People who’ve been reading this blog for a while will know that I like to keep track of things that I want to achieve. Usually, I draw up a basic chart and colour in the days that I succeed in my goals, though I’ve branched out to use a widget for one of the challenges I’ve set myself.

So how am I going so far this year?

The first challenge is the one I cleverly did to harness an activity I simply can’t live without to a bill that I absolutely hate paying.

If you cast your eyes to the sidebar of this blog, you’ll see that I’ve been progressing pretty well with my “Earn my rates back by reading” challenge. I set this goal in 2021 when I was outraged at having to pay $1,800 a year to the local council just for being able to live in my own house. Oh sure, the council provides garbage pickups every week and maintenance on public areas, but it still seemed like a lot of money.

BUT things changed when it occurred to my mighty intellect that if I utilise the local library instead of buying books, I can satiate my reading addiction and, in effect, ‘earn’ back my rates by using the books that my rates have helped to buy. It took 8 months to ‘earn’ back that $1,800, so I set my sights higher for 2022.

This time, I’ve included the council fees for the dogs in addition to the rates for my house. In September last year, I began chipping away at the grand total of $2,200 for council fees.

Going back to work as a casual teacher has really impacted the time I have for reading, but I’m pleased to report that I only have $333 to go. That’s roughly 10 more books to go before I reach my goal.

I’m glad I set myself this challenge, not only for the satisfaction I get from succeeding at reaching a goal. It’s also opened me up to reading books I might not have come across, so it’s added to my quality of life to a huge degree. I follow some prominent authors on Twitter and every now and then they’ll either spruik a book that they’re releasing, or they’ll recommend a great book that they’ve just finished reading.

It’s a simple matter to flick across to the library website to see if they have it. In a surprisingly high number of times – they do. And it’s awesome.

Am I really earning back my rates by doing this? Of course not! But it’s a bit of fun. Retirement and reaching financial independence are all about having fun, baby!

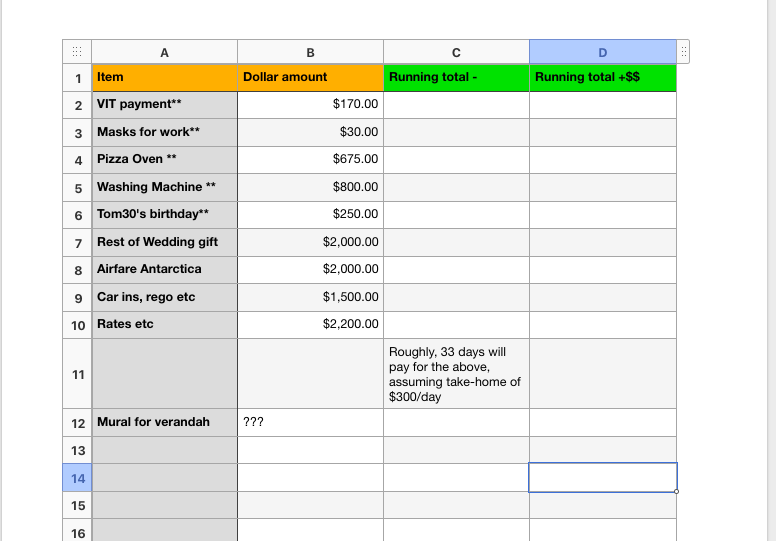

My CRT teaching chart is the newest addition. I designed this in my post about deciding to pivot and go back to teaching – not as a ‘real’ job but as a CRT (casual relief teacher.) I knew that if I was dragging myself back to work, getting up before it was daylight, and selling my sweet, sweet freedom that I’ve cherished so much; I needed to chip away at ‘paying for’ things that I’ve bought.

I knew that would keep me motivated.

Every payday since then, I’ve entered the amounts onto the chart and I’ve seen my progress. It’s very satisfying to be able to cross things off the list and move on to the next line.

To be honest, I never expected that I’d have as much work as I’ve been getting. Schools are reeling with the huge numbers of staff getting sick from either covid or the flu. So far this term I’ve had 3 straight weeks of full-time work and it doesn’t appear to be slowing down any time soon. And I’m only teaching at one school!

The other CRTs tend to work at a few different schools, so it’s been interesting hearing what other schools are like. I think I’m on a pretty sweet deal working here – the kids are beautiful and working here is usually an absolute pleasure.

Even if a kid is naughty, it’s always a silly teenage naughtiness, not a nasty thing. I can certainly live with that.

