, so close to the road.

Then our driver suddenly floored it. We rounded a few bends, hanging on for dear life as we stood, then we saw a big clump of jeeps.

It was a pride of lions, next to a kill that they’d made yesterday.

The aroma was pretty rank, but who cared?

They were sated, sprawled out across the grass, uncaring that we were all so close. Occasionally, one would yawn, stretch out its legs and roll over.

A couple of lionesses and some cubs were still fooling around with the carcass.

I mean… are you kidding me? We could hear them breathing.

As we were there, word had spread over the short wave, and more jeeps pulled up.

I know I call myself Fortunate Frogdancer, and I’m obviously not deluding myself!

After a few minutes, we left so that other people could see them. The lions couldn’t have cared less. The sunset was beginning to appear.

Not five minutes later, we saw a small cat dart across the road and into the scrub. It was a Seville cat, and they mainly eat birds. It was so small compared to the lions.

I’m very proud of this shot. Everyone else in the jeep was stampeding over to get a copy.

Ostriches!

Thomson’s Gazelles were everywhere. Aren’t they beautiful?

And then, as if we weren’t spoiled enough, we came across this couple. They were on their honeymoon.

When lions hook up, they stay together for around a week, ignoring food and mating every 15 minutes. These two were exhausted, but they were still holding hands. After a minute or two we left them to it.

After all, dinner was waiting.

A silver backed jackal. It looks like it has a coat strapped around it.

What an amazing afternoon.

We have the whole day here tomorrow. Can’t wait to see what else we can see.

Dad Joke of the Day:

© 2026 Burning Desire For FIRE

Theme by Anders Noren — Up ↑