It was July 3, 2016. I was just shy of my 53rd birthday.

Poppy, Jeff and I were walking on the beach. Scout wasn’t even born yet, let alone being part of the pack. It was a cool day, with a bit of a wind whipping along the shore. We’d moved into The Best House in Melbourne 3 months before and our spending was austere. That happens when you’re paying interest on a 750K bridging finance loan.

I’d taken a big risk – a risk that I thought I’d never take again once my little house in Bentleigh East was paid off and we were totally debt-free. I thought I would never borrow money again. But here we were, 750K in debt, waiting for that same little house to be torn down and townhouses put there in its place.

If it all worked out, I’d have swung a deal that would save me years of work because I could bump up my superannuation and investments with the equity I’d released. If the property bubble took a dive, then I’d have done all this with no real financial benefit at all. I would have swapped my commute from 2 minutes to 45 minutes for the next 14 years…

Sure, I was paying 70+% of my wage purely on the interest for my new house. This would go on for 18 months. We were living on a shoestring. But if all went well, my overall dream of financial security would be brought forward by years.

Spoiler alert: it all worked out. I’m retiring in December this year, fully 10 years short of what I ever thought I’d be able to do. But walking on that beach 4 years ago, I didn’t know that then.

As we walked, I threw the ball over and over again for Poppy and I started thinking. To me, financial independence has always meant security first and foremost, but it also means freedom. Retirement coupled with financial independence means freedom on steroids – the ability to do whatever you want to do when you want to do it. Swinging this property deal would mean that this goal of a financially-free retirement that I knew I would reach when I was 67 could be brought forward. But I wondered…

When would I actually be able to retire?

What if I tracked the days? What if I set a stretch target of say… when I was 60? Surely, if the deal worked, I could shave 7 years off my working life. How cool would that be?

I already tracked my spending. Why not set a target, then track my working days? It’ll be a bit of fun, plus it would be FREE. (This was a heady consideration back then!)

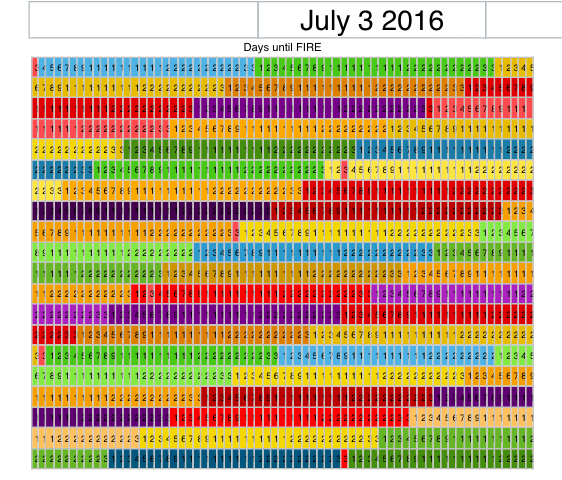

So the ‘Days to Retirement’ chart was born.

Every day, or every few days if I get busy and forget, I colour in another number. I decided I wanted it to look a little like a patchwork quilt, so every month has its own colour. Every July 3rd, I colour that square red, as I’m a sentimental old fool and it’s the chart’s anniversary. Every December 31 is red too, just the mark the passing of another year.

It takes surprisingly long to fill in this baby. The first page took just over three and a half years to complete. It had turned into a habit, something I drowsily did first thing in the morning before I got out of bed.

In a fit of industriousness a long while ago, I’d filled in the numbers for the days until the end of 2020, then I just let it be.

Maybe it was prophetic…?

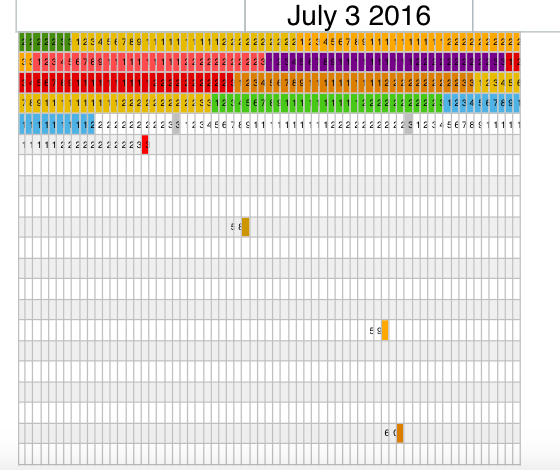

It occurred to me the other day how strange it was that I’d only filled on the days until the end of 2020, which has turned out to be the end of my working life. When I was filling in the numbers, I was fully intending for my ‘stretch target’ to be when I was 60. I was going to keep filling in the numbers but, frankly, it was boring and I thought, ‘Meh. I’ll save it for another day. I’ve done enough.’

(Just in case there’s someone counting the number of days in the years of 58, 59 and 60 – those markers are only approximate. I did a rough estimate, knowing that I’d get to them later.)

But still! Look at those days.

Look at how many of them there are! I just did some Maths – 365 X 3 = 1,095 days of me being able to do whatever I want.

A thousand days. That’s as long as Anne Boleyn was on the throne of England.

My mother once said to me, “A house revolves around the rhythms of either the oldest or the youngest people in it.” She meant that if you have either very young children or someone elderly, then everyone else’s routines and habits tend to bend to cater to the needs of these people.

My boys are all in the mid twenties and are years away from starting families. I’m selfish enough to relish having a few years to myself before I have to consider when/if I’ll put my hand up for childcare for grandchildren. Up until now there have always been demands on my time. School, then uni, then work, then kids, then work/kids again.

I have a feeling these next few years might be a gentle sweet spot where – for the first time in my life – how I spend my days is entirely my choice.

Look at all the empty days in the bottom of that chart.

Mightn’t be too bad…

how lovely – to your gentle sweet spot, to your security and freedom.

My gentle sweet spot thanks you!!!!!

LOL

Your future self will be ever so grateful for all you accomplished! This morning I had a chore plan of sorts, but the weather drew me outside on 3 different short hikes to see and photograph the fall colors. Not many chores were accomplished, but I had the loveliest day. You will love the freedom you have worked so hard for!

My parents came over – it was lovely to spend the afternoon chatting to them. 🙂

Ah … empty days … what a dream! Enjoy them – you deserve every single one of them 🙂

It’ll be you soon.

You are a girl after my own heart..I love a spreadsheet and this one looked so much fun for you. Kathy, Brisbane

It’s an easy way to start the day feeling immediately productive!

Well, this is brilliant! You inspired me to make my own days retirement spreadsheet countdown! Why not? Even if I fall short of my financial goal, I will be closer than never trying!

I love how you weave your personal stories with financial advice. It’s a delightful journey!

Thanks!

I didn’t blog about this before because I thought people would think I was crazy/obsessive/whatever… but the weirdness of retiring when the numbers ran out was too good not to share.