Readers of the other blog will already know that life has been unexpectedly busy this past week.

On Tuesday Mum, out to lunch with a couple of women she used to work with, had a nasty fall and broke her right humerus. She also badly wrenched her left shoulder, which means that for the last few days she hasn’t even been able to feed herself. Today (Sunday), after a couple of false starts, we’re hoping she gets into surgery.

This, of course, means that she’ll probably be in rehab for a long time.

Retiring early is fabulous when you’re free to travel; free to spend your days however you please; actually, when you’re free, full stop. I’ve experienced all of this since I pulled the plug on working.

But retirement rises to another level when it frees you up to take care of business when things go wrong.

Yesterday, I had the men from the Riley Club come over to the house to pick through Dad’s collection of spare parts. His friend David was with me and he was the one who negotiated prices with them, as I wouldn’t know a magneto from a crank shaft. Mum ended up earning $2,505!

Afterwards, I donated the rest of the bits and pieces to the Riley Club, so by the end of the afternoon a lot of metal had left the property. On Wednesday, the last vintage car will be collected by her new owner. I’ll be there for that, instead of being stuck in a classroom. My sister still works, so me having time during most days has freed her up at the busiest time of year for her.

Looking after someone else’s financial affairs is not for the faint-hearted, especially if they’re as convoluted as my parents’. By default, it all fell to me, partly because my sister backed away, hands raised, saying, “I’m not going to do it!” and partly because I have a cool head (mostly) when it comes to money stuff.

This year has been a huge learning curve, with me getting my head around all the moving parts and working out what has to be done to look after Mum’s interests. Their financial advisor, though a lovely man, has been pretty much MIA, leaving me to deal with all the paperwork. Kate was the one who pointed this out… I was too busy to take much notice.

It’s been 6 months since Dad died. Probate has been finalised. Mum can finish paying for her room at Bonbeach by selling some investments, which I’ve just finished doing. We’re going to hang onto the family home for now, probably moving David31 and Izzy in to look after the place. They can pay outgoings but no rent, which will avoid triggering a CGT event for Mum, while keeping the place maintained.

Poor Mum. This has been an awful year for her on so many levels.

My main task going forward is to simplify her estate, which seems unecessarily complicated. I’ll be meeting with their financial advisor in January, once he gets back from his holidays. In an ideal world, I’ll want things to be humming along before I fly away again.

Yes. Now we talk about the good times!

In 2026 I have more holidays booked, but ONLY 5 this year.

What deprivation.

I have Taiwan in March, the Balkans in May, The Galapagos Islands and South America in June and Bhutan/Nepal in August. This last one will be my mandatory birthday trip away.

Not content with having so much travel this year, I also bought a puppy and a brand-new sewing machine. To be fair, I snagged a great deal with 1K off the price of my new Bernina, but it was still a big purchase. I’d struggled with my old machine for 16 unhappy years, as it rarely workd properly, so, like the expense of putting the veggie gardens in a few years ago, I’m future-proofing my entertainment in the years to come.

That’s the rationalisation, anyway.

It’s another huge learning curve. There’s a lot more tech to get my head around on this new baby, but I’m already loving the automatic needle threading. No more squinting!

Retirement also gives more time for enjoyable things. Every year I do the Goodreads challenge, where you choose the number of books you want to read in the coming year, then see if you hit that target. In 2025, I kept my target at 120 books, even though I wasn’t sure if I’d have the time. Travel blogging takes up a couple of hours minimum each day, which I thought would cut into my precious reading time. However, I didn’t factor in all of the airport waiting times etc, so I made the target with a month to go.

My ‘Earn my Rates by Reading” challenge, which is on the side of this blog, is going gangbusters. I’m so far ahead at this stage, that I’ve gone back and I’m now working on the rates I paid before I thought to start this challenge. It’s crazy! You can see just how much money I’ve saved by using the library.

Well, it’s time to start the day. We’re hoping Mum has her operation today, as it’s been nearly a week since she fell. I’ll pop in to see her early, then the rest of the day is mine.

Maybe I’ll switch on my scary new sewing machine and have a play? After playing with my unscary puppy, of course.

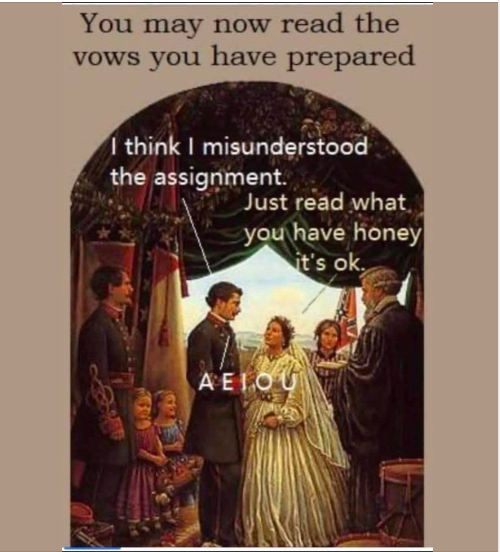

Dad joke of the day:

You have been so busy; I’d wondered where you’d gone! It’s been almost 2 yrs since I no longer had to care for my mother and her finances and all that. It was time consuming but I was glad to help her until her passing. Your success with your own finances makes sense for you to do it and I hope your sister appreciates all the hard work. The new puppy is adorable!

Hazel is a joy and a delight, especially since she seems to have finally worked out how to use the doggy door!

Keep hanging in there. You seem to facing all the drama and adventures with positivity. Well done!

I have been thinking about you and your very tough year with family illness. We went through this with my in-laws relatively recent, it is not easy. Sending you wishes for better times ahead.

Thank you. That’s lovely of you. 🙂