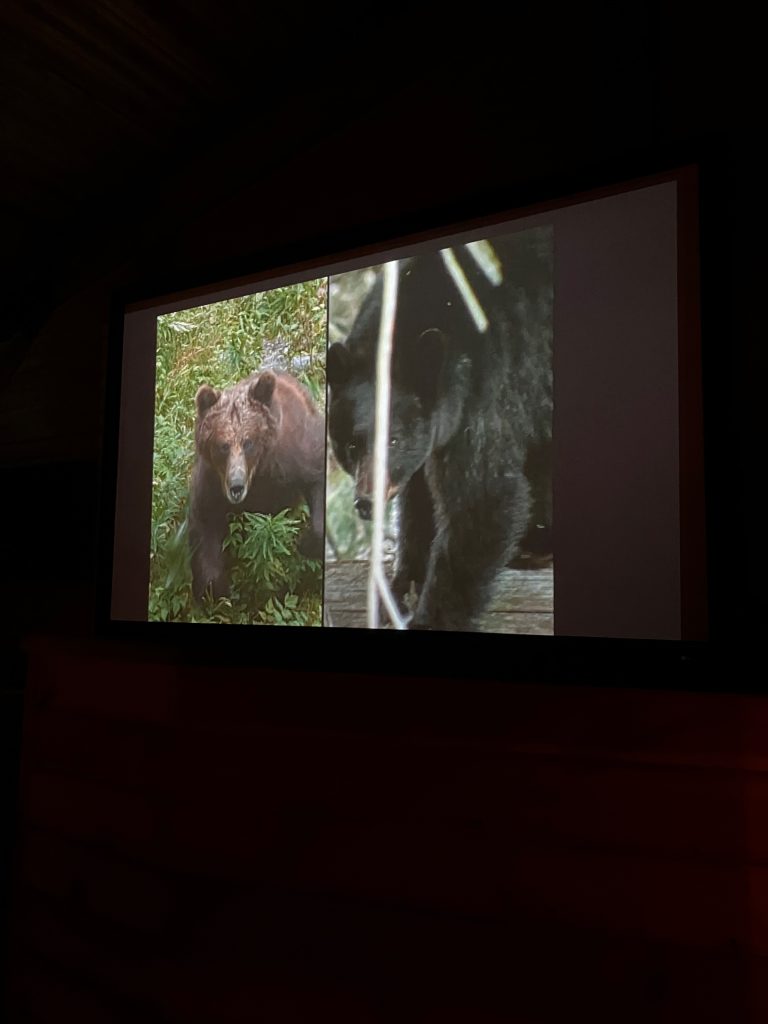

In the morning, on the way to the Jasper Canyon walk we saw another bear!!! It grumpily headed back into the woods when our huge coach pulled up, but see that black splodge in the middle? Definitely a black bear.

The bears’ way of pregnancy is very interesting. Now (May) is the prime time for bears to fatten up over summer before going into hibernation for the winter. It’s also the prime time for them to find a little love.

Once the female is impregnated, the eggs stay in stasis until she goes into the den to hibernate. Her body then does a stress test. Has she eaten enough? Does she have enough body fat?

If so, the eggs will develop. She’ll wake slightly and give birth in January. Black bears stay with their cubs for2 years; grizzlies for 3 years. The mothers have to stay with their cubs, not only to teach them how to survive, but also to protect them from the males.

A male bear will kill any cubs he finds because that brings the female straight back into heat. This, of course, is what he wants – his own genes to go forward another generation. But he doesn’t know which cubs are his. Male bears have been known to kill their own cubs.

When the mother bears are ready to leave their cubs, they just abandon them. Mother bears have been seen to fool their cubs into thinking there’s something scary in the area, so that they all climb up a tree, and then she’ll simply walk away, leaving them to it.

The Jasper Canyon walk was interesting We had a fresh new guide for this one, a guy from South Africa. We got off at the tourist stop and headed to see what we could see, all still fired up after seeing another bear.

We took a quick look at the Maligne River. It was just moseying along, minding its own business, with no idea of what was about to happen to it.

It was about to be squeezed through a narrow gorge. It was so narrow that you could probably jump across it. I guess that’s why they had all the fences, to stop idiots from competing in the Darwin Awards.

The gorge not only goes narrower but also plunges downwards. Our guide said that only 10% of the water stays on the top in the river that flows through the gorge. The rest is flowing underground through massive aquifers.

The canyon was once at the bottom of a shallow sea, which the guide proved by pouring water on some stones in the path. Voila! Seashell fossils were revealed! Unfortunately, my photos weren’t so clear, so you’ll just have to take my word for it.