I’ve decided that unless something really changes, I’ll accept as much work as I can get from the school. They definitely need CRTs, I’m putting the money to good use and after all, the school absolutely saved our financial bacon by giving me a job when the boys were small. The admin was incredible when one of my boys needed a lot of extra support due to depression in his teens. It seems like the right thing to do to help cover the classes while people are sick.

I’m just keeping my mask on during the whole day. I’d prefer not to get the flu or covid if I can help it.

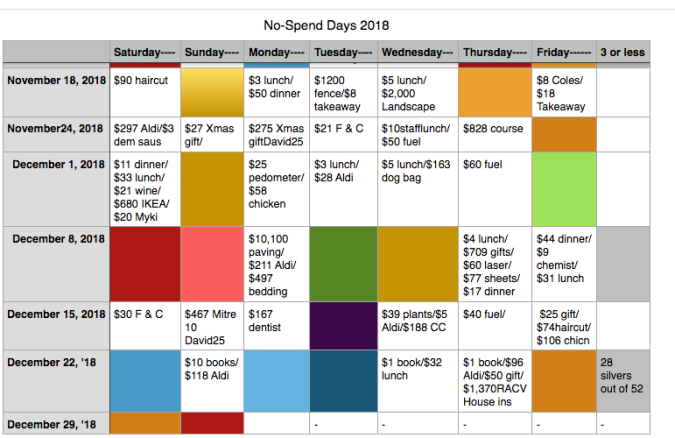

The No-Spend Days chart.

I’ve been keeping this chart for years. It was one of the first things I wrote about when I started this blog. It came about because it dawned on me that no matter how frugal a person wants to be, no one can avoid spending money. Sooner or later food has to be bought, the car needs petrol or your kid needs new shoes.

Trying not to spend money is an exercise that inevitably ends in failure.

But what if I tried to restrict the days in the week that I spend money on?

Instead of letting money dribble from my wallet whenever I felt like spending it – what would happen if I became far more intentional about WHEN I spent money? I’m a naturally frugal person, except when I go on holidays, so restricting the dollar amounts wasn’t a particular issue for me. But when I started bundling up my spending so that I only waved the credit card around 3 days per week or less… a couple of things happened.

I saved some money. Anything that was an impulse buy on a day when I was trying not to spend money got put off. “I’ll buy that tomorrow,” I’d think. Usually, what was an impulse buy on one day was totally forgotten about by the next. A little more money stayed in my bank account.

The simple act of keeping the chart meant that I had to write it down. If it was a silly waste of money like buying a Caramello Koala when I was marking a stack of essays, I sometimes wouldn’t buy it. Every time, I was glad the next day when I woke up. I’d saved a precious square on my chart!

This chart has also come in handy when I wanted to check on when I’d bought something, such as a computer, the little woofs’ vaccinations, or when I’d last had the car serviced. Every now and then I’ve been pleased that I had the chart to refer to.

It’s become part of the lexicon of this house.

“Mum, we’re out of ham. Can you get some more?”

“I’ll do an Aldi shop tomorrow, babe. Today’s a no-spend day.” Everyone knows what I’m talking about, and we’re all good with it.

Keeping track of personal challenges like this definitely works for me. If you’re still reading this, maybe something like this will work for you too. The saying “What doesn’t get measured, doesn’t get managed” has a lot of truth to it.

Like I said above, if nothing else, it’s a bit of fun. And there’s nothing wrong with that.

(Here’s a link to the chicken stock paste recipe that I mentioned yesterday. You make veggie stock paste by simply removing the chicken thigh. )

Dad joke of the day:

Why is it called a “dad-bod” and not a “father figure”?

I really like the idea of documenting your no-spend days. A great incentive!

Thanks. I like it too. It helps me to stay organised.

The no spend days chart is a great idea, especially for those who find that money burns a hole in their pocket. I once tried to spend less than an average of $5 a day, at the start of a new year. It worked until the end of January, when I was hosting a celebration! Thanks for the stock paste recipe.

I love the stock pastes. They are so much tastier (and good for you) than the chemical-ladenn stock cubes.

Great post! In the US (at least where I live) if my local library does not have a book I heard about, they will obtain it from another library in the area – for free!

For your CRT chart, do you count all the extra cost of petrol? Gasoline prices in the US have skyrocketed and I’m very glad I’m not do my commute any more!

Do I count petrol? No, I’m not that forensic. Today’s payday, so I’m looking forward to seeing how much pours into my account. 🙂