The river that’s flowing through the canyon is a dirty river, which means it’s full of sediment that’s continuing the erosion.

In the photo, the green side of the ridge has the canyon plunging down immediately behind it. It was pretty deep.

As we walked along, the canyon grew even narrower, with a log jam happening just before the waterfall on the other side. After our educational beaver movie yesterday, some people asked if it was the work of beavers.

“No,” the guide said. “In nature, trees and branches naturally fall into the river and they’ll flow along the water until they can’t move forward anymore. In this case, it’s the narrow walls of the canyon that’s stopping them.”

The river went from ground level to 37m in the space of a one-minute walk.

I took the chance to nip down some steps to get a closer look. It’s going to take a massive amount of water flowing down the canyon to break up those logs. Still, nature is patient. It’ll happen one day…

Further along, I took this photo. I like it. You can see the river thundering away far below, while near the top a fallen tree is casually lying there, waiting for a chance to topple in.

You can see the washing machine roundness where the rocks have been grinding away at the sides when the water level is higher than it is today.

The waterfall plunges to 78m deep.

I had to zoom in on this one, but can you see the rock suspended between the two sides? It’s been there so long it has vegetation growing on it.

So many little things happening.

It’s just a tiny slit of rock, but you can hear the river racing along below!

The next lake we stopped at was Medicine Lake. A wildfire had gone through there a year or two ago.

It should have felt desolate but it didn’t.

Someone asked Sharon if Parks Canada was going to remove the dead trees.

“No, they’re not going to touch them,” she said. “They’re taking a ‘hands-off’ approach to this. Gradually, the trees will fall and become part of the earth.”

Medicine Lake is like a big bathtub. No rivers or streams flow out from here – all the water drains into the aquifers below.

Here’s a clump of lucky trees. Or maybe they’re not?

The pines that make up so much of Canada’s forests are like some of our gum trees – they need the fires to bring on the new generation.

Also like Australia, the white Canadians have really screwed up this natural design by suppressing fires in the National Parks. By the time wildfires finally get a grip, there’s so much dead growth and tinder that they burn TOO much – and instead of burning the parent trees and leaving the pinecones to regenerate, everything burns to a crisp.

We drove off again, then the bus stopped by the side of the road.

“Here is a bald eagles’ nest,” said Sharon. “If you look, you can see a bunch of twigs on top of a tree, with the white head of the mother or father eagle poking out on top.”

Can you see it?

Here’s a zoomed-in shot in case you couldn’t see it.

There are two Bald Eagle chicks born every year. A competition sparks between them as soon as they’re out of the eggs. Each strives to get the food first, to become the bigger chick. One day, the bigger, stronger chick will push the other one out of the nest.

Only the strongest survive.

Then someone yelled, “Deer!” and sure enough, there was a small herd of deer running away from the bus in all directions directly underneath the eagles nest.

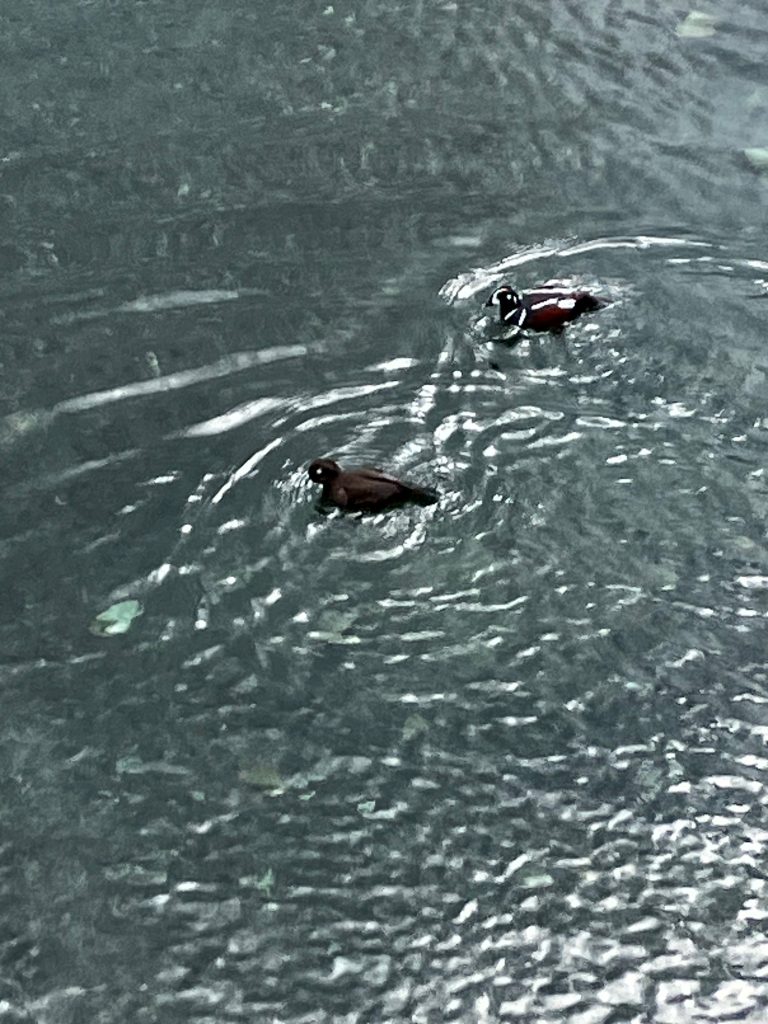

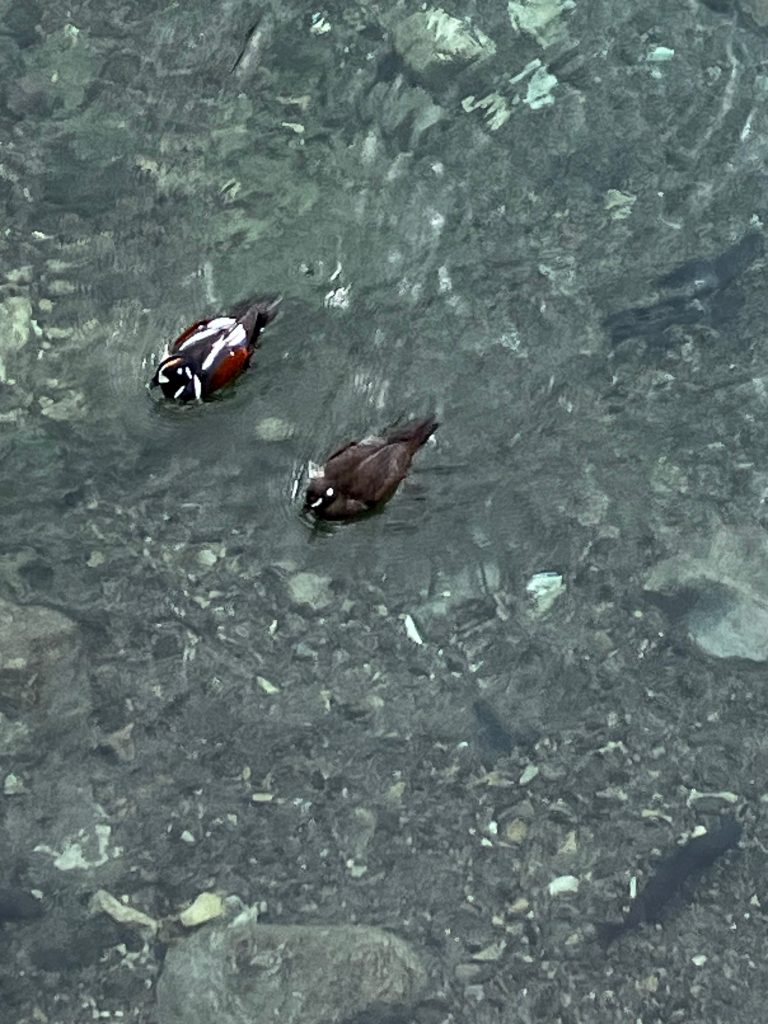

We drove, and soon the bus stopped at a small bridge.

Rainbow trout spawn here. Look at how big they are! I was surprised at the clarity of the water – we could see them so clearly.

Harlequin ducks come through and promptly eat the eggs. The trouts’ strategy is to lay too many eggs for the ducks to eat.

As I was standing on the bridge, suddenly there was a WHOOSH! of water as four Harlequin ducks swept in from under the bridge and started doing exactly as our guide had said. How lucky was that?

They started duck diving and eating invisible things in the water.

They were beautiful.

Then off we drove to what the guide said was “The jewel in the Crown.”

Lake Meligne.

And he was right.

It was utterly beautiful and, to my mind at least, left Lake Louise in the dust. It was far larger than Lake Louise and the isolation and complete lack of a chateau parked in front of it made it the best lake I’ve seen.

It was perfectly framed, with the mountains stretching away behind it.

As we were there, tiny snowflakes began to fall. It was magical.

Look at me in the Antarctica fleecy jacket that was so expensive that I thought I’d never wear it again! It’s been on two more trips now.

🙂

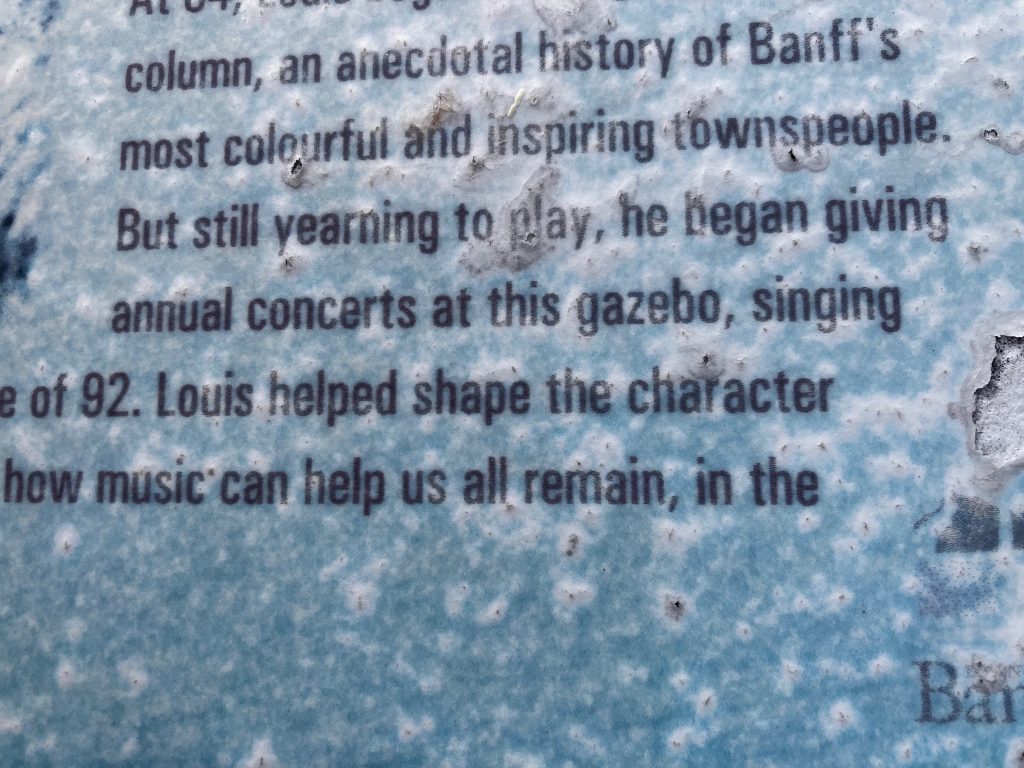

Incidentally, for any Laura Ingalls Wilder fans out there – Lake Melugne was named by a French explorer and priest called De Smet. Yes! The guy that the Ingalls’ town in North Gakota was named after.

He was exploring in the area and he had so much trouble with losing equipment etc on the lake, that he said it had a malign or “meligne’ (in French) presence about it.

Anyway, I got a little excited about that Little House in the Prarie connection.

After a good long while for us to soak in the beauty, we headed back to Jasper

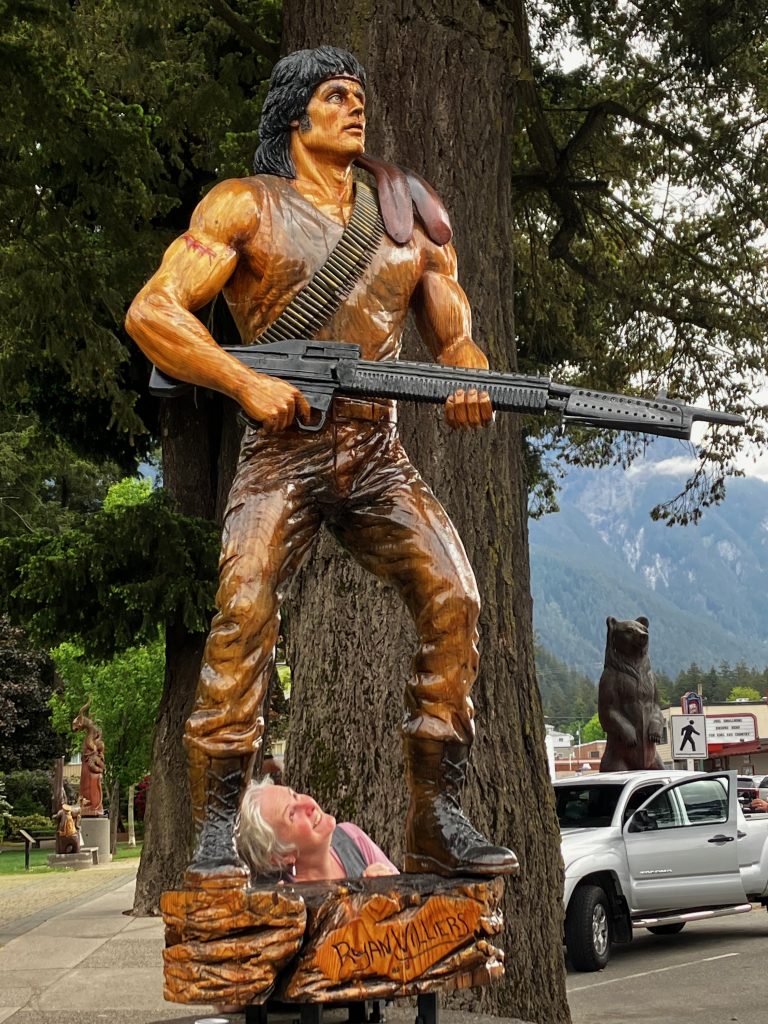

There, we did some laundry, I caught up on the blogging and then we went out to see what Jasper had to offer.

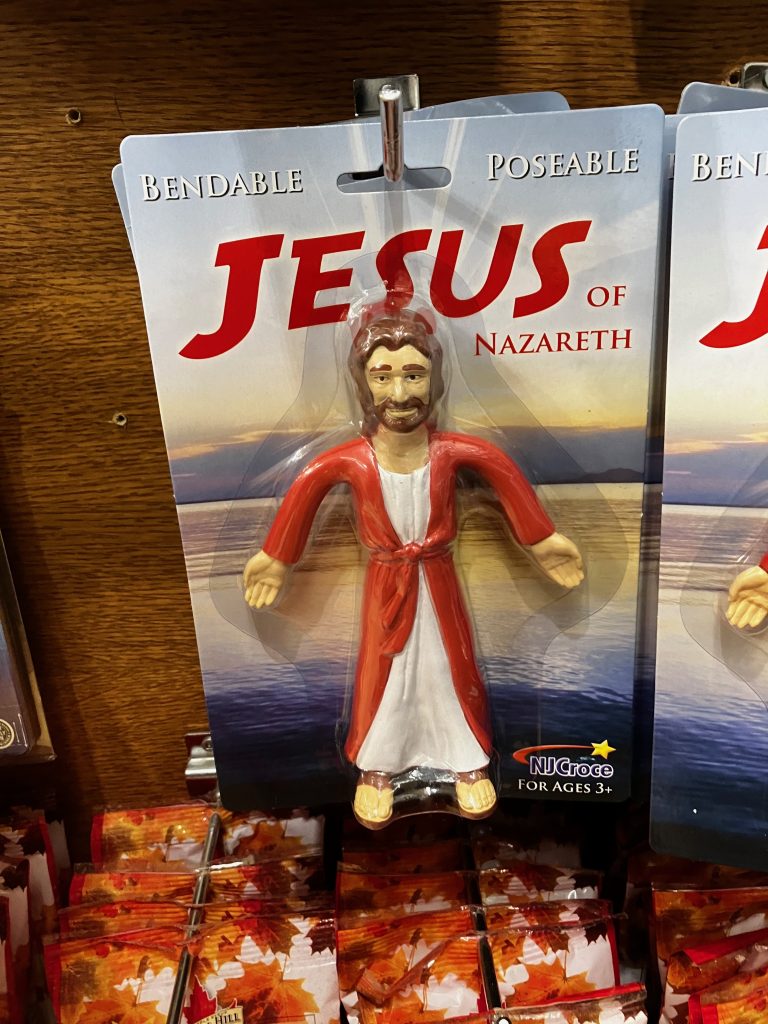

I liked this.

The Rocky Mountains still encircle Jasper, but there’s a feeling of more space in Jasper. It’s decidedly a tourist town, with every second shop being a junky gift shop. I bought a postcard of a black bear – because I’ve seen them now – to put on the fridge.

Other than that, we walked the length and breadth of Jasper, which was a whole two and a half streets, then we came back to the room for dinner.

Leaving on the bus the next day, Sharon asked if we preferred Jasper to Banff.

Everyone said, “NO!”

Dad joke of the day: